The dollar rally has been led in hopes of the Fed tightening rates in December of 2016. While most of the other developed nations are still struggling with low inflation, the U.S.Government provided data that has been largely supportive of a rate hike.

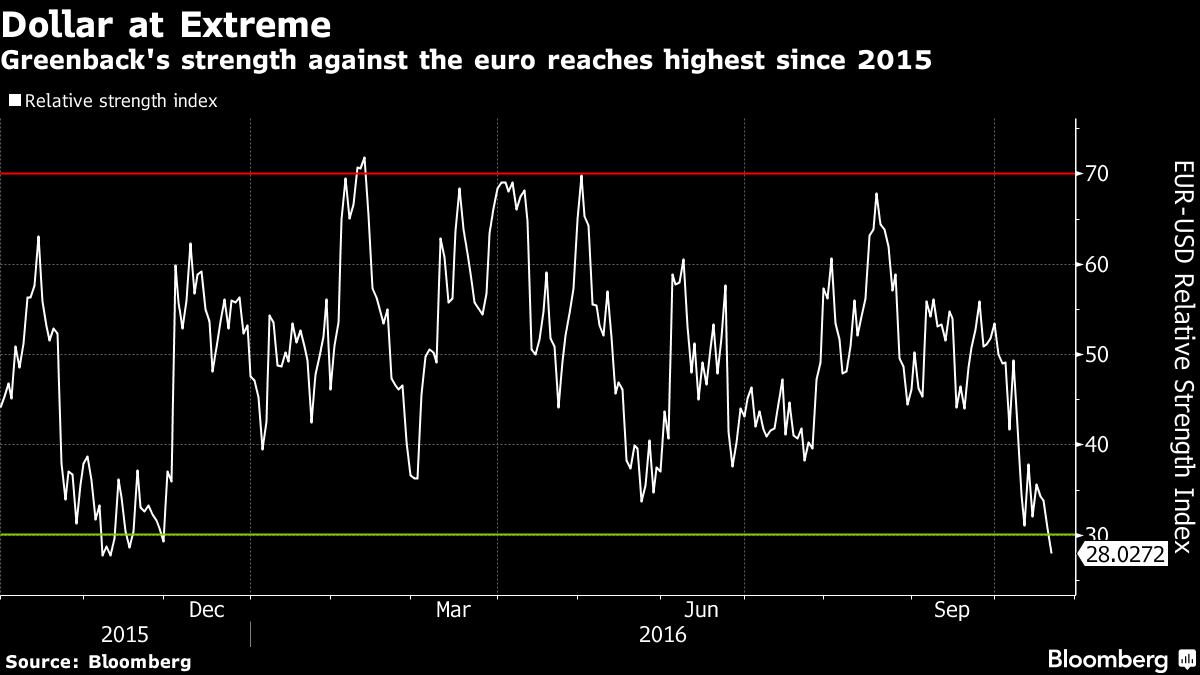

The sharp rise in the dollar had taken it to extreme levels against the euro, as shown in the Bloomberg chart below.The reversal was due, as evidenced by the RSI. However, the fall has been more vicious and looks like a correction, rather than a mere pullback.

The seesaw in the U.S. Presidential election polls is affecting the dollar

“There is some anticipation that the markets have built in a Hillary victory and that a Trump victory is going to roil the markets,” said Paul Nolte, portfolio manager at Kingsview Asset Management in Chicago, reports Reuters.

However, after recent reports of the FBI reviewing of more emails in its investigations of Hillary Clinton a few polls are now showing Mr. Donald Trump ahead in the polls. The markets have started to realize that both the candidates have an equal opportunity to win.

Will A Trump win quash any hopes of a December rate hike?

Mr.Donald Trump has long been critical of Fed Chair Janet Yellen. He has also spoken against the rates being artificially kept low to benefit Wall Street.

“It’s staying at zero because she’s obviously political and she’s doing what Obama wants her to do. And I know that’s not supposed to be the way it is, but that’s why it’s low,” Trump said during an interview with CNBC back in September, reports USA News.

Hence, most believe that a Trump win will force the Fed to push back their plans of a rate hike in December of 2016.

“The uncertainty over the election is certainly weighing on the dollar,” said Stephen Casey, senior foreign exchange trader at Cambridge Global Payments in New York, reports Reuters.

Yellen in support of running a “high pressure” economy

The Fed projected four rate hikes in 2017 after the first rate hike in December 2016. Following the China scare and the Brexit uncertainty in the early part of this year, the Fed developed cold feet and they brought down the expectations of rate hikes from four to two.

