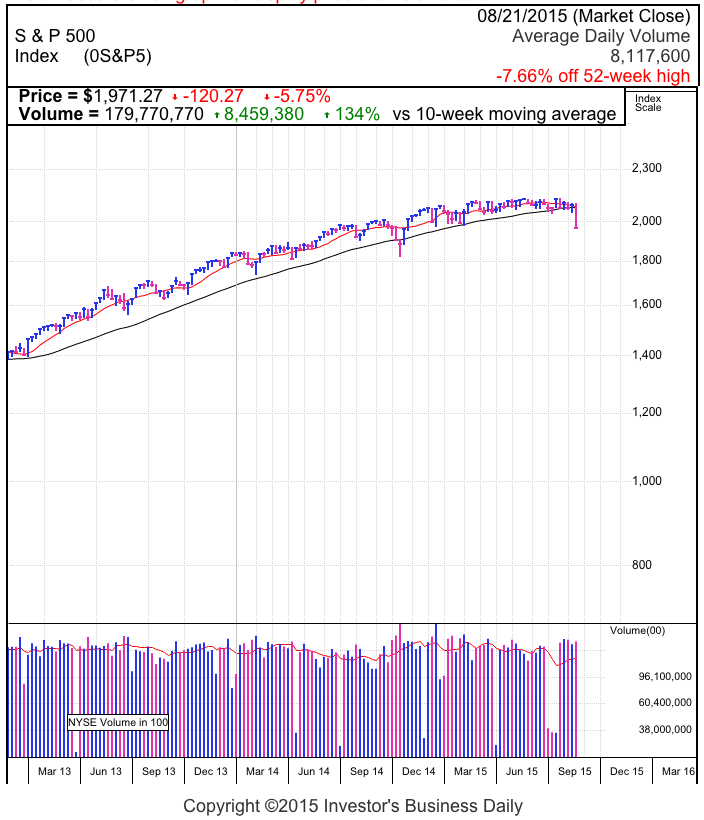

Last week’s nearly 6% plunge in the S&P 500 was the largest weekly decline since 2011. As painful as that was, what should we expect this coming week? The good news: these selloffs typically only last a few days. The bad news: emotion fueled selling can do an awful lot of damage in just a few days.

Unfortunately for many, the days of defensive selling are long gone. The only choice left for someone still in this market is to join the emotional selling, or stick to their original buy-and-hold plan. When stated that way, the right choice is obvious, but sticking to it when everyone around them is running around with their hair on fire is far harder to do.

Without a doubt the selling can and will likely continue into this coming week (overnight futures are already down over 1%). The only question is if we should get out ahead of a much larger decline, or if this is simply another series of buyable dips on the way higher? Of course there is a third option: both of the above!

The only reason to abandon this market is if we think we are on the verge of another crippling economic contraction. Something that will freeze our capital markets, crush consumer and business spending, and trigger waves of layoffs and spiking unemployment. Most of last week’s fear revolved around slowing global growth. That means we have to figure out how this will impact our economy.

To be perfectly honest, the US economy is extraordinarily self-absorbed. Seventy percent of our GDP is service based and we run a gigantic trade deficit. Does that sound like an economy dependent on global growth? Lower energy and commodity prices, cheaper junk at Walmart (NYSE:WMT); what does that mean for our economy? It means consumers will have more money left to spend on massages, vacations, and bathroom remodels. Should we be worried about our economy? Not really.

Obviously the China story will affect companies like Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) that have huge Chinese growth premiums built into their stock price. But these are the exception in the S&P 500, not the rule. While the pessimists are concerned about plunging energy sector profits, we know American consumers are lousy savers and without a doubt the dollars saved on energy will find their way into other sectors of the economy. That’s bad for energy shareholders, but it is a net neutral for our economy since one loss is offset by another gain.

And lastly, every time the stock market had a “lost decade” over the last 100+ years, we pulled out of it with a ten to twenty year secular bull market. The roaring ’20s, nifty ’50s, and ’80s and ’90s tech boom were brilliant times to own stocks. And all three followed a depressing and demoralizing decade of owner ownership. If history repeats itself, this bull market isn’t even halfway done.

I will gladly concede that our economy isn’t very impressive, but where pessimists see weakness, I see opportunity. Protracted bear markets start when economic activity reaches unsustainably high levels. This overshoot results in the inevitable economic contraction and a devastating bear market. At this point in our economic recovery, most bulls and bears will agree our economy has a long way to go before it reaches anything close to overheated levels.

That means we are safe from the next major economic contraction. While stock market selloffs happen inside major secular bull markets (1987 occurred in the middle of the greatest bull market in history), corrections in secular bull markets bounce quickly and are great buying opportunities. Keep that in mind when the crowd tries to tempt you into selling your stocks at a steep discount this coming week.