IAC/InterActiveCorp (NASDAQ:IACI) focuses on the areas of search, applications, online dating, media and e-Commerce. One of the most popular mobile applications among teenagers and young adults that IAC runs is a dating app called Tinder. Topeka Capital analyst Victor Anthony maintained a Buy rating on IAC with a price target of $87 on January 16th citing the ad potential on Tinder that could lead to increased monetization.

Tinder is a mobile application that allows users to view other users' photos and “swipe right” if they like what they see or “swipe left” if they don’t. Tinder is currently running an ad from iHeartRadio in which users who swipe right three times are entered into a sweepstakes to win a couple's Valentines weekend in Las Vegas, Nevada. Impressed by iHeartRadio’s ad on Tinder, Anthony believes “this is indicative of how Tinder could add ads to [their] potential monetization efforts.”

IAC currently uses the paid transactions model more often than advertising in order to bring in revenue. While Anthony sees “more opportunity overtime with the paid user transactions model,” he believes “advertising could be meaningfully incremental if done correctly.” In their latest earnings, IAC posted “$75M in EBITDA IAC guided to for Tinder at 50% margins [which] impl[ies] revenue of $150M.” Anthony feels “adding advertising could clearly help them get there.”

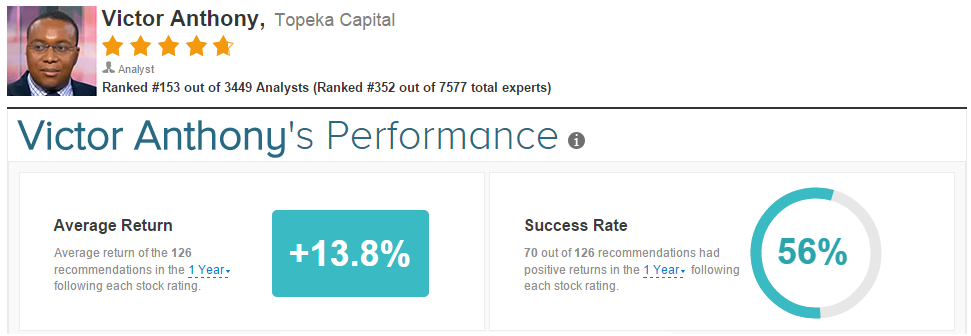

Victor Anthony currently has an overall success rate of 56% recommending stocks and a +13.8% average return per recommendation.

Anthony is known for rating internet related stocks, such as Yahoo! (NASDAQ:YHOO) and Amazon (NASDAQ:AMZN). On July 10, 2014, the analyst reiterated a Buy rating on Yahoo! when the stock was priced at $34.93 a share. Since then, Yahoo! shares have gone up to $46.47, marking a 33% upside. Anthony has rated Yahoo! 11 times since April 2013, earning an 82% success rate recommending the stock and a +23.0% average return per recommendation.

On the other hand, Anthony recently reiterated a Buy rating on Amazon on January 13, 2015 when the stock was priced at $294.74 a share. The stock has since dropped to $290.74 a share. Anthony has rated Amazon a total of 17 times since May 2012, earning a 41% success rate recommending the stock and a -2.1% average return per recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Topeka Capital Sees Ad Potential in IAC's Tinder Mobile App

Published 01/18/2015, 06:45 AM

Topeka Capital Sees Ad Potential in IAC's Tinder Mobile App

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.