Not much going on in the precious metals last week as they remain trapped within a tightening range for gold and silver but we did see an attempt to break gold which saw buyers emerge and push it back up, which is a very good sign.

I talk to subscribers about my disdain for wide, loose, and sloppy action, but gold has very tight action within a base which always leads to a nice move, it is just which way the move is that I’m not sure of.

As for markets, they really firmed up a lot this past week and we saw many stocks begin to move higher finally, after a long basing and corrective period of over 2 months.

Markets and stocks don’t always move so there is a time to be in cash, but when bases complete, it is time to get back into stocks and we began to get back into them this past week.

We’ve tried to dip our toes into stocks the past few weeks but we were stopped out quickly.

Not so this week.

It is really nice to see breakouts working again, allowing us to actually hold stocks overnight.

So far so good, but that can always change so stops are key.

There is no point in being in stocks unless they are moving.

Let’s check into the precious metals charts before I look into stocks for subscribers and I highly suggest you consider becoming one as we are now moving back into stocks, and if you get in early, at the right time, you can ride this whole move and make the big bucks!

Gold was flat this past week, rising only 0.02%.

There is nothing to say here other than we are getting very tight in this triangle, and while it should breakout higher, there is no certainty of that.

A break above $1,304 would be great and is the buy area while a break below $1,285 would not be so good.

The two positive takeaways from gold this past week are the tightening action in this pattern and the fact that gold was hit hard Wednesday and almost broke below this triangle but buyers stepped up and pushed gold back higher.

Let’s see how it goes but we should resolve this pattern this coming week.

Silver gained 0.59% this past week.

Silver is not nearly as tight as gold so gold looks to be ready to lead this next move.

Above $20 is good while a break under $19 is not so good.

Gold should lead this next move so I’m more focused on its action for the time being.

Platinum gained 0.69% for the week and is acting perfectly.

Platinum hit resistance at the $1,490 area and is now just building some steam to breakout higher.

The catalyst that would help is obviously gold breaking out.

As long as we remain above $1,460 in platinum, things are good.

This great "W" formation should resolve itself higher, and soon.

That said, if gold does break lower, platinum and the other precious metals will follow it regardless of how great they look.

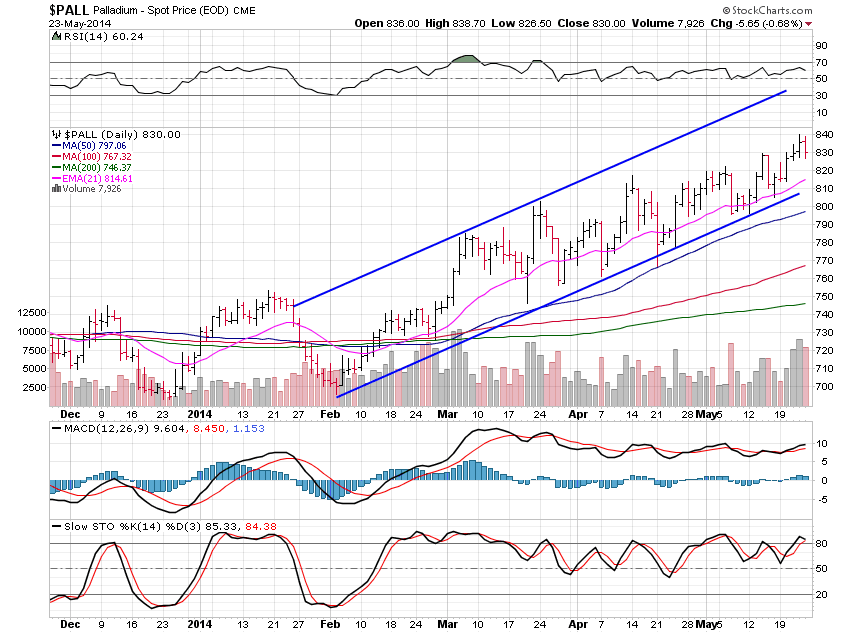

Palladium had a nice week gaining 1.73%.

Palladium remains in its long uptrend channel.

Last weekend I talked bout the 21 day moving average as being a nice buy point right near the lower end of this uptrend channel.

It worked again and would have given you a nice $30 in gains in only a week.

I hope you are having a great long weekend and are ready to really get back to work as we are finally able to be in stocks again.

There is a time to work and a time to sit.

We are just starting into the work phase again.

I have to work and make money when the markets dictate it.

If it were up to me I’d work in the fall, a couple months in the winter and take the summers off but it isn’t up to me.

I may be working a lot this summer instead of hitting the links and beach.