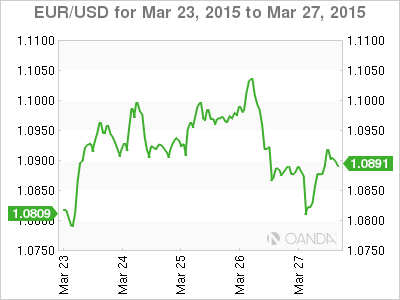

The USD was able to bounce back toward the end of the week and ahead of a crucial set of data releases. EUR/USD is trading at 1.0876 close to the price levels of the start the week (1.0809) after hitting and failing to stay at 1.10.

European inflation is the highlight in an indicator-packed Tuesday. Wednesday will bring further insight into the strength of the U.S. economic recovery with the release of the ISM manufacturing data and ADP nonfarm employment change. Trade balances in Canada and the U.S., along with the construction purchasing managers’ index in the U.K., will be the focus of the market on Thursday. The end of the week will bring the biggest indicator in forex: the U.S. nonfarm payrolls (NFP) report. Though April 3 is the Good Friday holiday, investors worldwide will once again be acutely focused on the resilience of the American jobs data.

Tuesday: European Unemployment Rate and Consumer-Price Index

European unemployment has improved slowly over the past two months after being stuck at 11.5% since the summer of 2014. Analysts are forecasting that the better-than-expected 11.2% recorded in March will be the figure released by Eurostat on Tuesday. The huge disparity within the region is likely to be highlighted again with Germany enjoying full employment (4.7% unemployment), and Greece and Spain at 23.4% and 25.8% unemployment rates, respectively. There has been little change in the way of reforms that could reverse the high unemployment rates across southern Europe, which is still reeling from the effects of harsh austerity programs. The change in government in Greece has not managed to reverse the effects of bailout demands intro credible reforms, which are now jeopardizing the much needed cash infusion to keep Greece out of bankruptcy. The Spanish and French political scenes are heating up with similar factors, but with bigger economies, the debate on European austerity continues to heat up.

European Central Bank (ECB) President Mario Draghi expressed his confidence in reaching a 2% inflation target in 18 months as part of the ECB’s aggressive quantitative easing program. The effects of the three-week-old program will not register in next week’s inflation numbers, but will serve as a benchmark of the success or failure going forward. Inflation numbers crossed over into negative territory in December of 2014 and the last reading was -0.3% for February. A positive inflation number will boost the EUR even though the ECB would get undue credit given the recent launch of the program. Further deflation would put pressure on both the EUR and the ECB as the price of the currency would continue to depreciate.

Tuesday: U.K. Gross Domestic Product and Current Accounts Data

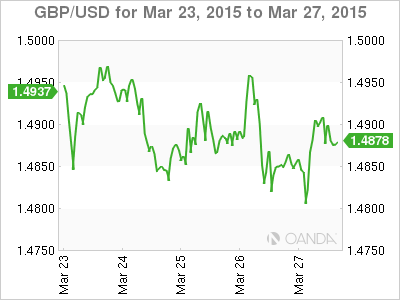

All of the United Kingdom’s political parties will zero in on the U.K.’s growth and balance of payments indicators as they jockey for votes in the forthcoming general election. Heavily politicized, they will have an impact on the direction of the pound.

The U.K.’s current account recorded a -₤27 billion deficit in the third quarter of 2014. The forecast points to a reduction to -₤21.2 billion citing the lower price of oil imports.

The final gross domestic product data will be published with an expected slowdown confirmed at 0.5% in the fourth quarter. The third quarter growth was driven by consumer spending, and with lower oil prices putting more disposable income in their pockets, the quarter-to-quarter drop is the result of lower government and business investment.

The two releases could have little impact in the direction of the pound but they will certainly be part of the political agenda, which in turn, could affect currency prices as the campaign heats up after the first debate.

