Following a holiday-shortened week with a shortage of economic releases, this week's data docket is brimming with valuable information. Undeniably, Wednesday's FOMC meeting will also scare up significant attention, though the Fed is widely expected to remain on hold. However, don’t misjudge the pause as the presser could be eventful.

FOMC

The FOMC should hold rates steady at the January meeting and reiterate that monetary policy is in the right place. As such, the current stance is likely to remain unchanged, barring a "material reassessment" to the outlook. Overall the market is expecting the meeting statement to be a mostly unaltered version of December's communiqué.

The focus will fall on the presser and should revolve around four major topics — the policy outlook, persistently low inflation, the Repo market, and implications of global risk events.

Bank of England

The sharp bounce in UK PMI data combined with other recent data (CBI, retail sales) infers that there has been a recovery in sentiment since the December 12 general election, which reduces the prospects of a January Bank of England rate cut. But at this stage, the decision on Jan. 30 remains a coin flip, as traders are still trying to figure out why four MPC members in quick succession we’re tripping over themselves to deliver ultra dovish comments. Of course, this raises concerns that the MPC has information about looming risks more so that the markets have priced.

Coronavirus Risk

The number of people who have contracted the novel coronavirus (2019-nCoV) rose sharply in the past few days. The market continues to use past experiences with the SAR's like a lens to view the current outbreak. And of course, contacting the virus will be complicated by billions of travel plans as the mass movement of people take place over the Lunar New Year.

Economically the focus will remain on travel and consumer spending, and compared to 17 years ago, online buying is more significant. That somewhat reduces the economic impact of the virus, but travel remains the big elephant in the room for oil prices.

However, most economic damage from a virus comes from fear. Social media is far more widespread today. We know that social media spreads fake news more now, faster, and more fearfully than it covers the truth.

In that context, last week's measured response from the WHO was received well by the market. But the agency was careful to hedge their bet, and probably wise to given the fact the virus has spread to Singapore, one of the most heavily scrutinized customs entry points in the world. And suggest that possibly the ideal window for controlling the infection may have passed and that it does warrant close monitoring while raising a visible red flag.

Global Equity Markets

Investors will continue to weigh the anticipated China growth fallout against the backdrop of the current global growth recovery. While the calculus is not coming up roses, it's far from a state of global market panic just yet. Still, if risk aversion starts to spread beyond China's borders and starts to affect more than the usual suspect's luxury, travel, and tourism, then we will likely see a more significant dive in the broader global indices.

On the data front this week, it's expected to mainly reinforce the Fed narrative that consumer spending can carry the load and sustain the expansion through the ongoing soft path in corporate America spending. So long as the labor market remains strong and consumer sentiment stays sturdy (released Tuesday), the Fed primary inflation gauge, the real PCE, should stay on track and a notch above 2 % this year. So, the market will continue to focus on the US jobs market as much of the Feds rosy view hinges on the US employment data.

However, and what could be more harmful to US equities and credit, in general, the collective view is that risk is mispriced. But given the cushy cash environment, there’s an impulse to stay invested, but when the Fed pulls the plug, it will be time to run to the hills. So, in other words, enjoy the party while it lasts but don’t celebrate too far from the emergency exit.

There’s growing concern the Fed has boxed itself in again to a never-ending cycle of liquidity injections that continues to pour gas on the fire pushing valuations into the mesosphere. And when the Fed signals a slowing or stopping of the liquidity firehose, it could trigger a mini taper tantrum and deflate the all aboard tech momentum trade.

The US impeachment process and the Democrats dogged determination to air Presidents Trump dirty laundry, there is some thought this could affect voting behavior, and this is why the US election risk is brought forward as investors set sights on Super Tuesday.

If President Donald Trump doesn't win, it will deal with markets a Smoking Joe knockout left hook. Equities are at record highs, so investors will most probably need to take some defensive measures as a hedge against their overweight positions. A recent Goldman Sachs (NYSE:GS) institutional survey showed 87% of the buy-side thought Trump would be re-elected, though

From a quantifiable perspective, a pullback of 3-5% in the S&P 500 has been typical every 2 to 3 months historically. The last knockdown occurred in early October. At over 3 1/2 months, the duration of the rally since then is already well above average. Is time being ripe for a significant decline.?( see chart below)

S&P 500

ASEAN Currency Markets

Depending on how widespread the outbreak gets, we could see more shifts in the market long ASEAN axes with tourist-heavy THB and the global growth-sensitive TWD as most vulnerable in this case.

The THB remains the most exposed to the new coronavirus outbreak as Thailand is a top destination for Wuhan tourists. Analysis of seat capacity on flights by OAG shows that the two largest international markets are Thailand, with nearly 107,000 seats and Japan with 67,000 seats available.

