Looking at the current state of the U.S. housing market, one could say, “It’s the perfect time to buy a home.” Mortgage rates are historically low. Home prices are still down significantly from their peaks in 2006. But unfortunately, potential homeowners are not coming into the housing market.

The reality of the U.S. housing market is that it never recovered. It’s still sick at heart. Low mortgage rates and low home prices definitely provided some support; but now, as the Federal Reserve is pulling back on quantitative easing and mortgage rates are rising, we see home buyers running away.

The biggest bump we saw in housing was in 2012, when institutional investors came in and bought billions of dollars worth of empty homes in bulk. This gave the mainstream a hope that there was going to be a recovery in the housing market.

But, as I have been writing since last year, investors buying houses to rent them will not create a healthy housing market recovery.

In fact, in the first quarter of 2014, the homeownership rate in the U.S. declined to its lowest levels in almost two decades, falling to 64.8%. (Source: U.S. Census Bureau, April 29, 2014.)

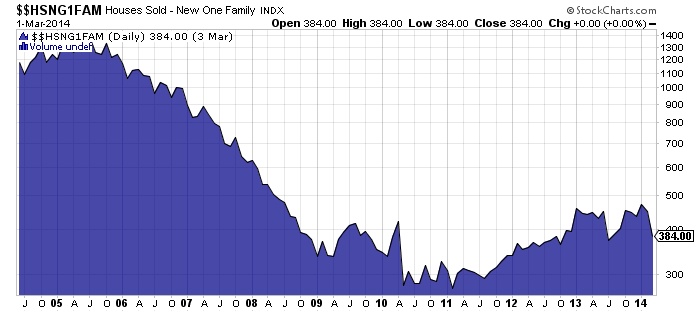

New-home sales are declining at a very ridiculous rate, further strengthening my argument that home buyers are just tapped out. The chart below is of new-home sales in the U.S. going back to 2005.

Back in 2005, the annual rate of new homes sold in the U.S. housing market was about 1.2 million. In March of this year, this rate was just 384,000. And in 2014, the dead cat bounce in the new-home sales that began in 2011 seems to be finding resistance. The annual rate of new homes sold in the U.S. has declined almost 20% between January and March.

And those who are still homeowners with mortgages are struggling.

In the fourth quarter of 2013, the delinquency rate on single-family residential mortgages at all banks in the U.S. was 8.21%. Back in the fourth quarter of 2006, the delinquency rate stood at two percent. (Source: Federal Reserve Bank of St. Louis web site, last accessed May 13, 2014.)

In the end, it all comes down to this: if a stock falls 30% one day and then recovers 10% over the next couple of years, would it be reasonable to say that stock has recovered? Of course not. This is where the housing market sits today. We are far from a real recovery in the U.S. housing market. And if interest rates start rising as I predict and the economy gets softer, the housing market could actually start going the other way again.

Disclaimer: Dear Reader: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.