The abbreviated week’s calendar has little important data. The economic news last week leaves open the timing of the next interest rate increase. As vacationing market participants yawn their way back to their desks and trading floors, what will be the focus? A look at the calendar and the end of summer will have them asking: Should we expect September mourning?

I borrowed the title from Alan Steel’s excellent post on this subject. More from him in the conclusion.

Last Week

There was a lot of important economic news. The picture was mixed, but mostly promising. The Fed can move in September or delay until December.

Theme Recap

In my last WTWA, I predicted another weeklong focus on the Fed. I expected every economic data point to get special attention, parsed through the perceived eyes of the Fed. This was the story all week – even on the quiet Friday afternoon. I asked whether the Fed would get a signal to hike rates. At the end of the week, most were answering “no.” I have had a good streak going on guessing the theme, but the week ahead is really a challenge.

The Story in One Chart

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. The overall range, once again, is very narrow. Doug’s take is that the market liked the slightly weaker than expected report, observing as follows:

The “bad news is good news” syndrome once again reaffirms the market’s primary dependence on Fed pampering via low rates. The index hit its 0.65% intraday high about 30 minutes into the session. Profit taking sent the index to its 0.13% intraday low in the early afternoon. But the buying returned, and the 500 ended the session with a 0.42% gain.

Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective.

Please Watch…

…for some upcoming events that might be interesting to WTWA readers.

- It is Labor Day weekend. Like you, I am enjoying some family time. Because the employment report is so important to markets, I will publish a little quiz to test your Jobs IQ. It will not be easy. You may keep your results secret or else boast about your knowledge!

- I am joining an outstanding group of fellow advisors in a webinar this week. It will be on Wednesday, September 7th at noon EDT. We meet regularly for our own benefit. This time our leader, Rob Martorana, felt that other might learn from the interchange. The subject is how to interpret financial news. The material is great, and I am looking forward to participating. If you miss it, check out the original article. If investors find this to be useful, we will do more.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The Good

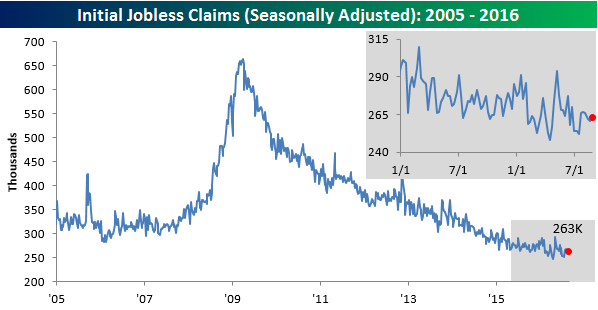

- Initial jobless claims remained very low at 263K and beat expectations. (Bespoke)

- Hotel occupancy remains at near record levels. (Calculated Risk).

- Withholding tax collections remain strong. (Barry Ritholtz).

As the total dollar amount of Federal withholding taxes continues to increase, we should expect to see retail sales and sentiment continue their improvements. This has resonance for GDP as well as the Presidential Election.

- Factory orders rebounded nicely. Up 1.9%, the biggest gain in nine months. Steven Hansen offers a sharp dissent to the headline figure.

- Earnings revisions have improved. There is a regular pattern of decline in over-optimistic estimates. Few are experts in studying the pace of these changes and how it is likely to impact the market. That is why we read the work of earnings expert Brian Gilmartin, whose most recent post which explains about this difficult question.

- Personal income rose 0.4% in addition to positive revisions. Consumer spending also increased 0.3%.

- Consumer confidence reached an eleven-month high. See Doug Short’s analysis for background, comparisons, and the best charts on the subject.

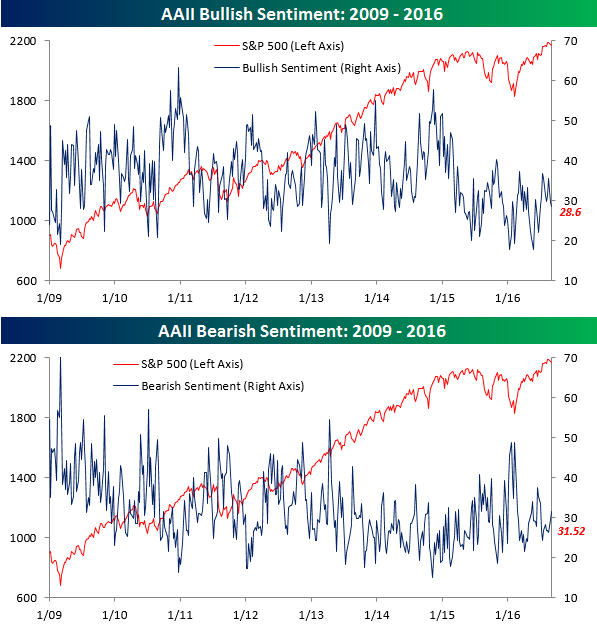

- Bullish sentiment remains low, a near-term positive for stocks. Bespoke provides this chart.