Coronavirus - Tracking Down The Bug (OAG)

Other analysts estimates suggest a 3% haircut to tourists during the Lunar New Year holiday week

But if the virus stunts economic growth in an echo of the SARS epidemic narrative and triggers a deeper slowdown in China and weakens the RMB, the jointly yuan correlated basket of KRW, HKD and MYR have the most to lose

The Yuan

It was a problematic week for Yuan bulls as long RMB was turning into a consensus trade after the P1 trade deal singing. But when it comes to the market, there seldom a free lunch, and what is comfortable is rarely profitable.

Risk is trading on the back foot again amid concerns regarding China's deadly coronavirus. And with the Shanghai Composite closing below the psychologic 3000 levels into the LNY, the first time since late December, investors were scrambling to cover downside risk in equities and topside risk in USD/CNH.

But this week caution should be exercised given the low liquidity profile typically around LNY. And while the outlook still looks favorable for the Yuan, it could be wise to monitor the virus outbreak and waiting for liquidity to return post-LNY before stepping up to the plate.

G-10 Currency Markets

G10 FX vols are holding in for now in though spot markets will be quiet in Asia due to the Lunar New Year holidays across the region. Implied levels are already low, and concerns regarding the new coronavirus outbreak continue, so market makers do not want to be short just in case fear escalates. If the virus outbreak expands, it could significantly impact the currency market where the safe-haven JPY and CHF should shine and the USD will attract its lion share of safe-haven flows. I'm not a fan of Yen given the proximity risk

The Euro continues to struggle even in the face of a moon shot on this week's ZEW data, and while hints of a move towards a symmetric inflation target are a small positive within the context of the ECB policy review. Still, without a more supportive fiscal policy input and a bounce in rates, the Euro could languish.

The Pound

Despite the most significant move in near end interest rate pricing for two years as the market upgraded, the probability of an MPC cut the Pound barely blinked. As we suggested on the dovish fist rate cut node for the MPC, the monetary policy transmission to the Pound remains week and has been the case since 2016. (See chart below) But the market could be getting that sense of déjà vu all over again that the opportunity of capital flows drifting back to the UK in 2020 is too big to ignore.

Monetary Policy Transmission Into The Pound (Bloomberg)

Oil Markets

Time for an oil change? A sell-off that started in cents is now getting scaled in multiple percentage increments.

Oil sold off aggressively last week on concerns about the impact on China's economy of the outbreak of a SARS-like virus. Brent is down close to 6% relative to previous week highs as fast money speculators are out for bear and were quick to price in worst-case scenarios.

However, oil prices could remain on a slippery slope as traders remain incredibly twitchy about the effects of the Coronavirus outbreak could have on Chinese GDP and air travel more broadly with current estimates implying 250-300kbd of demand at risk.

China remains the most significant driver of year-on-year oil demand growth, so it's fair to assume that the Oil markets will continue to bear the brunt of the China flu fall out. And if the virus stunts economic growth in an echo of the SARS epidemic nearly 20 years ago, the falls could be even more precipitous than projected. And there are two reasons why: 1) consumption is now a more substantial part of China's GDP, and 2) the overall growth trajectory. In 2002, retail sales accounted for 34% of nominal GDP. This share is now 40%.

But significantly for oil markets consumption of services, like transport (related to tourism), has also increased exponentially. Using the SARS epidemic as a lens: In 2002 from a sector perspective, the transport sector was the worst-hit, followed by accommodation and catering, and other services (culture, entertainment, education, social service, etc.)

There is an extremely tight linkage between Chinas economic growth and its appetite for oil.

