By Jonathan Spicer

ALBANY, N.Y. (Reuters) - The Federal Reserve can be "gentle" in removing monetary stimulus since U.S. inflation remains low and the economic expansion could last five or more years, one of the most influential Fed policymakers said on Wednesday.

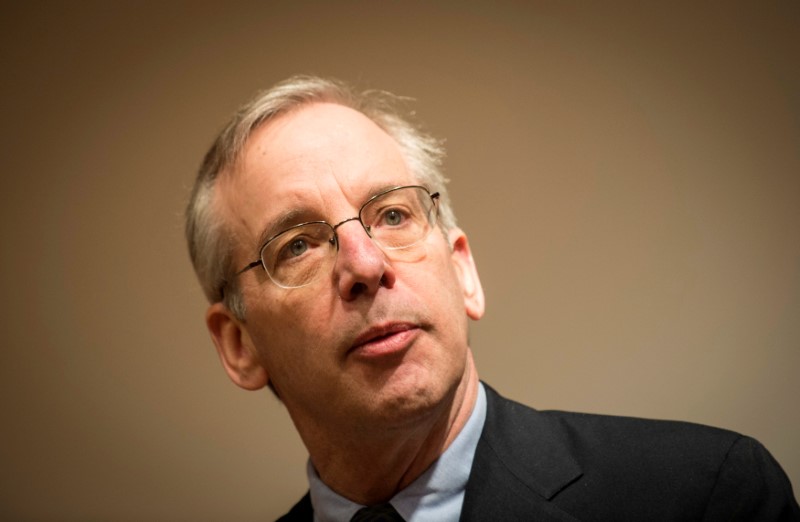

"We're at a point where the economic expansion has plenty of room to run," said New York Fed President William Dudley, echoing Fed Chair Janet Yellen's message last month after the central bank decided to leave interest rates unchanged at near a record low of 0.25-0.5 percent.

"Inflation is a little below our target, rather than above our target, so I think we can be quite gentle as we go in terms of gradually removing monetary policy accommodation," said Dudley, a close ally of Yellen and a permanent voter on policy.

The U.S. central bank lifted rates in December for the first time in nearly a decade and has stood pat since, as market volatility and overseas events were seen to threaten the U.S. economy, which slowed in the first half of the year. Still, most Fed officials still expect to raise rates again before year end.

"I think this economic expansion can last a good while longer," Dudley told a business council gathering, adding one reason the Fed has been patient in mulling a rate hike this year is that "slack," or underutilized workers, remain in the U.S. labor market.

The Fed, he said, is aiming for a best-case scenario in which the economy grows at a "moderate rate over the next five to 10 years" while unemployment remains around 5 percent or a bit lower "and just have a very long-lived economic expansion."