By Howard Schneider and Andrea Shalal

WASHINGTON (Reuters) - Joe Biden speaks to the nation tonight at a time of record low unemployment, rising wages, and diminishing fears of recession - facts the U.S. president is likely to trumpet as a sign his economic plans are working in the wake of the COVID-19 pandemic.

But there are pressing economic issues, most notably the need to lift a statutory debt limit that, in the extreme, could cause the U.S. government to stop paying its bills.

And simmering in the background: A still unresolved Federal Reserve fight to control inflation that may pose the largest outstanding risk to the Biden economy, and over which the White House has little influence.

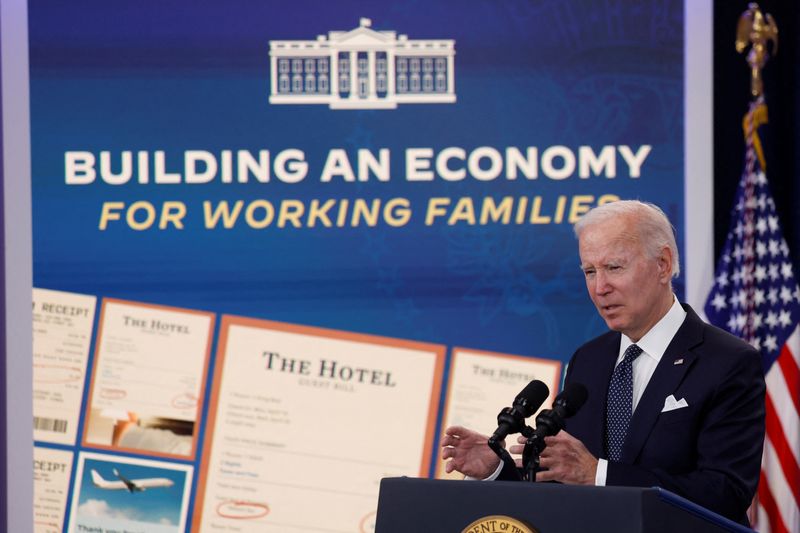

Biden will deliver the annual State of the Union address to a joint session of Congress on Tuesday night, his second such speech as president and the first since the Republican party narrowly took control of the House of Representatives after November's mid-term elections.

The overall mood is still mixed, economists and pollsters report, with Biden's approval ratings hovering at around 40%. Consumers are "reconciling layoff announcements with record job numbers, inflation that is rolling over yet prices remain elevated. It is not black and white," said John Leer, chief economist with Morning Consult.

In his speech, Biden "has to thread a bit of a needle," said Brian Gardner, Washington strategist for investment firm Stifel. Despite positive employment and other trends, "people are still anxious and you cannot be tone deaf to that," after a year in which prices rose at the fastest pace in 40 years and the Federal Reserve's aggressive rate hikes put home mortgage and other credit out of reach for some families.

GASOLINE AND INFLATION DROP

On the whole, economic data in recent months has moved in the president's favor, particularly after inflation spiked to a 40-year high last summer and government reports showed the U.S. economy could be heading into a recession.

The consumer price index dipped from a nearly 9% annual rate in June to under 6.5% as of December.

Gasoline prices that hit $5 a gallon over the summer were below $3.50 this week. Consumer confidence and the household inflation outlook have improved.

Graphic: Inflation eases- https://www.reuters.com/graphics/USA-BIDEN/INFLATION/znvnbklyzvl/chart.png

GDP AND JOBS RISE

After a tepid start to 2022, the U.S. economy ultimately grew by more than 2% for the year after a stronger than expected second half, prompting firms like Goldman Sachs (NYSE:GS) to lower the perceived risk of a downturn.

The progress on inflation, meanwhile, has come so far without any corresponding hit to job growth or the unemployment rate.

The economy added an average of a half million jobs a month in the first two years of the Biden presidency, nearly triple the pace seen before the health crisis - and 4.8 million in 2022 alone. The 571,000 added in January showed unexpected ongoing strength and put the economy within a few months of potentially returning the employment level to its pre-Covid trend.

Graphic: The jobs hole facing Biden and the Fed - https://www.reuters.com/graphics/USA-ECONOMY/JOBS/jbyprzlrqpe/chart.png

STRONG LABOR MARKET

The gains have been spread across industries and demographic groups.

High profile tech firms may be laying off employees, but other businesses have picked up the slack thanks to still booming demand at restaurants and for other services.

The unemployment rates for Black and Hispanic people are near the lows seen before the pandemic hit the U.S. economy in March of 2020.

Graphic: Unemployment by race and ethnicity- https://www.reuters.com/graphics/USA-FED/JOBS/gdvzqqznapw/chart.png

What's still to be determined, and what could shape the landscape Biden and his Democratic Party ultimately face in 2024, is whether inflation continues to steadily decline, and, if not, what the Fed chooses to do about it.

Fed officials see the current levels of job and wage growth as unsustainable. If inflation does not continue to slow they have pledged to raise interest rates as high as necessary to win that particular fight - even at the cost of rising unemployment.

Biden's message Tuesday night, however, will be focused on what the administration sees as the progress that is continuing, and the sense that the economic impact of the pandemic has waned.

"On average, American households are in a better position than they were before the pandemic hit," National Economic Council director Brian Deese said on Monday. "We find ourselves today in an economy where we have real resilience."