As gold bullion prices continue to take a beating because of the belief that the easy money policies of the Fed won’t go away anytime soon, silver prices have fallen into the same rut. Just like gold bullion, the silver market has also become a place where bears prevail.

But in the midst of the negativity towards silver, I see that the fundamentals that ultimately drive silver prices higher are getting stronger.

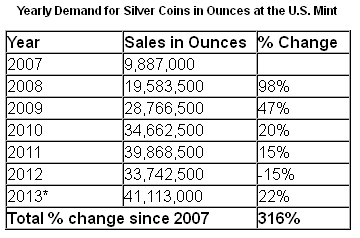

Demand for silver is robust. Sales of one-ounce silver coins at the U.S. Mint have reached a record for the year, and 2013 still isn’t finished! The table below shows how demand for silver (coins in ounces) has increased at the U.S. Mint since 2007.

Notice on the table above how demand for silver coins at the U.S. Mint this year has already surpassed the level seen in 2011—a time when silver prices were at about $50.00 an ounce.

Rising demand for silver is just one reason why I am bullish on silver prices. But I have another reason, too, as to why I expect silver prices to rise ahead.

While there have been some comments among economists that the Federal Reserve will start pulling back on printing paper money in 2014, the Fed has printed so many trillions of dollars in new money that it has placed downward pressure on the value of the U.S. dollar. Other central banks in the global economy are doing the exact same: printing more paper currency in an effort to lower the value of their currencies to increase exports.

Precious metals like gold bullion and silver, from a historical perspective, have proven to be great stores of value in times of uncertainty. (As I have been writing for some time now, the massive fiat currency printing we see now by world central banks will not end well.)

My take on silver? With silver prices having fallen so much, and demand for the metal rising, I see a significant opportunity in quality, well-managed silver mining companies.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why This “Other” Metal Looks So Attractive

Published 12/03/2013, 04:25 AM

Why This “Other” Metal Looks So Attractive

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.