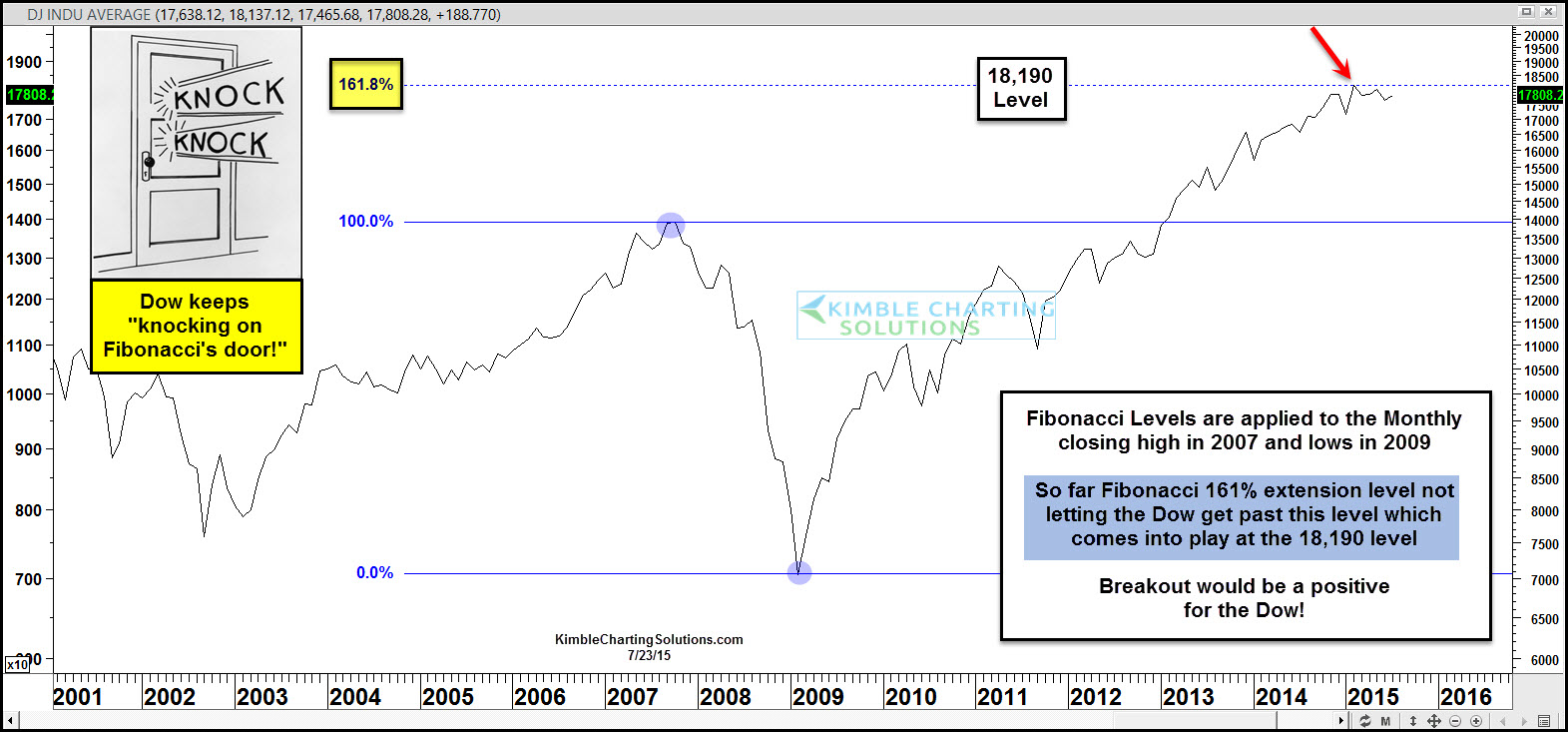

For the Dow, two of the most impactful prices over the past 15 years happens to be the 2007 highs and 2009 lows. Could those two dates have an impact on the Dow in 2015? The Power of the Pattern thinks so.

If one applies Fibonacci levels to these key dates, a Fib 161% extension level is created at the 18,900 level. And that becomes a breakout/resistance zone for the Dow.

The Dow closed at 18,132 in February, 58 points shy, a 3rd of a percent away from the 161% level and has since backed off a little bit. For the majority of the year, the Dow has been knocking on the door attempting to breakout above this price zone.

I believe we are all aware that the Dow represents just 30 stocks and it's not a great tool to measure the broad markets. Just remember that if one applies Fibonacci to the same price points on the S&P 500, you'll find that it has been knocking on the same 161% extension level, which has held it in check as well.

Will the Dow and S&P be able to knock the 161% door down and push higher? A breakout for both would be viewed as a positive event, so stay tuned to see it they can push past these key levels.