Following the Fed’s last meeting, we published a simple question:

“What does the Fed know?”

Of course, this meeting followed the stock market plunge at the end of 2018 where their tone that turned from “hawkish” to “dovish” in the span of just a few weeks. Seemingly, despite the previous comments about concerns over rising inflationary pressures, it was pressure from Wall Street and the White House that quickly “realigned” the Fed’s views.

- The Fed will be “patient” with future rate hikes, meaning they are now likely on hold as opposed to their forecasts which still call for two to three more rate hikes this year.

- The pace of QT or balance sheet reduction will not be on “autopilot” but instead driven by the current economic situation and tone of the financial markets.

- QE is a tool that WILL BE employed when rate reductions are not enough to stimulate growth and calm jittery financial markets.

This change in stance, not surprisingly, buoyed the stock market as the proverbial “Fed Put” was back in place.

But the change view may have also just trapped the Fed in their own “data dependent” decision-making process.

The Fed Should Be Hiking Rates

As we noted in our RIA Pro article:

“During the press conference, the Chairman was asked what has transpired since the last meeting on December 19, 2019, to warrant such an abrupt change in policy given that he recently stated that policy was accommodative, and the economy did not require such policy anymore.

In response, Powell stated:

‘We think our policy stance is appropriate right now. We do. We also know that our policy rate is now in the range of the committee’s estimates of neutral.'”

Powell’s awkward response, and unsatisfactory rationale to a simple and obvious question, the question must be asked if it is possible that economic or credit risks are greater than currently believed which would account for the policy U-turn?

However, given that the Fed’s two primary mandates are supposed to be “full employment” and “price stability,” the conflict between managing inflation and supporting the markets is a conundrum.

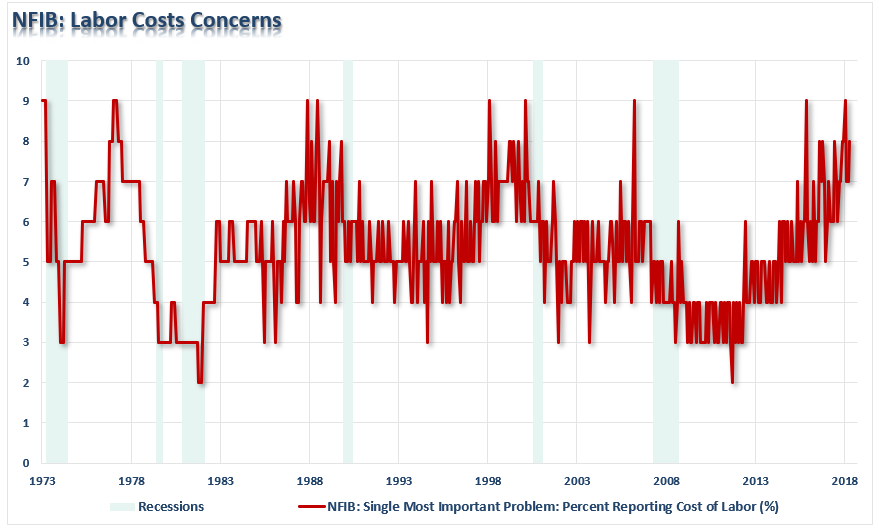

For example, there is currently sufficient data which suggests “real inflationary pressures” are mounting in the economy. For example, with a 300,000 job print in January and rising wage pressures, the Fed should raise interest rates. The chart below of labor costs clearly show the problem business owners are facing.

