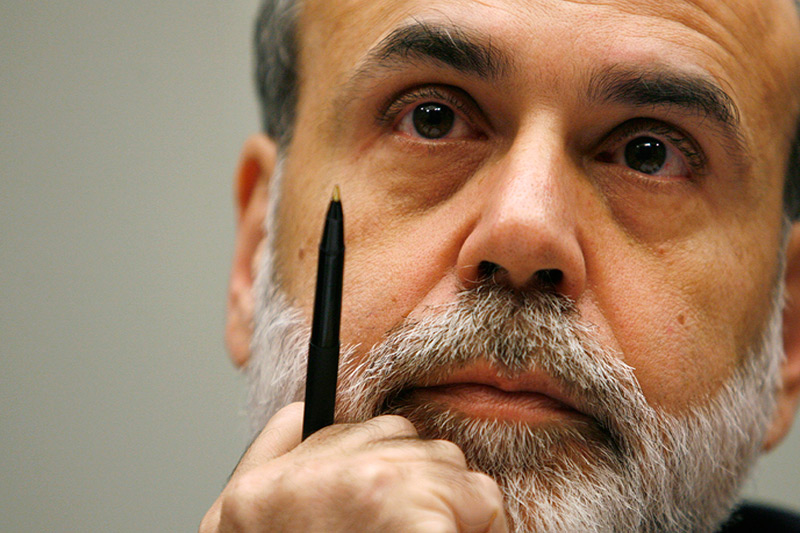

Investing.com - Gold futures were higher on Wednesday, ahead of congressional testimony on the economy by Federal Reserve Chairman Ben Bernanke later in the day.

Gold traders also looked ahead to Wednesday’s Federal Reserve minutes for further hints regarding the central bank’s monetary policy.

On the Comex division of the New York Mercantile Exchange, gold futures for June delivery traded at USD1,384.85 a troy ounce during European morning hours, up 0.55% on the day.

Comex gold prices rose by as much as 0.7% earlier in the session to hit a daily high of USD1,387.45 a troy ounce.

Gold futures were likely to find support at USD1,337.85 a troy ounce, the low from May 20 and resistance at USD1,399.55, the previous session’s high.

Investors remained cautious ahead testimony at the U.S. Joint Economic Committee by Ben Bernanke, amid speculation over whether the U.S. central bank will begin to scale back its asset purchase program this year.

The minutes of the Fed’s May meeting are to be released later in the trading day.

On Tuesday, St. Louis Fed President James Bullard said the Fed should continue its bond buying and make adjustments as the economy changes.

Comments by New York Fed President William Dudley were also interpreted as suggesting the central bank wasn’t about to taper off its bond-purchase program.

Bullard and Dudley will both vote at the central bank's next scheduled meeting on June 18-19.

Gold prices have been under heavy selling pressure in recent sessions amid expectations the Fed will wind down its stimulus program, citing indications of an improving U.S. economic outlook.

Moves in the gold price this year have largely tracked shifting expectations as to whether the U.S. central bank would end its bond-buying program sooner-than-expected.

Despite the gains, sentiment on the precious metal was expected to remain bearish after data showed that holdings in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, fell 0.8% on Tuesday to 1023.08 tonnes, the lowest since February 2009.

Elsewhere on the Comex, silver for July delivery added 0.6% to trade at USD22.58 a troy ounce, while copper for July delivery rose 0.8% to trade at USD3.370 a pound.

Gold traders also looked ahead to Wednesday’s Federal Reserve minutes for further hints regarding the central bank’s monetary policy.

On the Comex division of the New York Mercantile Exchange, gold futures for June delivery traded at USD1,384.85 a troy ounce during European morning hours, up 0.55% on the day.

Comex gold prices rose by as much as 0.7% earlier in the session to hit a daily high of USD1,387.45 a troy ounce.

Gold futures were likely to find support at USD1,337.85 a troy ounce, the low from May 20 and resistance at USD1,399.55, the previous session’s high.

Investors remained cautious ahead testimony at the U.S. Joint Economic Committee by Ben Bernanke, amid speculation over whether the U.S. central bank will begin to scale back its asset purchase program this year.

The minutes of the Fed’s May meeting are to be released later in the trading day.

On Tuesday, St. Louis Fed President James Bullard said the Fed should continue its bond buying and make adjustments as the economy changes.

Comments by New York Fed President William Dudley were also interpreted as suggesting the central bank wasn’t about to taper off its bond-purchase program.

Bullard and Dudley will both vote at the central bank's next scheduled meeting on June 18-19.

Gold prices have been under heavy selling pressure in recent sessions amid expectations the Fed will wind down its stimulus program, citing indications of an improving U.S. economic outlook.

Moves in the gold price this year have largely tracked shifting expectations as to whether the U.S. central bank would end its bond-buying program sooner-than-expected.

Despite the gains, sentiment on the precious metal was expected to remain bearish after data showed that holdings in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, fell 0.8% on Tuesday to 1023.08 tonnes, the lowest since February 2009.

Elsewhere on the Comex, silver for July delivery added 0.6% to trade at USD22.58 a troy ounce, while copper for July delivery rose 0.8% to trade at USD3.370 a pound.