Weekly CFTC Net Speculator Report

Large Speculators net bearish positions rise to a total of -129,409 contracts

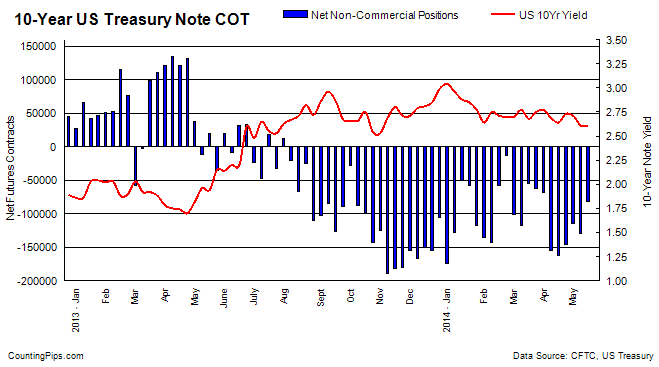

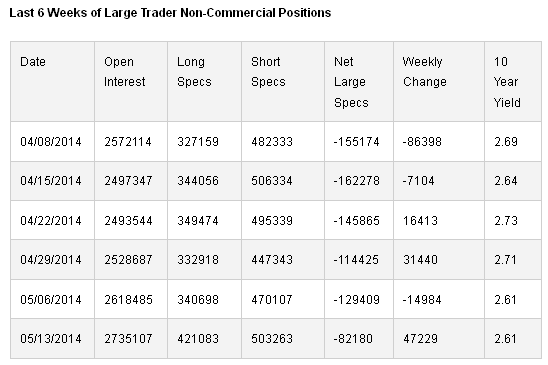

10 Year Treasuries: Large futures market traders and speculators reduced their overall bearish bets in the 10-year treasury note futures last week to the lowest level in six weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of the 10-year treasury notes, primarily traded by large speculators and hedge funds, totaled a net position of -82,180 contracts in the data reported for May 13th. This was a change of +47,229 contracts from the previous week’s total of -129,409 net contracts that was recorded on May 6th.

The 10-Year Note non-commercial net bearish positions are now at their lowest level since April 1st when total net positions equaled -68,776 contracts.

Over the weekly reporting time-frame, from Tuesday May 6th to Tuesday May 13th, the yield on the 10-Year treasury note showed no change at the 2.61 level, according to data from the United States Treasury Department.

Disclaimer: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI