Anyone in their position with the tools at hand would not have any other real option other than to buy stocks in whatever quantity is needed to reverse the selling and blow the shorts out of the water.

Since I'm writing this on Sunday evening, if the Dow Jones Industrial Average opens down 1,000 on Monday morning, I'm going to look very foolish. Such is the risk of being contrarian. So what's contrarian now--expecting a crash or expecting a bounce and rally?

Exactly what the sentiment consensus is right now is open to debate. Analysts expecting a stock market crash see those expecting a rebound as the consensus view.

But if we look at various measures of sentiment such as the Put-Call Ratio and greedometer.com, we find elevated levels of fear over the past few weeks. The consensus can hardly be said to complacent when the VIX index is over 20.

Let's set aside sentiment measures and technical analysis and ask a larger question: will the Fed let the stock market crash before an election? Once again we find two camps among participants. One camp believes markets still obey the basic rules of technical analysis. The Fed and other central banks may intervene at the margins, but their interventions only work on low-volume days. When selling increases, it overwhelms the relatively modest size of central bank intervention and the market then crash.

The other camp holds that all markets are now engineered, and intervention can reach essentially unlimited levels if the Powers That Be deem that necessary. I covered this view in Have We Reached a Financial Singularity? (September 4, 2014)

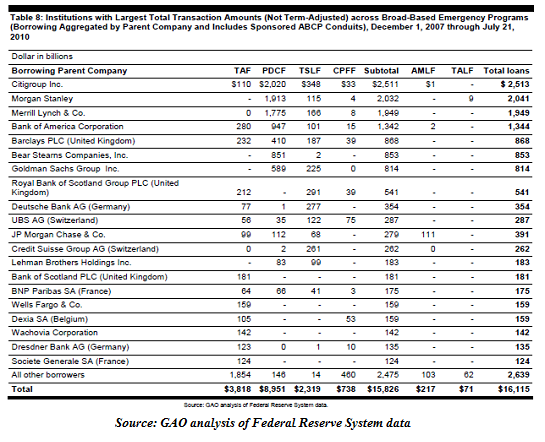

For context, let's recall that the Fed conjured up $16 trillion to backstop global banks in the Global Financial Meltdown; (the Levy Institute came up with $29 trillion after poring over all the data):

To put $16 trillion in context, note that entire gross domestic product (GDP) of the U.S. is about $17.3 trillion, and all residential mortgages in the U.S. total about $10 trillion.

Long-time readers know that I see the Federal Reserve as an intrinsically political entity. Though it casts itself as an independent institution that's above the political fray, this is simply good PR: the Fed is as political as any other institution of the central state.

What would happen to incumbents in the election a few weeks from now if the stock market crashes? The happy story--that all is well and you would be wise to re-elect the incumbents responsible for the economic good news--would be reduced to rubble.

One can only imagine the phone calls being made to Fed governors by politicos of both parties suggesting that it would be a terrible shame if all the hard work of those in power was destroyed by a needlessly destructive market crash.

We can also imagine similar calls being made to officials in the Bank of Japan, the European Central Bank, etc.

We know central banks are openly buying bonds and stocks, either directly or through proxies. What possible reason would the central banks have to suddenly reverse their interventions and stand aside right when the global markets are in meltdown?

Thus we can also imagine some conference calls being made this weekend to coordinate intervention on whatever scale is necessary.

If central banks have learned anything since 2008, it's that waiting around for the panic to deepen is not a winning strategy.

We can also ponder the psychological consequences of the vast expansion of intervention. Where prior to 2008 the Fed and other central state players might have viewed $10 billion as a major intervention, what do you think whatever it takes is now? Do you really think $1 trillion would give those in charge pause? Since we're talking about propping up a $160+ trillion edifice ($80 trillion of assets in the U.S. alone), what's a trillion or two between pals?

Some observers think it bearish that no central bank has stepped up and announced a new easing program. I reckon the central banks have fully grasped that the public is now skeptical of PR campaigns, and so the smart move is to avoid public jawboning in favor of buying the assets directly, in whatever quantities are deemed necessary.

Put yourself in their shoes. Isn't this what you would do, given the dearth of alternatives and the very real risks of implosion? Anyone in their position with the tools at hand would not have any other real option other than to buy stocks in whatever quantity is needed to reverse the selling and blow the shorts out of the water.

If $1 trillion doesn't do the job, make it $3 trillion, or $5 trillion. At this point, it doesn't really matter, does it?