- Why Negative Rates Could Drive EUR Down 3%

- CAD: What to Expect from the Bank of Canada

- NZD: Drops to 3-Month Lows

- AUD: RBA Maintains Neutral Bias

- GBP: Hoping for Some Volatility on PMI

- Yen Crosses Extend Gains, Wages Rise

Why Negative Rates Could Drive EUR Down 3%

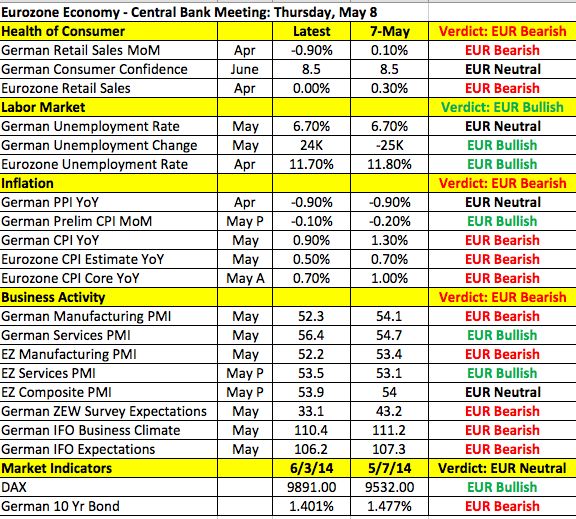

Over the past 5 years, only 2 major central banks have dared to cut the deposit rate below zero and this week the European Central Bank is widely expected to introduce a series of unconventional measures that will most likely include lowering the deposit rate to negative levels. As ECB Mario Draghi once said, these are “largely uncharted waters” for the central bank. In doing so, they would effectively be taxing lenders for parking their funds with the ECB. While policymakers have either downplayed the significance of a small cut in the benchmark rate or talked up the benefit that it could provide to the economy, history shows that this extremely rare policy action could have a significant short-term impact on the currency.

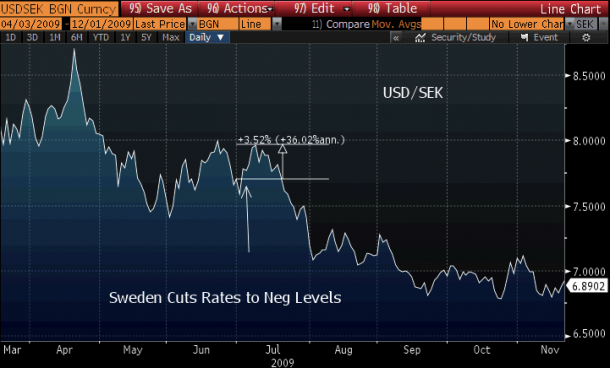

Denmark & Sweden’s Currencies Fell 3% After Negative Rates

The last time a relatively major economy decided to introduce negative deposit rates was in July 2012. Unlike the ECB who needs to boost inflation and lending, Danmarks’ Nationalbank was primarily interested in preventing a further appreciation of its currency versus the euro and to do so, they cut the interest paid on certificates of deposit to -0.2%. Like the euro, the Danish Krona sold off leading up to the announcement and fell another 2.8% versus the dollar after the central bank cut interest rates. Before that, in July 2009, Sweden introduced negative deposit rates and as shown in following chart, the Swedish Krona dropped 4.5% versus the dollar after the move. Based on the price action of these 2 currencies, negative rates can lead to sharp reaction in the euro. However the relatively short-lived nature of the sell-off is also interesting. In the case of the Danish Krona, USD/DKK peaked 3 weeks after the central bank cut rates while the USD/SEK peaked 1 week after. While Sweden’s currency had a larger reaction to the rate cut than Denmark’s because their decision was a surprise, the impact on SEK faded quickly as the size of the deposits affected was very small.

So what does this tell us about Euro? That negative rates could trigger another 3% decline that takes EUR/USD down to 1.3250 but the sell-off should end quickly as investors focus on the positive impact that the move could have on lending.

But Here’s 5 Reasons Why its Different for EURO

While it is no secret that the European Central Banks wants the euro to weaken, just because other European currencies have fallen as much as 3% after negative rate decisions in the past, doesn’t mean that EUR/USD will do so as well. Here are 3 reasons why the EUR/USD could have a benign reaction to ECB easing:

1. EUR/USD is more liquid

2. Eurozone has a current account surplus in the billions and not millions

3. EONIA curve shows investors have completely discounted the move

4. Strong action by ECB could attract more investment flows

5. Anything short of a 4 pronged move (refi cut, depo cut, end SMP sterilization, LTRO) could help the euro

First, it is important to realize that the EUR/USD is a far more liquid and actively traded currency pair than USD/DKK or USD/SEK. This means there will be more two-way action with bargain hunters attracted by the decline especially for a currency with a current account surplus in the billions and not millions like Denmark and Sweden. For most of this year, euro was also supported by the return of funds that fled the region during the sovereign debt crisis and strong action by the ECB could make foreign investors more confident and willing to invest in Eurozone assets. At the same time, the EONIA curve shows that the market has already priced in easing by the central bank. The ECB has not been shy about sharing their plans, which is naturally part of their strategy to minimize volatility when the decision is made on Thursday. At this stage, they are widely expected to lower the refinancing rate, cut the deposit rate, end SMP sterilization and provide another LTRO for banks. Anything short of these 4 moves could end up lifting the euro on the basis that the central bank under delivered. For EUR/USD to fall 3%, the ECB would need to signal plans to initiate a broad scale asset purchasing program or Quantitative Easing. While they are discussing this possibility, we don’t believe they are prepared to resort to this nuclear option. However if they suggest that it is becoming more feasible, EUR/USD will decline with a sell-off that should be limited to 1.35/1.3450.