The Bad

- Auto sales fell to an annualized rate of 17 million. This was not far from expectations for most companies, but a decline nonetheless.

- Rail traffic continues to decline. Steven Hansen (GEI) does his typical comprehensive analysis.

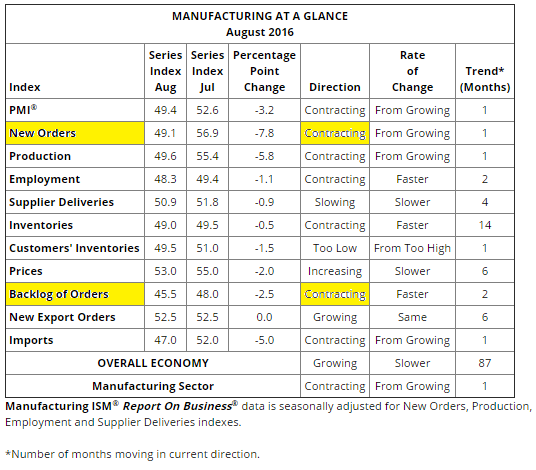

- ISM index moved into contraction, registering 49.4 compared to 52.6 last month. Steven Hansen (GEI) has a comprehensive analysis including comparisons to the Markit PMI measure. It helps to consider the “internals” of the index calculation.

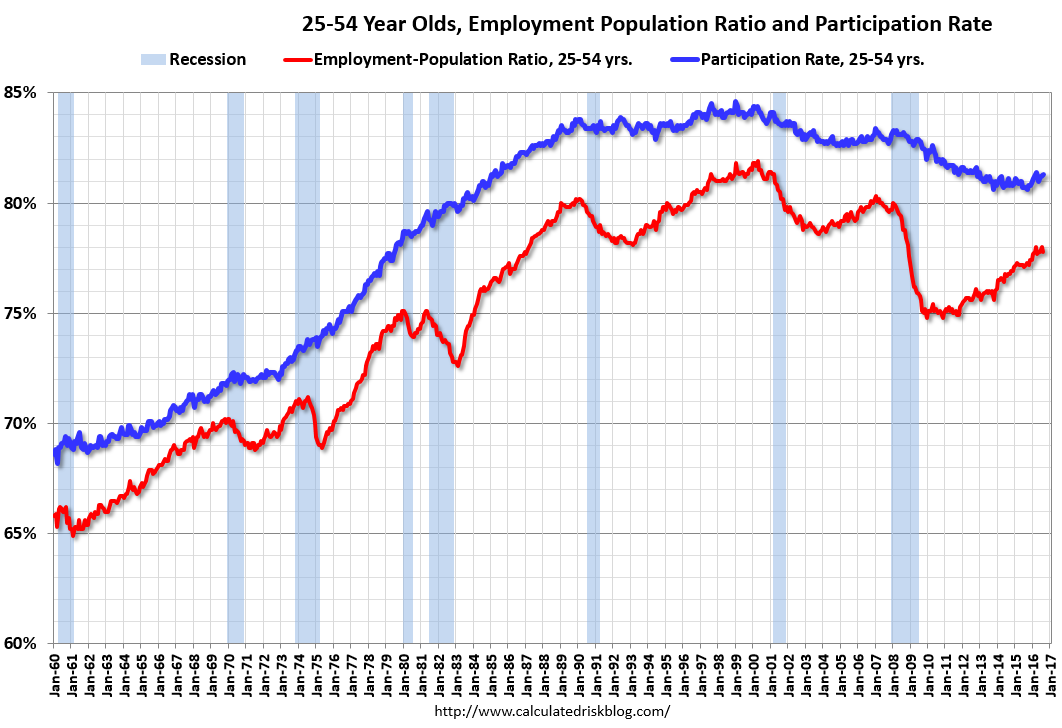

- Employment gains disappointed. I am listing this as “bad” even though most see the overall story as pretty neutral. (WSJ). I am listing the specifics, but all are within their normal sampling error bands. The bond market reaction was also neutral. Calculated Risk said a “decent” report, which captured mainstream sentiment.

