The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday higher, low confidence..

- ES pivot 1878.42. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Ooh! Ahh! Watching the market on Monday was like watching the fireworks on the Fourth of July. Ooh! Look at the VIX skyrocket! Ahh - watch the Dow dive! And why? Because a few thousand people croaked in some countries in Africa most people couldn't even find on a map? Not to diminish the personal tragedies for those personally involved, but Procter & Gamble (NYSE:PG) down 1.56% on Monday? Are people going to start brushing their teeth 1.56% less often because of Ebola? Clearly Mr. Market is not just off his meds but he's having an all-out psychotic attack Can the charts make any sense of this lunacy? Let's put on our snowy white hazmat suits and find out.

The technicals

The Dow: Yowza! This is called taking the heat, with the Dow down 223 in one day for a three day losing streak. Of course that still leaves us exactly where we were eight days ago but it triggers a few, mostly bad, uh, things. First we've now got a down Friday followed by a down Monday - bearish. Second, we did not bounce off the 200 day MA - instead we cratered on it - very bearish. Also we broke support at 16,364. And the indicators are all just off overbought, even after this massive drop.

The only good piece of new here (and it may be the determining one) is the fact that the Dow is now going negative exponential. And these things always, and I mean always end pretty quickly.

The VIX: Ja ja, on Monday the VIX gained another 16%. And it's now clearly going exponential, trading entirely above its upper BB.. The last time we were here was June 2012. The indicators are now quite oversold (RSI = 90.5) and the stochastic is about to swing over for a bearish crossover. It's not at all clear to me that the VIX can keep this up much longer. At these levels I'd be a lot happier going short than long the VIX.

Market index futures: Tonight all three futures are significantly higher at 12: 19 AM EDT with ES up 0.56%. On Monday ES, like just about everything else, smashed through its 200 day MA. But that isn't always fatal and that seems to be the case here as it appear that buyers are showing up in the overnight. The move appears to be more than a garden variety DCB and definitely bears watching.

ES daily pivot: Tonight the ES daily pivot dives further from 1906.25 to 1878.42. However, this time while we are still under the new pivot, we're now very close, just two points under. That puts the pivot in play. For the moment, it' bearish, but just, uh, barely.

Dollar index: And what's out pal the dollar up to? Not much, with a funny green gap-down 0.35% mini-hammer on Monday. The result is an evening star that cancels Friday's bullish RTC exit. But with indicators still just offo oversold, this chart becomes too tough to call.

Euro: Meanwhile the euro continued meandering higher on Monday after exiting its descending RTC last week. It has now hit overbought but also formed a bullish stochastic crossover. This is indicative of the fact that the euro is more a political football these days than a legitimate trading instrument. Stay away!

Transportation: Boom! The Trans went completely off the rails on Monday, crashing right through their 200 day MA with a 2.22% loss on greatly increased volume. And this was the first such break since November 2012. There's absolutely nothing bullish about this chart but with the indicators now quite oversold, It seems like the bottom is near. Sniff sniff - smells like capitulation.

I don't know - the macro picture may or may not be changing but in the short term it seems to me that there's a lot of irrational hysteria in the market and that the latest three day crater was vastly overdone. And given the recent craziness in the VIX, a turnaround could happen at any moment. And the futures seem to be suggesting that for Tuesday. So instead of taking the rational course which would be to take the rest of the month off, I will go way out on a limb and call Tuesday higher.

ES Fantasy Trader

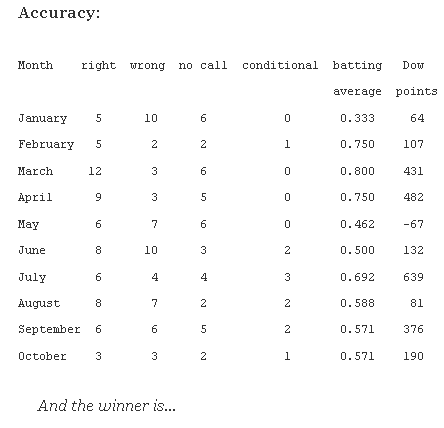

Portfolio stats: the account remains at $121,625 after nine trades in 2014, starting with $100,000. We are now 7 for 9 total, 5 for 5 long, 2 for 3 short, and one push. Tonight we stand aside - I am by policy boycotting the market until the VIX goes back below 20.