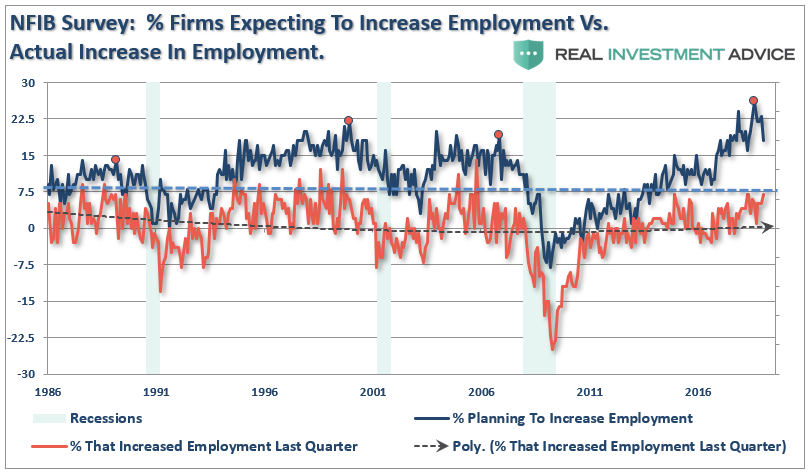

As noted employment remains strong and data suggests there is upward pressure on companies to hire more workers.

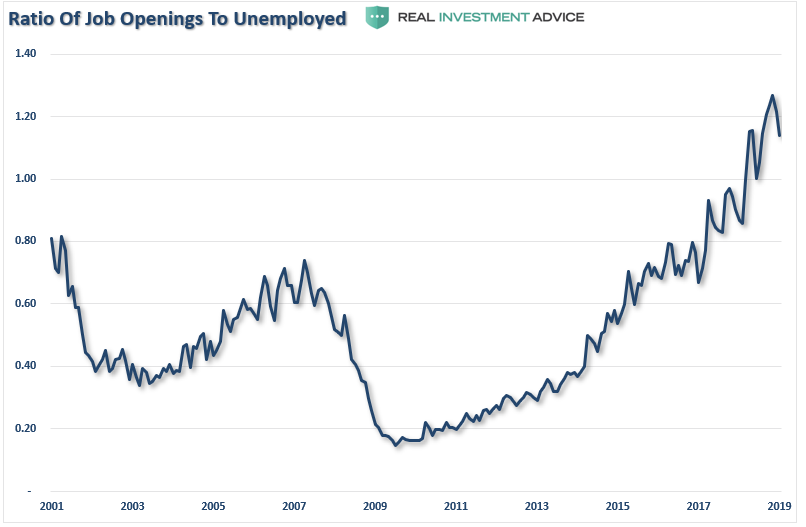

That pressure to hire is coming from the reality there are currently more demands on labor than there are people to fill them.

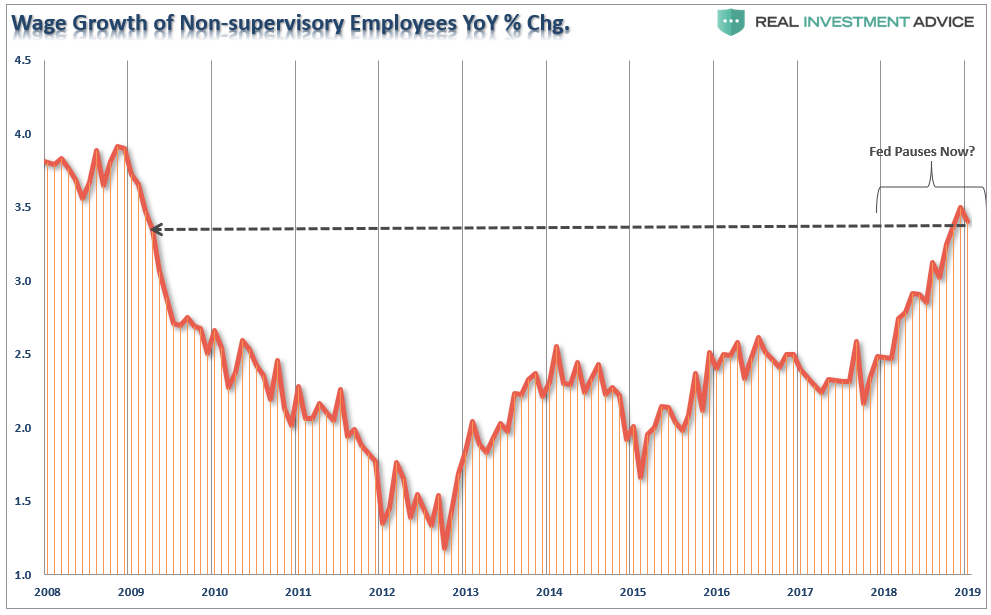

Wage pressures are clearly rising in recent months putting additional upward pressures on pricing as companies pass on higher labor costs.