- The net increase in payroll jobs was 151K. While this still represents reasonable growth, it was significantly below the last two months and also below expectations of 180K

- Private hours worked declined and hourly earnings increased less than expected.

- Unemployment remained at 4.9% and labor force participation was stable.

- ADP reported private sector employment gains of 177K – reasonable but also a bit below expectations.

The Ugly

EpiPens. Rex Nutting gets to the heart of it: Saving lives isn’t Mylan's (NASDAQ:MYL) business; maximizing profits is. The story has widespread implications. We all want to save lives. To do this there must be an incentive for drug development. When does this cross into exploitation? Should U.S. prices subsidize foreign drugs? It is an important issue on many fronts.

The Silver Bullet

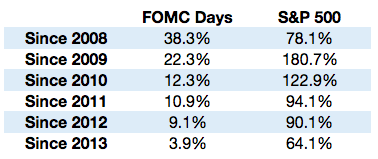

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week’s award goes to Ben Carlson, who takes on the apparently compelling statistical link between the Fed and stock performance. Since 2008 more than half of the increase in the market comes on days of FOMC meetings. He notes that this argument was featured in the WSJ, but it shows up in various places.

What happens if you change the starting date of the analysis?

Ben points out that the relationship is mostly a result of 2008.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a light week for economic data. While personally I watch everything on the calendar, you do not need to! I highlight only the most important items in WTWA. Focus is essential.

The “A” List

- ISM services (T). Continuing strength in the service sector?

- Fed Beige book (W). Anecdotal evidence adds color to the data for the next FOMC meeting.

- JOLTS report (W). The Fed uses this to analyze labor market structure. It is less useful for employment growth.

- Initial claims (Th). The best concurrent indicator for employment trends, but less attention during “employment week.”

The “B” List

- Wholesale inventories (F). July data but relevant for revision of Q2 GDP.

- Crude inventories (W). Often has a significant impact on oil markets, a focal point for traders of everything.

There will be some FedSpeak. There may also be news from the G20 conference. See Treasury Secretary Lew’s presentation at Brookings for a preview.

Next Week’s Theme

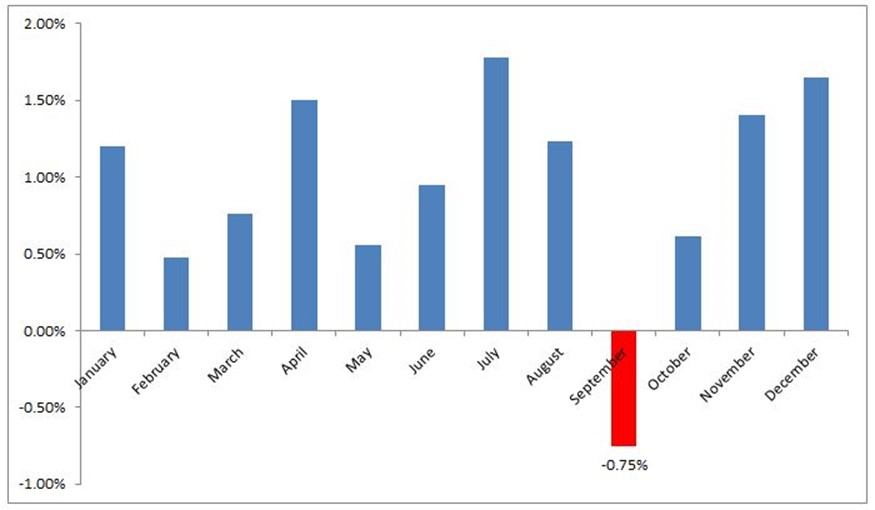

Last week brought us more quiet trading with no clear message from the data. As people slowly return from vacation, it is a natural time to review events. We will see plenty of stories about how September is the worst month for stocks. Everyone will be asking: Will September bring a market correction?

Michael Brush, writing at MarketWatch, has a typical example, Get ready for a 5%-10% stock-market drop. Expect more such predictions and advice to do something or other to avoid this kind of decline. This week’s Barron’s cover was similar.

Most expect the record streak of low volatility to end. Here are the top worries:

- The calendar. This chart from Michael Batnick (who does not present this as a trade) makes the point.

- The Fed. Some are worried that rates will rise. Others are worried that the Fed will keep rates too low.

- Energy prices. Some worry about a sharp rebound. Others are concerned about another crash.

- China.

