by Chaim Siegel of Elazar Advisors, LLC

After speaking directly with the company, we came away with the sense that if you want to buy Twitter (NYSE:TWTR) shares, the only way to do it is when you get a whiff of momentum. In particular, when there's a hint that revenues can drive earnings back up. That’s the right time to buy.

It can happen, but we’re not there yet. There is no way we want to buy on valuation because right now Twitter shares are not cheap on a P/E basis. That said, when you get a suggestion of momentum, that will be the exact time to enter.

For now we have at least six months before we get there, which we'll explain further in this report. Currently, our numbers are below The Street's and several factors are likely going to delay that momentum shift, which we’d need before we get excited about the stock.

The Benefits Of Keeping Twitter On The Radar

Twitter of course can’t be ignored. We want to want to own the stock. We can’t ignore their over 300mm users which is about 1/4 the size of Facebook (NASDAQ:FB). Twitter has a great—and now growing—user base and there is no doubt people love to use it. The Twitter 'franchise' keeps us searching for the right time to buy into the stock even while others probably want to give up on the company.

When profits do turn, this can easily become an exciting story. We’re not there yet, but we want to keep it on our screens.

We’ll explain what we need to see to anticipate catching this when it can again turn into an 'exciting story.'

First, Valuation: No Way, Not Yet

The company said they are gunning for profitability on a GAAP basis. That could get confusing for investors. If the company shifts focus to GAAP, then the valuation is going to look worse. We all know that GAAP earnings are lower than non-GAAP earnings. Targeting GAAP profitability is of course the right strategy, but it will make valuation metrics look worse because of the lower earnings in price-to-earnings ratio comparisons.

Elsewhere, some “value investors” may be licking their chops. You have a stock down from around $70, currently trading at $15, almost everybody bearish, and 10% of the float is short. All these are typical contrarian buy signals.

However, we’re not sold on buying momentum stocks “because they’re cheap.” We buy value stocks on value. We want to buy momentum stocks on… momentum. So let’s keep things simple.

As for valuation, as mentioned above, it’s currently not cheap and we think it could get worse before it gets better.

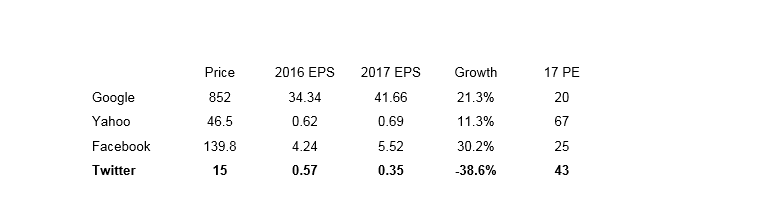

We took a fair collection of peers for comparison. On The Street’s non-GAAP earnings, Twitter is still more expensive than owning companies with momentum such as Google (NASDAQ:GOOGL) or Facebook.

In addition, while Twitter is more expensive on an earnings basis, we think The Street's earnings are too high. We think there is downside risk to earnings (as we will explain below). That downside makes Twitter even more expensive if we are right.

Buying Twitter because it’s plummeted from $70 to $15 is not a value investing strategy. That's because Twitter is not yet cheap, therefore not a true value stock.

Twitter's Chart Scares Us

If we were to expect higher earnings than The Street and a pickup in growth rates we wouldn’t be worried about a chart like this. In the meantime we don’t see fundamental or valuation support that can hinder this downtrend, at least for now.

Later in the year, however, we do think there can be revenue and earnings momentum drivers as we will explain. That’s six months away (at the earliest) and we’re not ready to carry the risk of this chart until then.

By getting in now, value investors could have to lug a stock that, if it were to break down, would hurt...a lot.

What’s Holding Back Earnings and Timing

We have two main problems with Twitter earnings.

- Suffering from past slowdown

- Increased competition

Past Slowdown

The company is suffering from the past slowdown because most of their revenues are generated from “brand” advertisers. Twitter is not set up to do as much “direct” advertising where advertisers can log in, target the exact type of customers they want and spend on just the audience they wish to reach, as can be done on other sites. With Twitter, advertising is still driven mostly by a sales team dealing with traditional ad agencies and marketing divisions to elicit spending.

So even though they are a progressive internet site on the front-end, their back-end selling process is much more conventional. For that reason we are at the mercy of traditional advertising industry sell-cycles.

Brand advertisers are generally the bigger, more established, well-known companies that Twitter needs to pitch to sell in order for them to spend their marketing dollars on Twitter. Direct advertisers are typically smaller businesses that can spend directly on the site. That can turn much faster. However, Twitter isn’t set up for those sales right now, as is their competition. Twitter is dealing with large clients who need approvals from the top of each of their own organizations. This keeps the Twitter sales cycle running slower. That’s why this turn takes time.

Those traditional brand advertisers make most of their decisions later in the year as they plan for the fourth quarter holiday and their strategy for the next fiscal year.

For that reason, to win back lost advertisers, Twitter needs to wait for their core customers—brand advertisers—to be ready to shift their ad spend. That usually comes closer to the flip of the year.