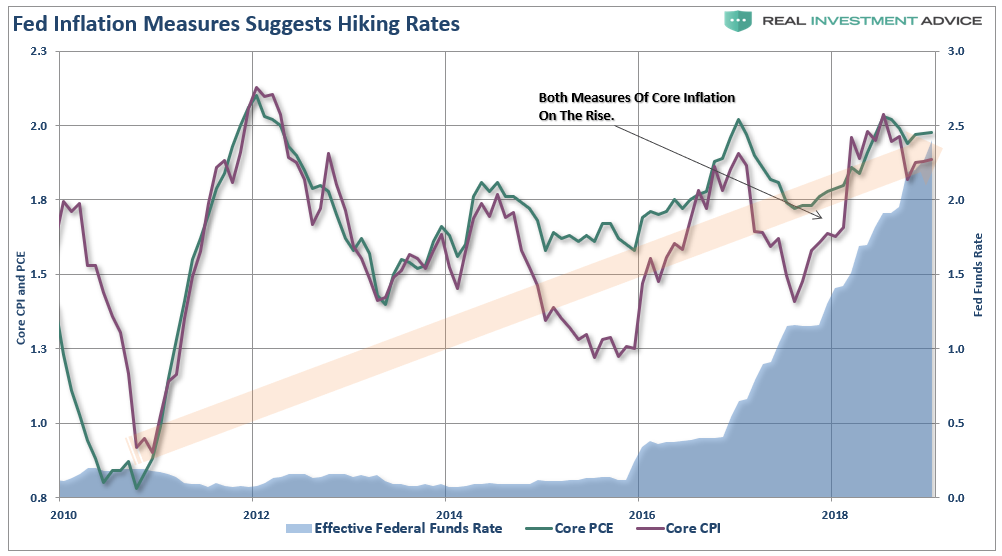

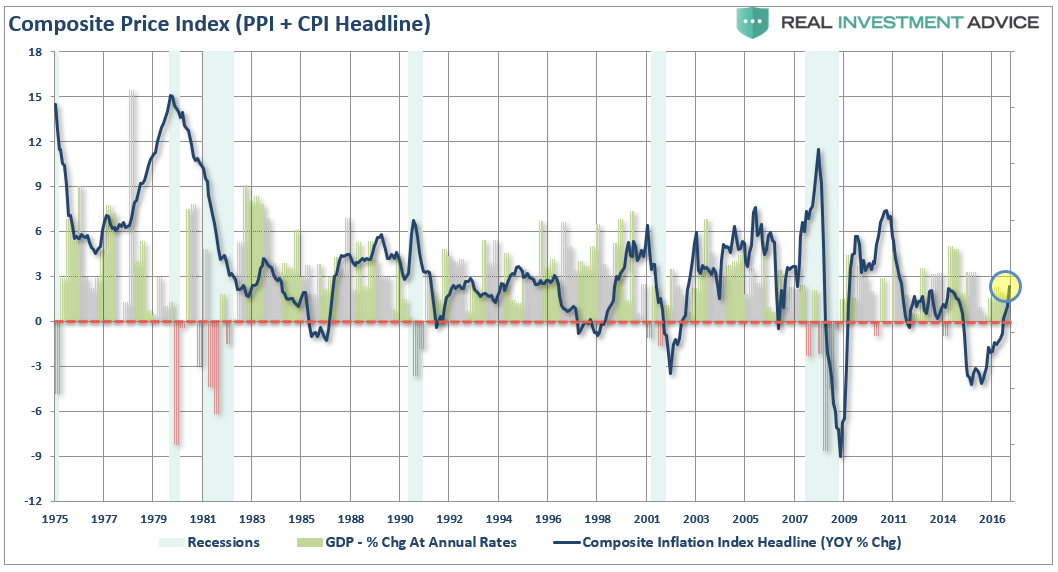

More importantly, inflationary pressures as measured by both PPI, CPI, and the Fed’s preferred measure of Core PCE, continue to rise as well.

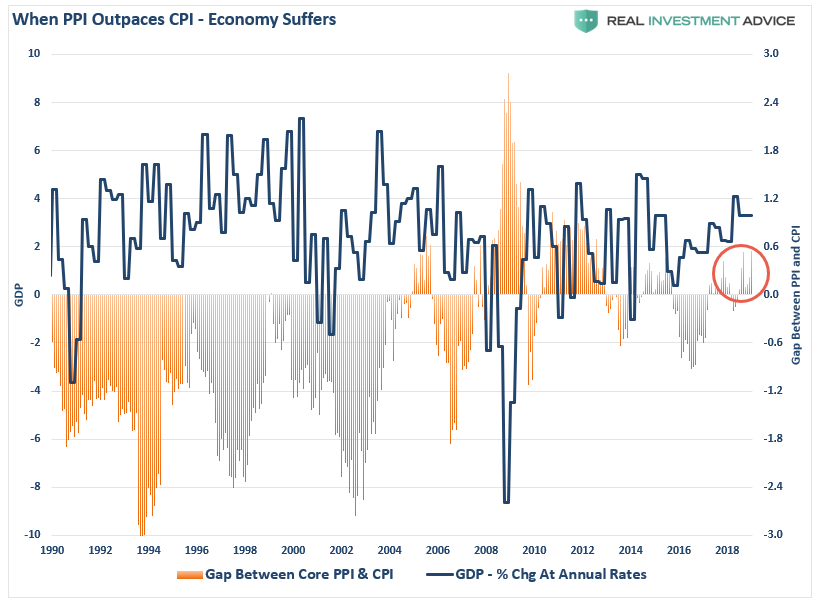

The chart below is the spread between PPI and CPI, historically, when “producer price” inflation rises faster than consumer prices, it has impacted economic growth by suggesting that inflation can’t be passed on to consumers.

The composite inflation index is also screaming higher suggesting that if the Fed pauses they could potentially get well “behind the curve.”

Even the Federal Reserve’s favorite measure of inflation, PCE, is also suggesting the Fed should be hiking rates rather than pausing.

All of this data clearly suggests that the Fed should be hiking rates currently, rather than pausing.

The Conundrum

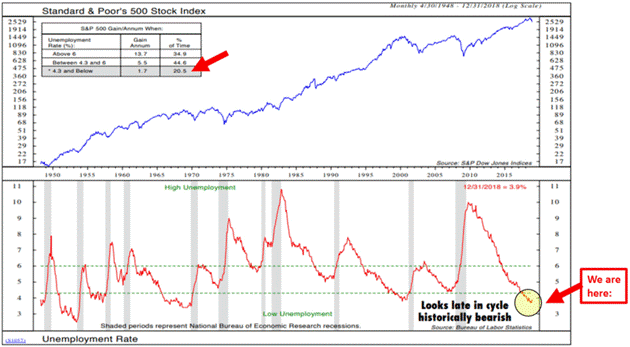

However, all of this data is also consistent with the end of an economic cycle rather than a continued expansion. As we quoted last week from John Mauldin:

“I think because unemployment is lowest when the economy is in a mature growth cycle, and stock returns are in the process of flattening and rolling over. Sadly, that is where we seem to be right now. Unemployment is presently in the ‘low’ range which, in the past, often preceded a recession.

