Markets Know Rate Deferrals Cannot Last Forever

As noted on April 20, under the 'economy-continues-to-grow' scenario, the Fed cannot indefinitely postpone the next rate hike. From Bloomberg:

When does treading carefully lead to falling behind? Federal Reserve officials signaled last week that they expect to raise interest rates twice this year, while investors see only one move. If economic theory is any guide, even the central bank’s more hawkish outlook would still leave the target for the benchmark policy rate way too low.

Conditions Will Never Be Perfect

At last week’s meeting, the markets were not expecting the Fed to raise rates. However markets were expecting the Fed to signal its intent regarding a rate hike in June. Instead, it Fed delivered another vague statement about the timing of any future rate hikes. From CNBC:

Lindsey Group chief market analyst Peter Boockvar made the case that the Fed will never get the “perfect” conditions they seek before increasing short-term rates once again. The Fed’s mandate “isn’t to have a perfect world. That only exists in fairy tales, dreams and in your econometric models,” Boockvar said in a recent note to clients. Boockvar argued that the Fed has been taking cues from shaky international banks, and that doing so will always offer a reason to keep interest rates low.

It’s been excuse, after excuse, after excuse,” Boockvar said. “This is why, eight years into an expansion, they’ve only raised interest rates once. They’re afraid of their own shadow. They’re in a terrible hole that they’re not going to be able to get out of.

'They all believe that, by making money cheaper, you can somehow generate faster growth,' Boockvar said. Based on this, Boockvar said that central bankers are losing their credibility and their ability to generate higher asset prices, putting the stock market in a precarious position. 'In a world that’s already choking on too much debt, the cost of money really isn’t an important variable and it is not a binding constraint on anybody’s decision making.'

Bullish And Bearish Clues

This week’s stock-market video covers numerous bull/bear charts that may be helpful in the coming days and weeks as the markets weigh economic pros and cons in the context of Fed policy.

Rates Have Boosted Asset Prices

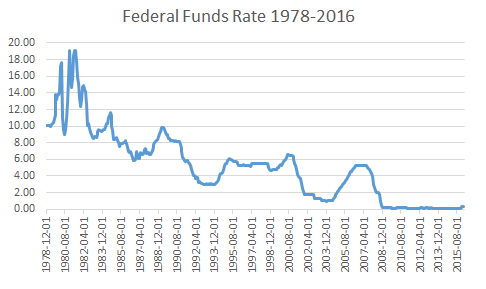

Low interest rates have been helping boost asset prices in many asset classes, including stocks and bonds. Relative to historical norms, interest rates remain at extremely low levels.

The interest-rate chart above seems to align perfectly with the expression “pushing on a string”. From CNBC:

Central banks have been “great” at delivering financial outcomes, if not economic results, in recent years, according to El-Erian. But he now believes policymakers will soon find it difficult to provide support even on the financial front. Investors should prepare for the end of an era in which growth has been low but stable and central banks have repressed financial volatility when it rises too much, he warned.

The 'No-Rate-Hike' Scenario

Is there a scenario that includes no more rate hikes in this cycle from the Fed? Sure, if the economy remains weak and eventually rolls over into a recession, the Fed would most likely remain on hold. However that scenario is not favorable for the stock market.