By Max A. Cherney

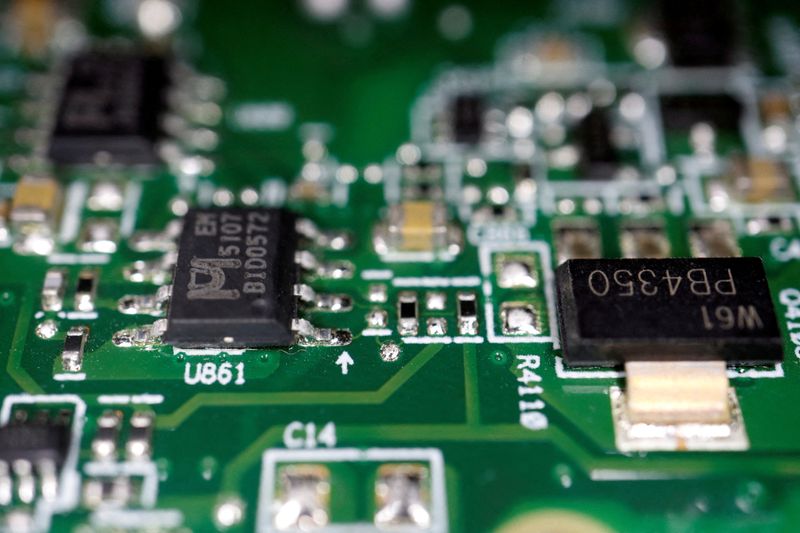

SAN FRANCISCO (Reuters) - A surge in demand for artificial intelligence (AI) and a steady rise in automotive chips will help propel a rebound in global chip sales this year, according to an industry group's annual sales data released on Monday.

The Semiconductor Industry Association (SIA) forecast a 13.1% jump in global chip sales to $595.3 billion, compared with a drop of about 8% in sales in 2023.

"AI is a super strong market - I think of you look across the landscape, there's a lot of positive things to look at," SIA Chief Executive John Neuffer told Reuters in an interview.

Despite a slow start to the year for auto chips, that slice of the chip market is still expected to grow 6%, according to SIA Director, Industry Statistics and Economic Policy Robert Casanova.

Last year, weak demand for PCs and smartphones punished chipmakers like Intel (NASDAQ:INTC) and Qualcomm (NASDAQ:QCOM), partially contributing to a 1.1% increase in sales of so-called "logic" chips to $178.5 billion. Memory sales plunged 29% to $92.3 billion and was the second largest category tracked by the SIA.

But this year, the frenzy among tech giants to deliver products and services that deploy AI triggered a surge in demand for the advanced chips produced by Nvidia (NASDAQ:NVDA), as cloud computing companies seek to build more capacity to run such software.

AI applications require large quantities of graphics processing units (GPUs) strung together, and a range of other types of chips around them to achieve the performance necessary. AI systems need massive amounts of high-bandwidth memory made by SK Hynix and speedy networking processors to move data between.