I enjoyed the Rasmussen Poll this week where 78% of those polled would vote to get rid of the entire Congress and start over again.

I am an analyst without much to analyze due to the government shutdown. The economic news becomes the shutdown itself. The shutdown likely caused only transient damage to the economy. Depending on your political persuasion, the transient damage is either little or huge. But the truth is that fiscal policy since 2000 is one of the major reasons why the economy sucks – and the shutdown effects are only an additional nail in the already sealed coffin.

The USA government was shut down because of the inability of Congress to perform its constitutional task in Article I Section 8:

The Congress shall have power to lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defense and general welfare of the United States; but all duties, imposts and excises shall be uniform throughout the United States;

This clause places squarely on Congress the responsibility for taxation and spending. If Congress does not authorize a tax or prescribe a spending program for the USA government – then there is no authority for the President to collect revenue or spend money. Clearly, the responsibility for this shutdown is Congress. From here, the problems go from bad to worse as another part of Article I Section 8 states:

To borrow money on the credit of the United States;

Some have suggested that US Treasury has an option to fund the government (and circumvent the debt ceiling) by issuing a trillion dollar coin and depositing it with the Federal Reserve – or maybe issuing a new debt free currency. Here too the constitution seems to prevent the issuance of any coinage (and by logical extension any currency) without Congressional approval*:

To coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures;

*Note: Congress passed and the president signed into law in 1996 the authorization for the U.S. Treasury to mint platinum coins to be of any valued declared, irrespective of metal content, at the discretion of the U.S. Treasury. The intent of the legislation has been reported to provide for the production of commemorative coins rather than currency, but the wording of the law clearly authorizes the production of money.

Congress has chosen an archaic method to set borrowing limits, even though they authorized the expenditures and taxation in the first case. Some point to President Lincoln’s unilateral actions during the civil war in funding the government, but there is question whether this would have survived constitutional review at that time**.

**Congress retroactively blessed Lincoln’s actions.

What good would a unilateral Presidential action be in 2013 – would you buy a debt document where there was a question of its validity? Anyway, the shutdown is over – and there is a considerable backlog of government reports. These catch-up reports should be published within the next few weeks.

The impact will cascade, and the scheduled releases for next week will likely will be late also. The various government manpower and data gathering systems are sized for a release schedule spread over a month. The cascade therefore will likely impact data releases for at least a month.

In the end, the shutdown ending compromise is again kicking the can down the road – the debt ceiling and government funding is only for 3 months.

- no long term solution to debt ceiling (such as eliminating the ceiling as Congress both authorizes expenditures and taxation, and has full control over government debt).

- seemingly unwillingness to compromise by right and left wing fringe – I fear people who destroy rather than allowing an opposing idea to proceed.

- no can kicking to date (the last six years worth) has resulting in a long term solution.

There is no question that the government costs (compared to not shutting down) are higher. As a pragmatist, I see no gain but damage caused.

Other Economic News this Week:

The Econintersect economic forecast for October 2013 again improved and it appears an improving cycle has begun. There is no indication the cycle is particularly strong, as our concern remains that consumers are spending a historically high amount of their income, and the rate of gain on the points we watch are not very strong.

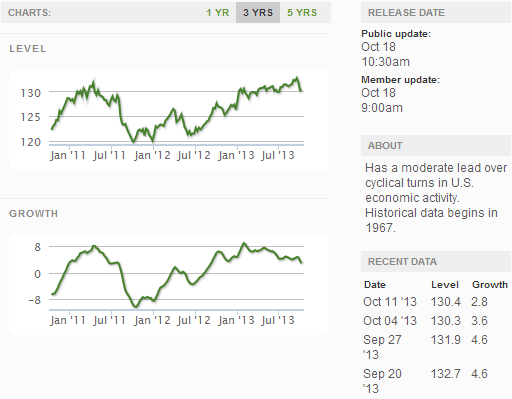

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

Initial unemployment claims went from 374,000 (reported last week) to 358,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate.

The real gauge – the 4 week moving average – degraded from 325,000 (reported last week) to 336,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

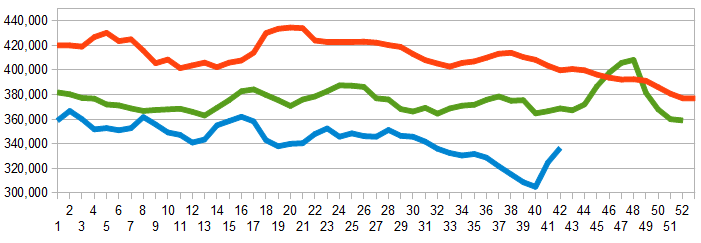

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: Valley Forge Composite Technologies, Savient Pharmaceuticals

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements growth trend is continuing to accelerate.

All other data released this week either does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.