Since then, the members of the Central Bank have been jawboning the dollar. Though there were three dissenters in the last meeting, the permanent members are of the opinion that the economy should be given more time.

In a recent speech, Dr. Janet Yellen said she might be open to “temporarily running a ‘high-pressure economy'” to help heal the damages caused due to the anemic recovery. “High pressure”, implies to allowing inflation to rise above the Fed’s target of 2% to 3%. This can be possible only if Dr. Yellen does not do a rate hike at all in the near future.

What does the technical picture of the dollar forecast?

The dollar has a history of making double tops, as marked by the circles in the chart (below). Every major double top formation has led to a slide in the dollar. Presently, the dollar has again formed a double top, along with a false breakout. A fake out leads to a sharp fall, as being seen in the dollar currently.

The ADX reading shows hysteric buying of the dollar, which is coming to an end. Similarly, the Stochastics are showing a trend change. So, what do we do to benefit from this fall in the dollar index?

Buy inverse ETF “UDN”

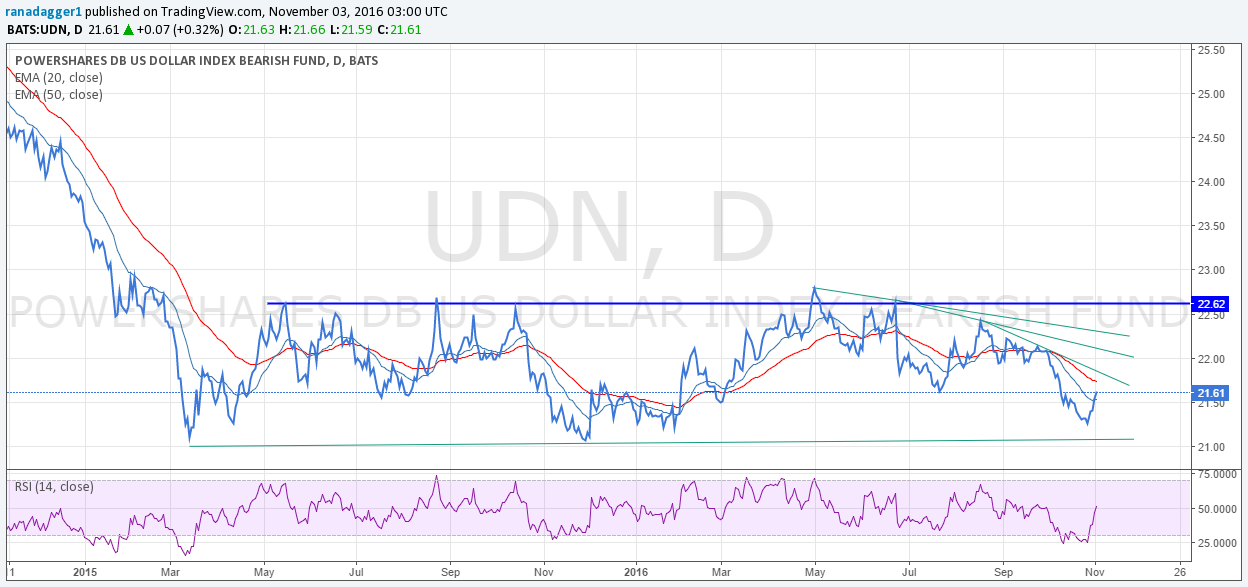

The chart (below) shows that the PowerShares DB US Dollar Bearish ETF (NYSE:UDN) has been trading in a range since March of last year. The last two times this ETF had come to the lower end of the range, it showed a sharp pullback, which carried it towards the highs. Currently, the ETF is rising from the support levels and a rally to the highs of $22.62 cannot be ruled out in the medium-term.

The current rally will face resistances at the three trendlines as seen on the chart (below). There is a trade in UDN for both the short-term and the medium-term trader.

The Bottom Line:

I have been warning readers throughout the year that the Fed will not employ a rate hike and I have been proven correct, now, I am again going to forecast a Q.E.5 sometime in 2017. I have been among only a couple analysts who has gone against the crown and has been proven correct.

Stock markets are at a critical juncture, as is the dollar and gold. The different markets are not following the traditional rules of trade. The globe has changed with the ultra-loose monetary policy of the Central Banks. Hence, a deep understanding of economics and trading is needed to catch the next move up or down.