Silver price broke through the September’s low in the middle-term trend

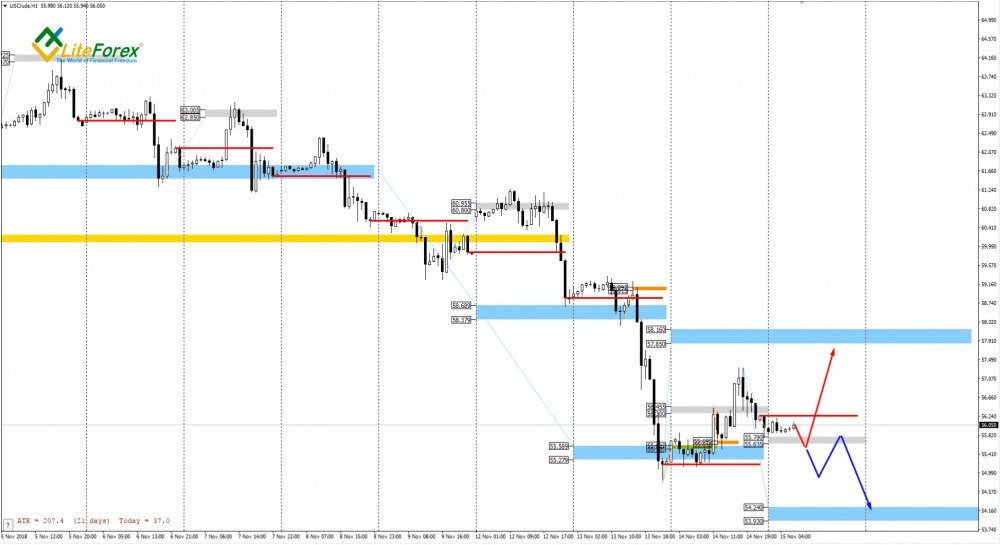

WTI

Oil traders are holding the strong middle-term support target Zone 6 [55.09 – 54.78]. The further decline can’t be currently expected; so, to enter new sales, I suggest expecting the test of the resistance at [58.16 – 57.85] and looking for a pattern.

In the shorter timeframe, there are some signs that the short-term trend may reverse upwards. Yesterday, buyers broke through Intermediary Zone [56.45 – 56.30]; although the US session closed below the zone, I suggest that the resistance is broken out.

Therefore, I can safely rearrange the support from the yesterday’s daily high and suggest looking for buys according to the pattern in the zone.

If IZ is broken out from above, we shall continue looking for short trades.

WTI trading tips for today:

Buy according to the pattern in Intermediary Zone [55.79 – 55.63]. TakeProfit: 57.28, Target (NYSE:TGT) Zone [58.16 – 57.85]. StopLoss: according to the pattern rules.

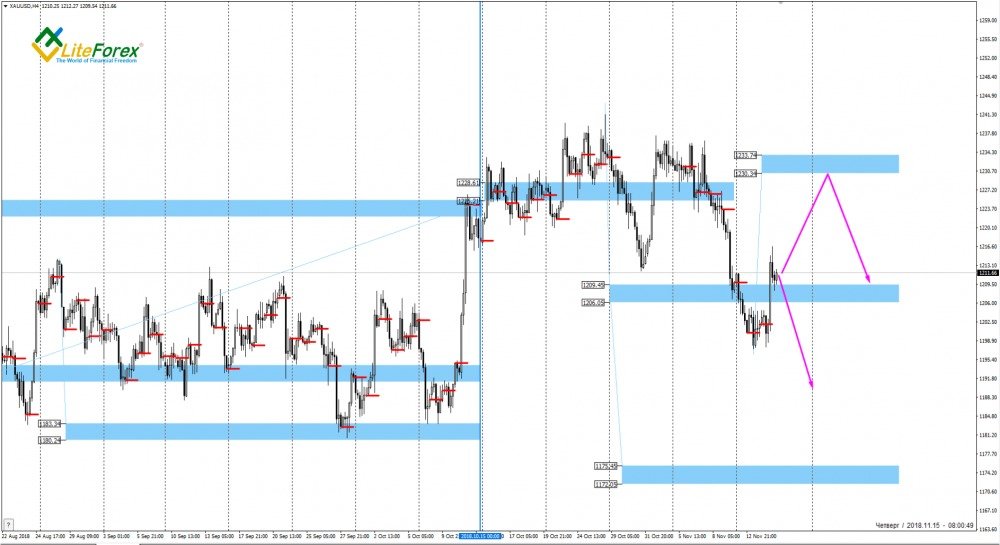

XAU/USD

Gold price is testing the resistance zone of [1209.4 – 1206.0] from below. The key resistance of the trend is at [1233.7 – 1230.3]. I recommend looking for sales in these two price zones.