While Twitter's daily active user growth has accelerated from 3% in Q1 to 11% in Q4, Twitter's advertisers make their decisions based on their own, past experience. Since advertisers experienced weaker results on Twitter they are taking their time to re-up. If the user growth metrics continue to improve for Twitter, that will help to convince brand advertisers to give Twitter another shot. But that happens towards the end of the year.

That’s why we hear from Twitter that while their user growth metrics are accelerating their revenues are not. They need to hit these traditional buyers when they are ready to buy, during their traditional buying cycles. As we've laid out, we have some time before that happens.

Increased Competition

Since we're more momentum-oriented investors, we have another issue, which is that the company only just started facing increased price competition. That doesn’t just go away.

Google, Facebook, You Tube (which Google owns) and others spot an opportunity to compete on price in order to gain share. Twitter cited that a major portion of the competition is coming from video, exactly where Twitter was planning to grow.

Because competition just became more aggressive, we have a few quarters before we lap this impact. We don’t cycle this new level of competition until later in the year.

Combining the increased competition, which hits gross margins, along with the need to wait for a new ad buying cycle, we have time before we need to give Twitter a closer look.

Why Our Earnings Are Below The Street's

Revenues

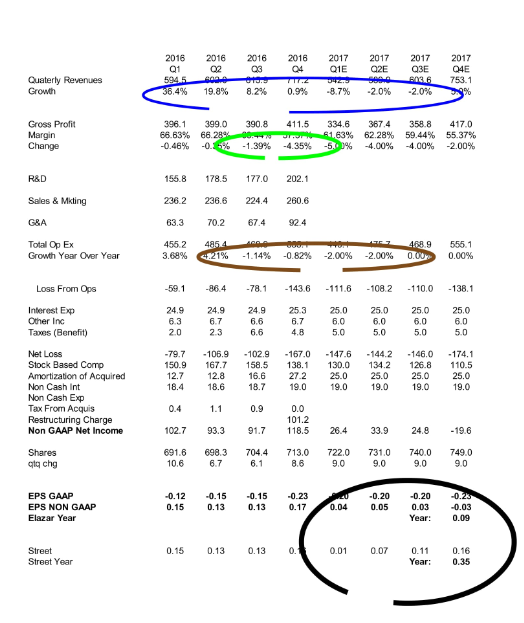

Revenue growth over the last four quarters has slowed from 36% to 1%. There is nothing stopping this slowing trend. (Denoted in blue on the earnings model, below.)

Gross Margins

The company only just started facing more price competition. Much of that competition was directed at video which is a core driver for Twitter.

Gross margins from Q3 to Q4 went from being down 140bp to being down 400bp. (Denoted in green on the model.) We need to get through a few quarters before we’re likely to see this trend reverse. This is a meaningful cause for the risk to earnings.

Operating Expenditures

The company had flattish expenses last quarter. We don’t think they have much room to drop expenses further. (Denoted in brown on model.) Plus, a high multiple company does not get paid for making earnings through lower expenses.

What they really need to do is spend more money (not cut) on R&D and Sales to help drive revenues and profits. Momentum investors would much prefer to buy revenue growth rather than cost savings. This is not an old industrial company. Twitter should be able to drive topline and earnings growth. We think they can. If they cannot, then this story doesn’t have much of a future.

When we run what we think are fair estimates for the various line items, we get to about $.09 for 2017 versus The Street’s $.35 non-GAAP. (Denoted in black on the model.)

We don’t expect momentum or value investors to pay for slowing earnings and misses, if we prove to be correct.

Timing Twitter

That said, if the stock were to take a hit, breaking lower into the fourth quarter, we think there is a real chance for a change in momentum as the year flips into 2018. It could be worth taking a closer look ahead of that, after the third quarter reports.

The ad buying cycle of their core customer 'brand' advertisers picks up in the fourth quarter. If brand advertisers see a continued pickup in Twitter’s user metrics they could decide to give Twitter another shot for the 2017 holiday. If that goes well and advertisers see an ROI (Return-On-Investment) they could decide to extend purchases into 2018.

That’s why the timing would be better around the third quarter report since you have some visibility that business could start to pick up again.

That’s also when we start to lap the big hits from increased competition while at the same time potentially getting the benefit of brand advertisers giving Twitter another chance.

For now, even if numbers were coming down into the fourth quarter, we think 300mm users and growing would be worth dipping a toe into the water… at that point, just not yet.

As we see it, buyers could grab the trifecta: in all probability a cheaper stock, a growing user base and the potential to hit the sweet-spot of Twitter's core customers’ buying cycle.

Earnings Model

Conclusion

Keep Twitter on the radar, but we think it’s still too early to buy the stock. Twitter is a momentum stock and can’t, nor should it be bought on value. We think the trough quarter is Q3, so we probably want to wait for that report. We can then decide if we can start to benefit from easier comparisons as well as the sweet-spot of their customers’ buying cycle.

Disclaimer: Portions of this article may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.