We believe that (NASDAQ:Microsoft’s) proposed acquisition of LinkedIn (NYSE:LNKD) for $196/share or $26.2 billion represents vast overpayment and a transfer of wealth from MSFT to LNKD shareholders. We’ve previously touched on the issues at LinkedIn, dating back to our original Danger Zone report in August 2013. Microsoft (NASDAQ:MSFT) was previously featured as a Long Idea in June 2015, largely because of the company’s good capital stewardship over the years. Today’s bid for LNKD is not good stewardship of capital. Our models show that, even with the most optimistic forecasts, over $20 billion, or $2.60 per MSFT share, of the $26.2 billion purchase is an overpayment and a direct destruction of value for MSFT shareholders.

Microsoft Is Spending On A Deteriorating Business

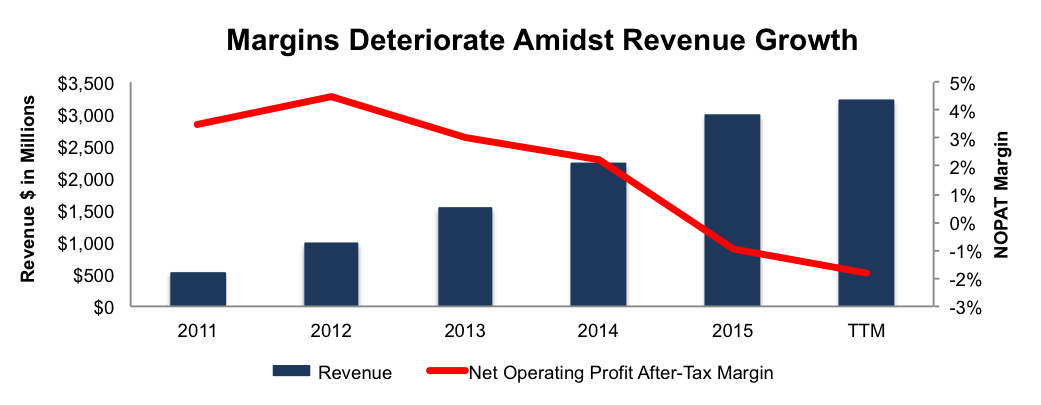

LinkedIn’s revenue growth masks growing losses. Per Figure 1, LNKD’s net operating profit after-tax (NOPAT) margin, has declined from 3% in 2011 to -2% over the last twelve months. LinkedIn’s NOPAT has declined from $18 million to -$59 million over the same time.

Sources: New Constructs, LLC and company filings

Overpayment Creates a Misallocation of Capital

Microsoft’s acquisition history has been checkered at best. Now, the company is paying $26.2 billion to acquire an unprofitable company. The capital outlay of $26.2 billion to acquire -$59 million in NOPAT earns a return on invested capital (ROIC) of -0.2%, which is much lower than Microsoft’s top-quintile 30% ROIC and below the company’s 8% weighted average cost of capital (WACC). To justify paying $196/share, Microsoft would need, at a minimum, LinkedIn’s NOPAT (assuming no capex) to be $2.1 billion or 8% of the $26.2 billion purchase price. At that level, the deal would earn Microsoft an ROIC equal to its WACC, which is still a low hurdle, but at least the deal would not destroy value. For reference, the highest NOPAT earned by LinkedIn was $50 million in 2014.

How Much Is Microsoft Overpaying?

To get a sense of how much shareholder value Microsoft is destroying, let’s look at some reasonable scenarios for how much the company can improve LinkedIn’s business so that it generates some cash flow. First, we account for liabilities that investors may not be aware of that make LNKD more expensive than the accounting numbers would suggest.

- $1.5 billion in off-balance-sheet operating leases (9% of market cap prior to acquisition announcement)

- $150 million in outstanding employee stock options (1% of market cap prior to acquisition announcement)

- $27 million in minority interests (<1% of market cap prior to acquisition announcement)

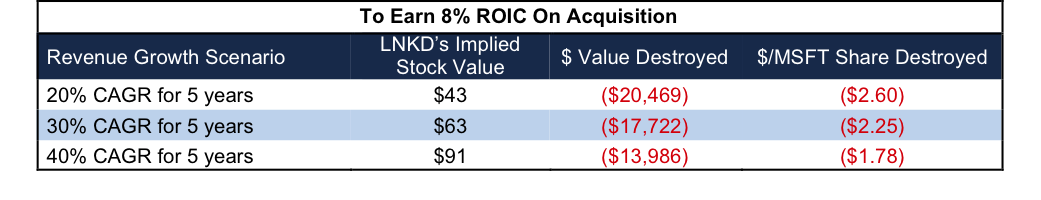

Next, Figures 2 and 3 show the implied stock prices that Microsoft should pay for LinkedIn to achieve separate ‘goal ROICs’, assuming different scenarios for revenue growth. In each of these scenarios, we conservatively assume that Microsoft can grow LinkedIn’s revenue and NOPAT without any capital spending beyond the $26.2 billion they are already paying.

Each scenario also assumes LinkedIn immediately achieves 6% NOPAT margins, which are above LNKD’s best ever margin of 4.5% achieved in 2012. LNKD’s current NOPAT margin is -1.8%.

Sources: New Constructs, LLC and company filings. $ values in millions except per share amounts.

The first ‘goal ROIC’ is 8%, which is equal to Microsoft’s WACC. The big takeaway from Figure 2 is that even if LinkedIn grows revenue by 40% compounded annually for the next five years, the most Microsoft should pay to ensure an ROIC equal to WACC is $91/share, or $14 billion (47%) less than the proposed purchase price. For reference, LinkedIn grew revenue by 35% in 2015, and consensus estimates peg revenue growth at 25% in 2016 and 20% in 2017. Note that any acquisition that earned an 8% ROIC would be value neutral and not create value.

Sources: New Constructs, LLC and company filings. $ values in millions except per share amounts.

The next ‘goal ROIC’ is 30%, which is Microsoft’s current ROIC. In Figure 3, we see that even in the most optimistic scenario, the most Microsoft should pay for LNKD is $25/share, or 87% below the acquisition price. Any price above $25/share would destroy shareholder value and decrease Microsoft’s ROIC.

The bottom line is that Microsoft’s management should have some explaining to do to justify this acquisition at $196/share. Why should they pay so much for an unprofitable company? What sorts of synergies are expected and how do they justify such a big price tag?

Implied Synergies Are Unreasonable

The only reason for a firm to pay a premium over the market value for another firm is if the acquiring firm believes there are significant synergies attainable via acquisition. As the deal is constructed, Microsoft is paying a premium of $64.92/share (from 6/12/16 close price), or slightly over $8.7 billion above market price. Microsoft has yet to make any mention of the dollar value of synergies between the two companies.

Conclusion

Until investors hold management accountable for intelligent capital allocation, they can expect companies to continue to destroy shareholder value without feeling any accountability to their investors. Given our analysis above, we think it fair to ask both management teams how this deal is fair to their investors. The answer for LNKD investors appears easy. The answer for MSFT investors is not so easy.