The local gold trend is downwards; however, the price rebounded up from Target Zone [1203.4 – 1200.0].

Currently, buyers are testing Intermediary Zone [1215.0 – 1213.3], where there are the best sell prices. To sell, I recommend expecting the correspondent technical signal. If it is emerges, I suggest selling gold with the first target in TZ, and the second one around the low of November 13.

Alternative scenario: buy XAUUSD up to the upper TZ [1233.7 – 1230.3] if the resistance is broken out. In this case, the US session should close above 1215.0.

XAU/USD trading tips for today:

Sell according to the pattern in Intermediary Zone [1215.0 – 1213.3]. TakeProfit: Target Zone [1203.4 – 1200.0], 1196.8. StopLoss: according to the pattern rules.

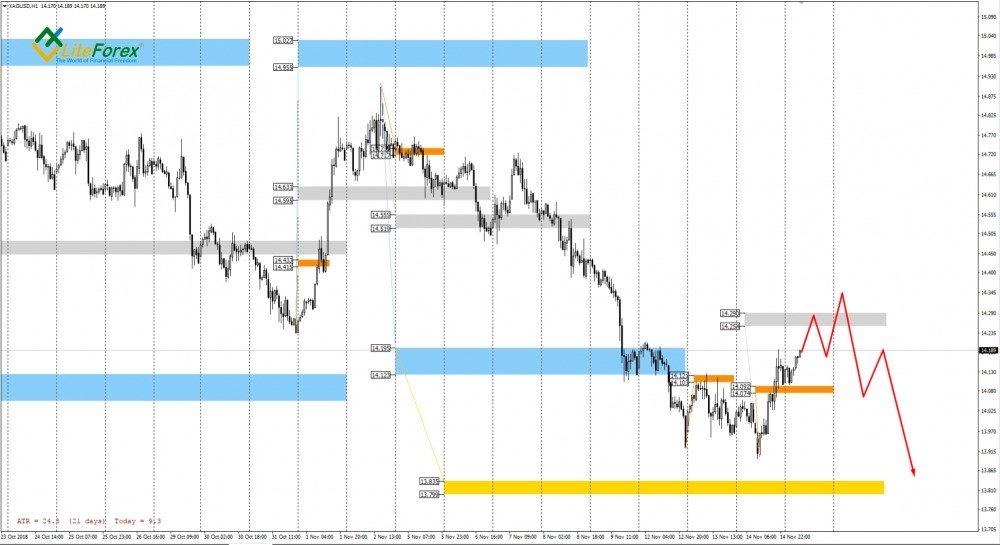

XAGUSD

Silver price has again renewed the September’s low moving in the downtrend. Currently, silver price is being corrected with a possible target at the lower border of the flat + Target Zone 4 [14.39 – 14.31]. After the resistance zone is reached by the price, look for sales. Buying will be relevant if the price is consolidated above level 14.39.

The local silver trend is downward. The correction is developing ta the moment. The price is approaching the key resistance at [14.29 – 14.25]. After the zone is tested, look for sells with a target around yesterday’s low and in Gold Zone [13.83 – 13.80].

If IZ is broken through, we shall start buying XAGUSD tomorrow.

XAG/USD trading tips for today:

Sell according to the pattern in Intermediary Zone [14.29 – 14.25]. TakeProfit: 13.90, Gold Zone [13.83 – 13.80]. StopLoss: according to the pattern rules.

IZ - Intermediary Zone: responsible for the price momentum reversing.

TZ - Target Zone: a zone that is 75% likely to be reached after IZ breakout.

GZ - Gold Zone: zone in the medium-term momentum.

All zones are calculated based on the average daily price of the instrument and margin requirements of the futures.