Tuesday: U.S. Conference Board Consumer Confidence Data

The consumer is the pillar of the U.S. recovery and insights into the confidence in the economy going forward is a strong leading indicator for the USD. Confidence has been on the rise, even as the actual spending has not had a direct correlation. Last month the survey of 5,000 households came in under expectations at 96.4 from a forecast of 99.6. The higher expectations were the result of an impressive print in January of 102.9 when the forecast was for 95.3. This time around analysts are expecting a more subdued 96.6. The weather will be a major factor in consumer confidence as cold conditions remained even if the costs were offset by lower energy prices, the willingness to spend did take a hit.

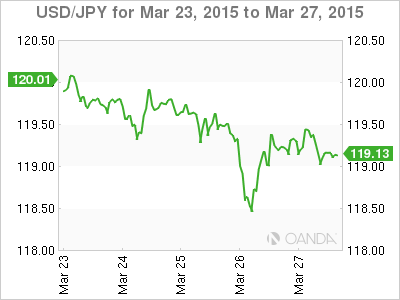

Tuesday: Japan’s Tankan Large Manufacturing Outlook

The weaker JPY has taken its time to boost Japanese exporters, but the forecast for the large manufacturing outlook in the first quarter of 2015 is positive. The expectations are on a reading of 16, higher than the previous nine that came under the 14 forecasted ahead of the release. The USD/JPY has fallen after the U.S. rally hit the Federal Open Market Committee’s mixed message last week. Strong manufacturing indicators and a hot stock market has appreciated the JPY without any interference from the deflated USD. As long as the USD cannot build momentum or find traction in the market, positive economic indicators will boost the JPY to continue to pressure the Bank of Japan to assume a more proactive stance if it is to achieve its lofty growth and inflation targets.

Wednesday: US ISM Manufacturing PMI and ADP Nonfarm Payrolls

The USD has been overtly sensitive to negative data and missed expectations. The manufacturing sector has struggled against a strong USD and even though U.S. manufacturing continues to expand it is doing so at a slower pace according to the Institute of Supply Management’s survey. In February there were a lot of labor conflicts that contributed for the lower-than-expected number, it remains to be seen if now that those issues are out of the way the figures come above expectations or if the slow down trend continues.

Given the importance that the Federal Reserve continues to give to employment, the ADP private nonfarm payrolls (NFP) will act as a preview to the main event on the following Friday’s NFP report. With revisions taken into account, the ADP report also shows the strong jobs recovery trend that the NFP has done for the past year. Last month the ADP showed that private U.S. employers added 212,000 jobs in February and the forecast expects 231,000 in March. The latest report started to show a slow down in different industries with an expectation that energy providers would add less going forward as oil prices continue to decline.

Thursday: US Trade Balance Data

In January the trade balance reached a deficit of $41.8 billion with the same issue that affected manufacturing (West Coast ports labor dispute) also impacting imports and exports. Both components showed reductions in January and the expectations are that the trade deficit widens in February, as the strong USD will keep hurting exports to the benefit of imports. Market watchers will take this into consideration to further understand the comments from the Fed on the effect of a strong dollar on the American economy.

Friday: US Nonfarm Payrolls

Strong emphasis on data dependency from the Fed gives even more attention to the influential employment report released on Friday. The NFP has revealed month after month a solid employment recovery. Some cracks have appeared in the form of a slower wage growth, but the headline unemployment rate and other components show a jobs picture that has overcome most of the losses from the credit crisis. The NFP has been the positive outlier on an otherwise softer U.S. economic data release.

Even when the headline number has beat expectations and the unemployment rate has hit pre-crisis lows, the market has been well trained by the Fed to look deep into the details. Wage growth in particular will be in focus, as analysts scour the report for signs that corporations have hired more but also are paying more. The dovish FOMC took the air of the USD rally’s wings, but a strong NFP could put pressure on the Fed’s decision to start raising rates regardless of what other indicators have signaled during the week.

Interest rate divergence will continue to drive the EUR/USD, and the more the ECB keeps driving an easing monetary policy and U.S. economic indicators align with the Fed starting a tightening cycle, the pair will continue to trade lower.