- Europe. The current focus is Italy. The last hot spots (Greece and Great Britain) are OK for now.

- The US election. You can worry about either candidate or just the uncertainty.

- Congress is back in session (see conclusion*). Note the shaded area of the VIX chart, marking the recent seven-week recess, perfectly coinciding with the record lows in volatility.

Feel free to add your own thoughts in the comments, including anything I have missed.

As always, I’ll have a few ideas of my own in the conclusion.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

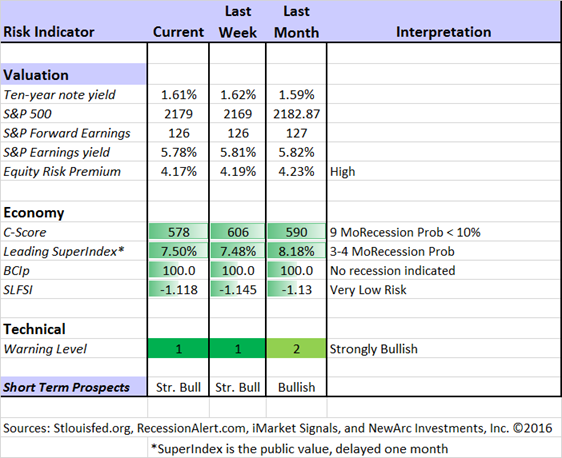

Whether you are a trader or an investor, you need to understand risk. Think risk first, reward second. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies. This week he expresses more confidence about growth in earnings.

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

The recession odds (in nine months) have nudged closer to 10%.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score. This week, as he always does after an employment report, Georg updated his unemployment-based recession indicator. No recession is indicated.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. For most readers, they can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!)

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions or suggestions for new topics.)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested, including several aggressive sectors. The more cautious Holmes also remains fully invested.

Top Trading Advice

Brett Steenbarger describes the three main causes of big drawdowns. See if you remember any of them from your own experience. Here is how to think about the diagnosis.

If you’re in drawdown mode, it’s important to ask if the problem is with your betting versus folding or if the problem is sitting at the wrong table or playing the wrong game altogether.

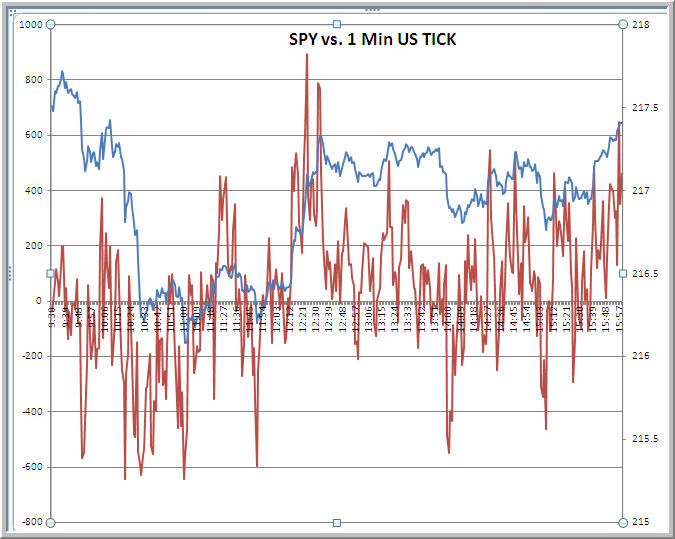

Dr. Brett has another lesson, showing how to milk information from data to find the best trades. Take a look at this chart and then read his analysis.

We have all had losing trades. The Trading Goddess discusses the best way to exit, including the thorny question of stops.

But as soon as you’ve entered the position, the price falls apart and forces you out of the trade when your protective stop is triggered.

Then, as soon as you’re out of the trade, the stock swiftly reverses back up.

After running 5% to 10% higher over the next few days, you’re left in the dust with no position and tear in your beer!

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Morgan Housel’s final column at The Motley Fool. He has been the best advice choice many times. His work is consistently helpful to investors. He promises that he will keep writing in his new gig, and I hope that is true. This week’s article reviews some of his key lessons. They are all worth careful study, but I especially like this one:

Progress happens too slowly to notice; setbacks happen too quickly to ignore. The market quickly lost 38% in 2008, and it was huge deal. Books were written about it, and Congressional hearings were held. We’ll be talking about it for decades. The market then slowly tripled from 2009 to 2015, and barely anyone flinched. You had to sit down and show people the numbers to get them to believe you. This is common: Recessions take place over months; recoveries take place over years. It can take decades for companies to become valuable, but bankruptcies happen overnight. Pain hurts more than the same level of gain feels good, but the duration differences between progress and setbacks helps explain why there are so many pessimists amid a backdrop of things getting better over time.

