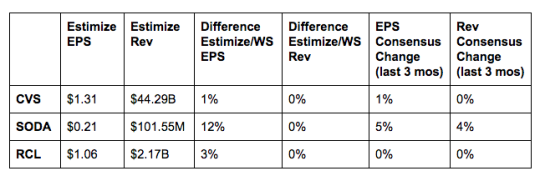

CVS Health Corp (NYSE:CVS): The pharmacy giant is coming off a better than expected first quarter which saw sales rise by 19% and earnings jump by 4%. Unfortunately, investors didn’t see any of those gains as the stock is down 4% year to date. Key factors for the quarter to be reported include same store sales, customer satisfaction, margin and the conversion of Target pharmacies. In December 2015, CVS closed a deal with Target (NYSE:TGT) to rebrand all its pharmacies with the CVS brand and logo. The move single handedly added over 1600 pharmacy locations but the conversion isn’t completed yet. Any indication of its progress would be a huge win as many believe the deal will reignite sales

Sodastream International Ltd (NASDAQ:SODA): SodaStream is the quintessential rags to riches story. After a string of weak quarters, SodaStream kicked off its fiscal 2016 with strong sales and margins. The growth plan to shift away from soda to healthy water based beverages has paid off faster than many expected. The company has devoted a slew of resources to promote this transition including launching TV, PR and digital campaigns. Backed by a strong Q1 and upward momentum, management raised its full year earnings and sales guidance. The stock has closely followed this reversal of fortune. Shares are now up 50% on the year with limited signs of changing any time soon.

Royal Caribbean Cruises Ltd (NYSE:RCL): Strong booking and travel trends should prove to be favorable for Royal Caribbean. The cruise operator is seeing higher demand especially in North America and Caribbean regions. This should provided a buffer to from any downturns they could see in Europe and China. Lingering uncertainty and Brexit fallout could be a long term problem for RCL. Carnival (LON:CCL) has already stated Brexit as a possible obstacle for future growth. It won’t be surprising if RCL mentions any combination of Brexit and negative currency translation if earnings fall short of expectations. Another big concern is around the Zika virus, which could soon impact demand for Caribbean travel.