Central Banks Are Terrified Of Deflation

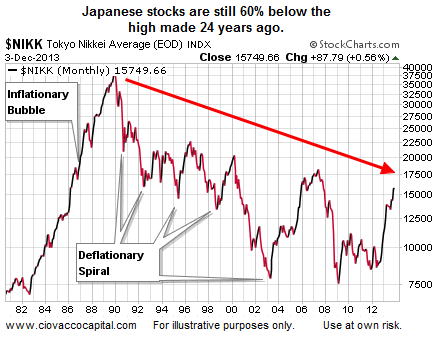

On December 29, 1989 a massive inflationary bubble began to pop in Japan. As prices dropped, investors with cash sat on their wallets waiting for lower equity prices. The desire to “get out” became much stronger than the desire to “get in” and prices continued to fall. Japan started a process that central bankers have nightmares about – a deflationary spiral. As the chart of the Japanese stock market below shows, a deflationary spiral is very hard to stop once it starts. In fact, 24 years later the Nikkei is nowhere near its 1989 high.

Can you imagine if the S&P 500 peaked this week and did not revisit the high for over 20 years? Japan has been desperately trying to reverse deflationary trends.

From Bloomberg

It’s been 22 years since annual inflation in Japan exceeded 2 percent, according to data compiled by Bloomberg. In the last five years of the 1980s, when Japan’s gross domestic product climbed from $1.3 trillion to $3 trillion and the Nikkei 225 Stock Average peaked at almost 39,000, the monthly readings for consumer price gains averaged 1.2 percent, the data show. The Nikkei 225 closed today at 15,407.94. “It’s difficult to say whether we are really exiting deflation,” Mitani said. “Consumer prices are starting to rise, but a large reason for that is based on the weakening yen and rising energy prices. We can’t say that looking at recent results, we have really exited deflation.”

Mistake Of Excessive Accommodation

In a still-relevant November 14 article covering how the Fed’s dual mandate impacts their tapering decisions, we highlighted the insightful remarks below from PIMCO’s Mohamed A. El-Erian.

From CNBC

The Fed is committed to keeping its foot on the accelerator even though outcomes may well continue to fall short of expectations, and even though the “costs and risks” are likely to rise. If it ends up making a mistake, something that it will try very hard to avoid, it would likely be one of excessive accommodation rather than premature tightening.

Economic Improvement Heightens Tapering Fears

The Fed hopes their bond buying program will act as economic lighter fluid, sparking growth and hiring. Therefore, stronger economic data increases the odds of the Fed cutting back on the lighter fluid. On Wednesday, economic bulls were 2 for 3, which increased taper chatter in the financial markets.

From Bloomberg

Data today showed companies boosted payrolls in November by the most in a year. Labor Department data on Friday may show the unemployment rate fell to 7.2 percent, matching the lowest level since 2008. A separate report indicated service industries in the U.S. expanded at a slower pace than forecast in November, showing uneven progress in the biggest part of the economy. Purchases of new U.S. homes surged in October by the most in three decades, signaling buyers are starting to take higher mortgage rates in stride.

Investment Implications – Aggressive Tapering Not Likely

Could the Fed begin tapering this month? Sure they could, but Japan and fears of a deflationary spiral tell us an aggressive tapering schedule is unlikely. Looking at it from a different angle, if markets are pulling back due to tapering fears, that is not such a bad thing relative to what the bull market really needs - growth.

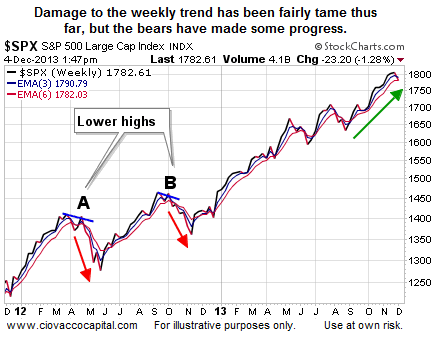

With the S&P 500 down roughly 15 points this week, we must keep an open mind about further downside. Since our market model relies heavily on weekly outcomes, we are more concerned how the chart below looks Friday at 4 p.m. EST.

If weakness becomes significant enough to warrant a reduction in our exposure to stocks, we will not hesitate to make the proper adjustments before the end of the week. For now, some patience remains in order, allowing us to hold our stakes in U.S. (VTI) and foreign stocks (VEU).