And also this one….

There has never been a better time to be an investor. Ever, in history. More people have access to first-class services than ever before. It’s so important, and we don’t spend enough time realizing how good it is.

Stock Ideas

Chuck Carnevale continues his strong recent series with a look at the “Big Five” Canadian banks. He emphasizes the importance of finding a good entry price! This is a thorough analysis, and you should read it carefully before investing.

Morningstar updates the top buys and sells from their “ultimate stock pickers.” This group was a “net seller” but still holds some favorites. Check out the full article for other ideas.

Holmes will begin contributing an idea each week, a stock we bought for clients a few days ago. I will mention it here and Holmes will also post it each Friday at Scutify.com. While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas may be a starting point for your own research. Holmes may exit a position at any time, and I am not going to do a special post on each occasion. If you want more information about Holmes and exits, just sign up via holmes at newarc dot com and you will get email updates. This week’s Holmes made no portfolio changes. Danaher (NYSE:DHR), which we bought last week, is still interesting and about the same price as our entry.

Energy

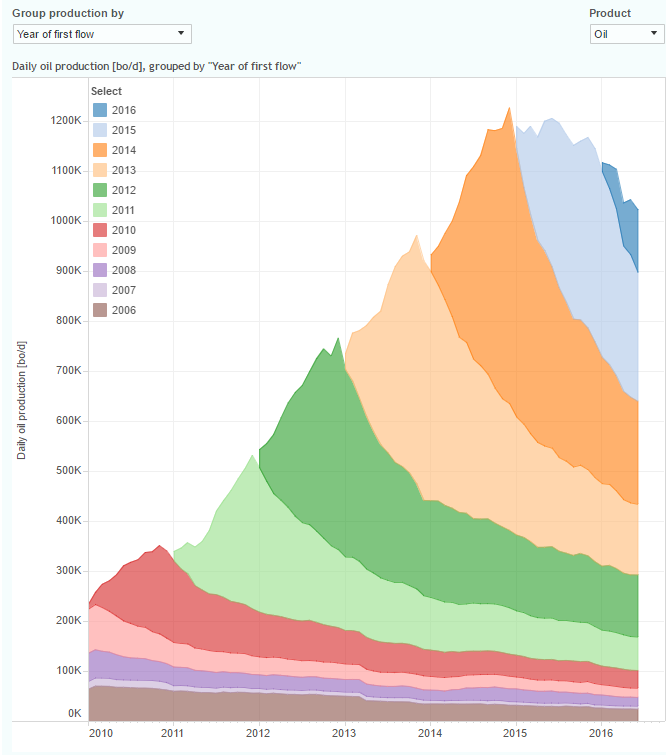

With a new trading range for oil prices there is renewed interest in energy stocks. Dan Dicker (Oil&Energy Insider – subscription required) recommends waiting until oil is closer to $40/bbl. He includes an interesting chart showing how some of the Bakken shale drilling sites developed. He writes as follows:

Oil wells cost money to drill and inevitably run dry. They need to be constantly replaced with fresh drilling to maintain output. Those drilling and maintenance costs sometimes overwhelm the returns of the oil being sold, as is the case this year and the previous two, and sometimes the returns greatly outpace the costs, as was the case before the bust in 2014. We know that most of the independent U.S. oil companies operating in shale have bypassed this current cash burn problem in the short term by raising efficiencies – which lowers costs – and by slashing capex, which sacrifices the ability of potential future replacement.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are several great choices worth reading, but my favorite is this advice from Jonathan Clements. He explains that people are living longer and must take that into account in setting an investment horizon. He notes as follows:

…your time horizon may extend beyond your own life expectancy. Suppose you are age 80 and you have money you plan to bequeath to your 20-year-old granddaughter, who will then use the inheritance to pay for her own retirement. The investment time horizon for this money might be 50 years, over which the stock market will likely clock dazzling gains.

[Jeff] I agree with this analysis, but I always start by securing enough of a portfolio to assure against life-changing market results. One good place to start is with another source from Tadas, Tim Maurer. He warns against taking too much risk.

Market Outlook

Eddy Elfenbein, continuing to impress on his CNBC segments, explains 5 Signs that Stocks have Room to Run. We turn off the mute and TIVO back when Eddy is on, our highest indication of respect!