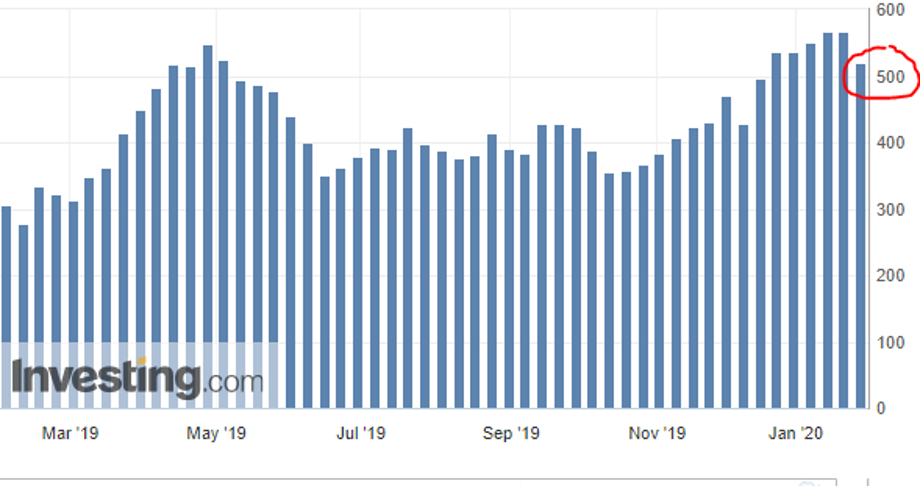

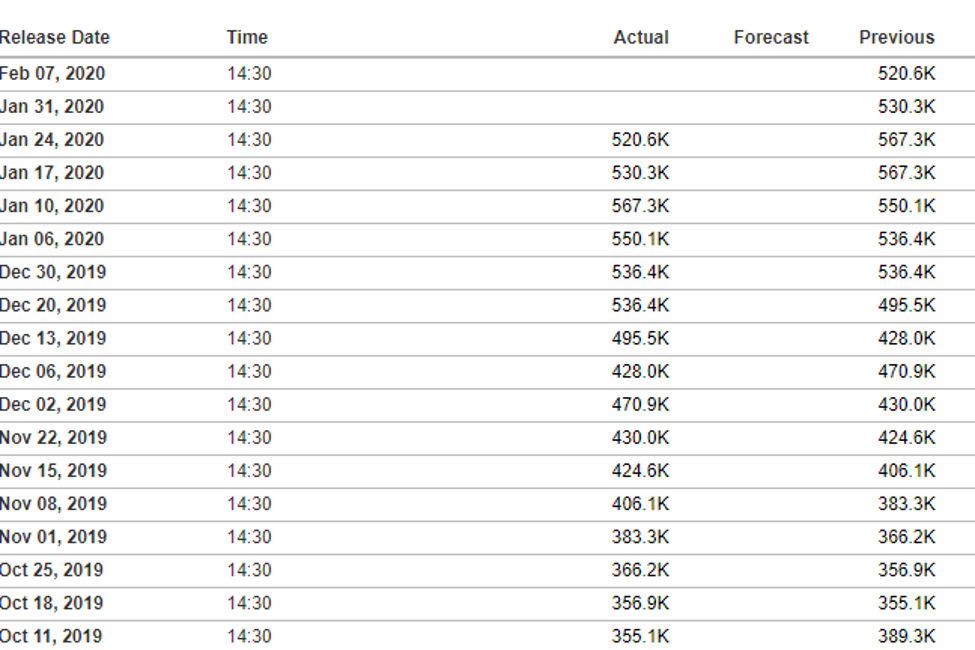

Positions at risk, the market remains relatively long and oil contracts are elevated in a six-month context, so these positions could be at risk if the oil market takes a deeper dive.

CFTC Crude Oil Speculative Net Positions

Gold Markets

Upping the defensive allocation in gold once more.

Gold prices ended last week above $1570/oz supported by defensive positioning due to the unknowns around the coronavirus. It’s the unknowns that warrant the market attention, and the fear of the unknows probably contributed to the gold market bounce. Its been a pretty consistent theme for the last two years, when the market looks unstable, buy gold.

As for the virus breakouts, the patterns can look random. But some health experts have predicted, based on the SARS epidemic 17 years ago, that the coronavirus has now entered a more explosive phase of growth, which could potentially reach its peak in March, before tapering off in May.

The upcoming Chinese New Year holiday looks to be a sure-fire catalyst. In 2019, an estimated 3 billion trips were made during this national holiday. And despite China-wide multiple city lockdowns, the fact the virus has spread to Singapore, an overly scrutinized customs entry point, suggests the best window for controlling the infection may have passed.

If the virus continues to spread, and at a faster pace in the coming months, it will represent another significant headwind to growth. Given how early we are in the newfound growth cycle, more policy easing will be needed to support growth, which could be viewed as bullish for gold. A policy response from the PBoC is a given, but the big question is if the Feds need to react.

But the virus in itself is not the primary reason to keep your percentage allocation in gold more elevated than usual.

With the FOMC next week, all eyes and ears will be honed on Chair Powell's presser. Still, more specifically, Chairman Powell will be grilled about the financial stability risks created via the Fed's liquidity injection due to balance sheet expansion.

There's no blueprint for unwinding the balance sheet without some element of risk. But the fear heading into the next week's meeting is a communication misstep as he will need to communicate a temporary pause in the Fed's repo activities. Still, a misstatement could easily trigger a huge adverse market reaction. This in itself demands some protection either via long gold or downside JPY structures.

Gold investors appear willing to increase gold allocation on dips ahead of "Super Tuesday "US election risk. And as a hedge against trade tensions reigniting, but broadly speaking, they haven't brought out the big guns just yet.

But overall, it remains a very comfortable environment to own gold with US yields drifting lower and 10-year TIPS lingering around the lower end of the range. The more prolonged low yield environment continues to add to golds allure as a must-have hedge against the backdrop of a plethora of market uncertainties.

But these strategies along with the January seasonality support might be worth reassessing on a clean break of $ 1540/oz