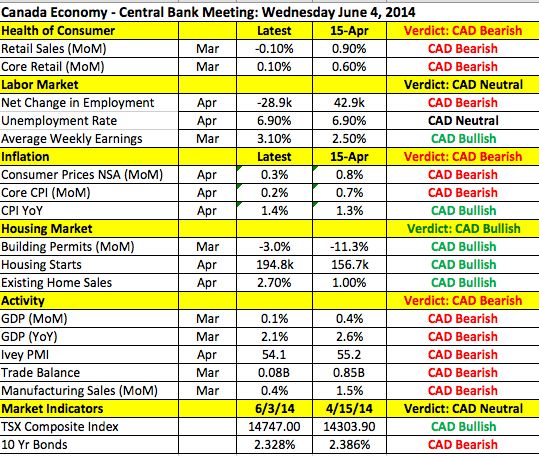

CAD: What to Expect from the Bank of Canada

Between the Bank of Canada’s monetary policy announcement and the country’s trade balance report, the next 24 hours should be a busy one for the Canadian dollar. There has been significant deterioration in economic activity since the last meeting with job losses, contraction in consumer spending, slowdown in manufacturing activity and growth. No monetary policy changes are expected from the central bank but based on these readings alone, the BoC should grow less optimistic and possibly even more dovish but the housing market, which was one of the greatest worries for the central bank this year seems to have stabilized and on an annualized basis, consumer price growth ticked higher. For these reasons, the BoC may temper their comments about the downside risks to inflation but concerns about growth could put pressure on the currency. Next to the ECB, the BoC is one of the least hawkish central banks and this attitude should limit the loonie’s gains. Meanwhile the New Zealand dollar dropped to a fresh 3 month low after Fonterra’s Global Dairy Trade price dropped another 4.2%. While last night’s terms of trade report was the best in 40 years, the data does not account for a large part of the decline in dairy prices. This quarter’s release will be significantly weaker and this reality will continue to shave expectations for RBNZ tightening, leading to further weakness in NZD/USD. The Australian dollar on the other hand rebounded against the greenback after the RBA left their monetary policy statement virtually unchanged. Despite speculation that the RBA could express concerns about domestic activity, the central bank sounded relatively upbeat and expressed very little concern about the level of the currency. This along with the improvement in the current account balance and rise in exports helped to offset slower retail sales growth. PMI services and first quarter GDP numbers were scheduled for release Tuesday evening.

Dollar Eyes Rebound in US Yields with Caution

Ten year Treasury yields rose to their highest level in 3 weeks, which should have been significantly positive for the dollar but unfortunately forex traders eyed the move with caution and only drove the dollar slightly higher against the Japanese Yen, New Zealand and Canadian dollars. Tuesday’s U.S. economic reports were good with factory orders rising more than expected and economic optimism rising in the month of June. While the dollar could be experiencing a delayed reaction to Tuesday’s move in U.S. bond yields, market participants are also weary of initiating new long dollar positions ahead of Friday’s non-farm payrolls report. They are most likely waiting for Wednesday’s releases before joining the move in Treasuries because on Wednesday we start to receive the leading indicators for NFPs. Their caution is justified because based upon last month’s jobless claims reports, all signs point to slower job growth. If the ADP and ISM non-manufacturing reports surprise to the downside, U.S. yields could reverse their gains quickly. As a service based economy, non-manufacturing ISM is one of the most important economic reports that the U.S. releases and with the trade balance and Beige Book also scheduled for release, the dollar will be in play over the next 24 hours.

GBP: Hoping for Some Volatility on PMI

Once again, the British pound ended the day unchanged against the U.S. dollar. The latest economic reports confirm that the housing market is slowing with house prices growing 0.7% in the month of May compared to 1.2% in April according to Nationwide’s report and the construction sector PMI index dropping from 60.8 to 60.0. These reports along with the other pieces of data released earlier this week should only harden the central bank’s conviction to leave monetary policy easy. The Financial Policy Committee could still take action to cool the market if house prices do not fall further but investors do not expect any action from the BoE, which explains the limited price action in the currency. However that will change with Wednesday’s service and composite PMI index. If service sector activity slows alongside manufacturing, GBP/USD could drop below 1.67.

Yen Crosses Extend Gains, Wages Rise

The Japanese Yen ended the day lower against most of the major currencies. Despite the pullback in U.S. equities, risk appetite remains healthy with Japanese stocks powering higher overnight and U.S. yields continuing to rebound. Economic data from Japan was also encouraging with labor cash earnings rising 0.9% in the month of April against expectations for 0.4% increase. This upside surprise is important because in order for the economy to grow in an environment of rising inflation, wages need to keep up with the pace. Asian equities also received support from China’s non-manufacturing PMI index, which rose from 55.5 to 54.8. The whole region benefits from the stabilization in Asia’s largest economy. PMI numbers were scheduled for release from Japan Tuesday evening but the focus will be on U.S. data.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management.