Yesterday the pair showed volatile trade amid ECB President Mario Draghi speech. The head of the regulator suggested the possibility of further monetary policy easing in the eurozone in order to stimulate inflation growth.

At the same time, the franc was pressured by weak data on the Swiss Trade Balance. In March, Exports slightly grew from 17.7 to 17.8 billion Francs, while Imports increased from 13.6 to 15.7 billion that led to a balance surplus decline to 2.2 billion Francs. In addition, the pair was supported by data on Initial Jobless Claims in the US. The figure unexpectedly fell to 247 thousands.

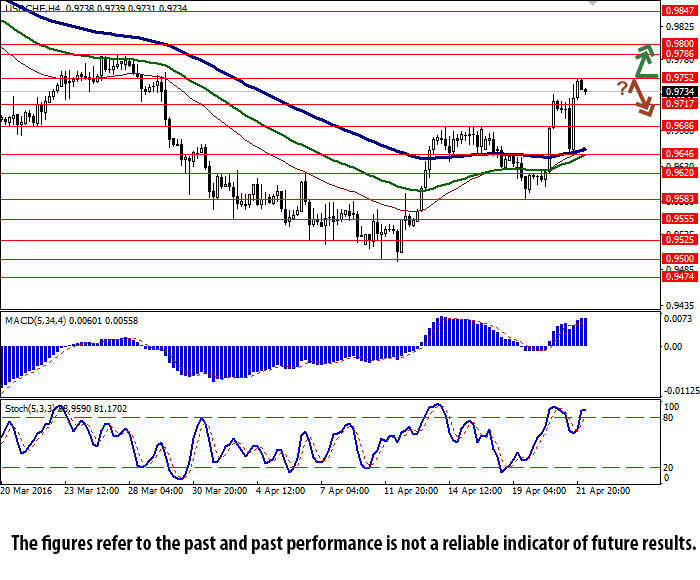

Bollinger Bands® on the daily chart is moving up while the price range is widening. However, the price remains above its upper border. MACD is growing and giving a strong buy signal. Stochastic returned in the overbought zone indicating the downward correction possibility.

The indicators recommend waiting for clearer trading signals.

Support levels: 0.9717 (local low), 0.9686, 0.9646 (local low), 0.9620, 0.9583 (19 April low).

Resistance levels: 0.9752 (local high), 0.9786 (25 March high), 0.9800, 0.9847 (16 March high).