Strategy

Michael Batnick (MarketWatch) has a helpful article about what investors could learn from horse bettors. There is a list of ten great ideas, especially for value investors. I especially liked this one:

There is always the temptation to abandon your strategy when it’s out of favor.

“If you begin espousing this approach, you are sure to suffer abuse from your fellow horseplayers. When one of them asks you who you like in a race and you say, ‘I think the 4 is a bigger price than he should be,’ the likely response is, ‘So what? Who do you like?’ Your cronies are apt to tell you that you should be betting on horses, not on prices, and after an inevitable stretch of watching some of their underlays win, you will begin to doubt yourself.”

I wrote on a similar theme last week. You might enjoy Why Smart Investors Struggle to Beat the Market.

Ben Carlson explains the importance of rebalancing. If you do not regularly review and execute this strategy, you are missing out on a natural way of selling high and buying low. You are also taking too much risk!

Final Thoughts

Volatility will eventually increase, but there is no reason to expect it right away. Most of the reasons have been recycled all year. Let me comment on the new ones.

- The calendar. One pundit stated that the reason for weak Septembers was that people were worried about October! Alan Steel covers this topic in a witty fashion. He deals with “the hordes of deviant scribblers…who have made single variable correlations into a media business.” His brief post has plenty of good advice, and you definitely won’t stop reading after the first line about the prune juice and Viagra diet. Take some time to read his other helpful and entertaining posts.

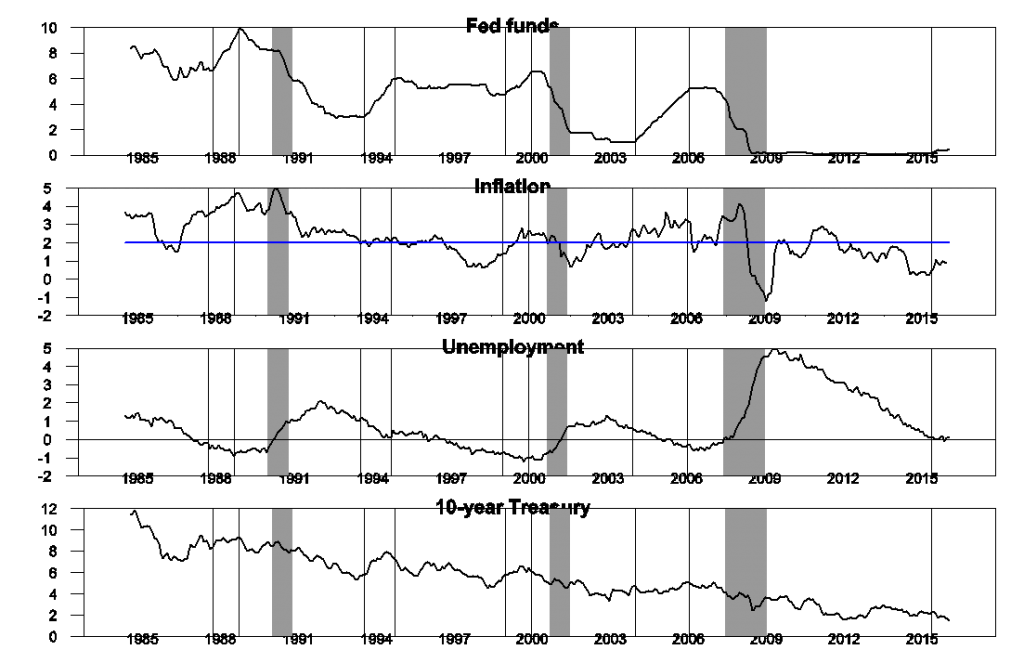

- Rate increases. James Hamilton has a nice analysis of the concurrent moves of other economic indicators during rate increase periods.

These 4 episodes have several things in common. First the inflation rate rose during each of these episodes and was on average above the Fed’s 2% target, a key reason the Fed moved as it did. Second, the unemployment rate declined during each of these episodes and ended below the Congressional Budget Office estimate of the natural rate of unemployment, again consistent with an economy that was starting to overheat. Third, the nominal interest rate on a 10-year Treasury security rose during each of these episodes, consistent with an expanding economy and rising aggregate demand.

- Congress back in session. While the information is accurate, this point is a joke. Mrs. OldProf said that I should footnote and include this line so that everyone would know to laugh. I told her that readers of WTWA know a silly bivariate chart when they see one!

Fundamental factors are more important than the small seasonal effects. The latter often include a couple of large moves that skew the result. The chance of a correction is no higher than it was last month, or the month before.