By Paul Carrel

BERLIN (Reuters) - The mood among German investors improved far more than forecast in December, a survey showed on Tuesday, with an unexpected rise in October exports boosting hopes for an upturn in Europe's biggest economy.

The ZEW research institute's monthly index on economic morale among investors rose to 10.7 from -2.1 a month earlier. The reading exceeded even the highest forecast in a Reuters poll of economists, which showed a consensus prediction of 0.0.

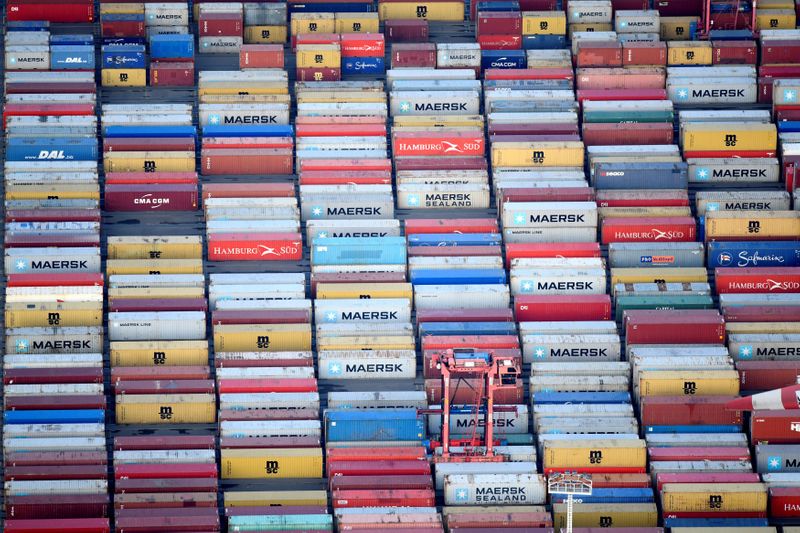

Europe's biggest economy has been going through a soft patch as its export-oriented manufacturers struggle against a backdrop of trade friction, an ailing car industry and uncertainties over Britain's planned departure from the European Union.

But data on Monday showed German exports rose unexpectedly in October as demand from beyond Europe increased, helping to buoy investor sentiment.

ZEW President Achim Wambach said the rise in morale "rests on the hope that German exports and private consumption will develop better than previously thought".

He added: "This hope results from a higher-than-expected German foreign trade surplus in October, alongside relatively robust economic growth in the EU in the third quarter and a stable German labor market."

In its 10th successive year of growth, Germany's economy has been relying on strong consumption as exports weaken, which resulted in a second-quarter economic contraction of 0.2%.

The economy grew by just 0.1% in the third quarter, narrowly avoiding recession, which economists usually define as two consecutive quarters of negative growth.

A separate ZEW gauge measuring investors' assessment of the economy's current conditions rose to -19.9 from -24.7 in the previous month. Analysts had forecast a reading of -22.3.

"The message is: The economy has bottomed out, without it pointing to a dynamic recovery," said Thomas Gitzel, economist at VP Bank.