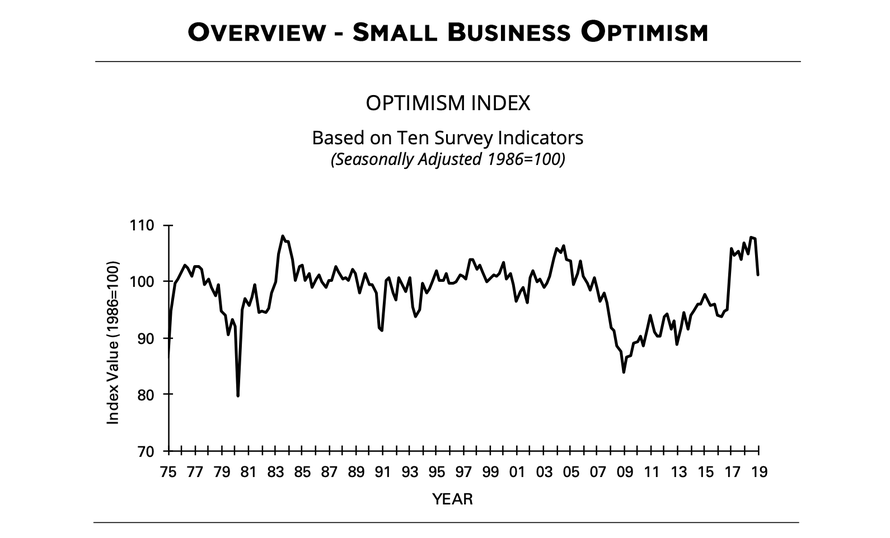

That loss of confidence is already beginning to show signs as noted recently by Zerohedge:

“American small-business owners are growing increasingly anxious about a looming economic slowdown.

After a report published last week by Vistage Worldwide suggested that small-business confidence had collapsed with the number of small business owners worried that the economy could worsen in 2019 numbering more than twice those who expected it to improve, the NFIB Small Business Optimism Index – a widely watched sentiment gauge – apparently confirmed that more business owners are growing fearful that economic conditions might begin to work against them in the coming months.”

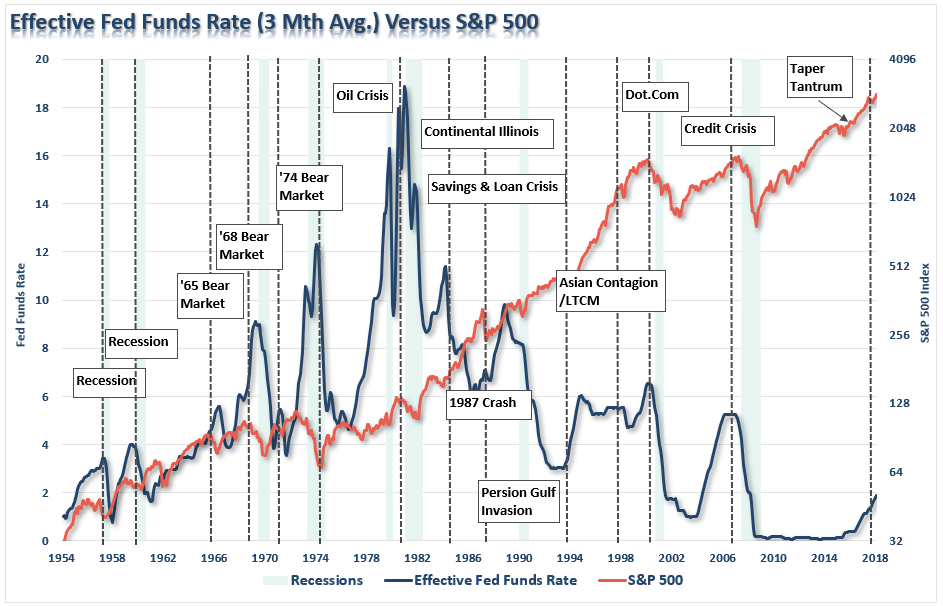

Furthermore, most of these data points are at levels that typically precede economic slowdowns and recession, so hiking rates further from current levels could exacerbate the recessionary risk.

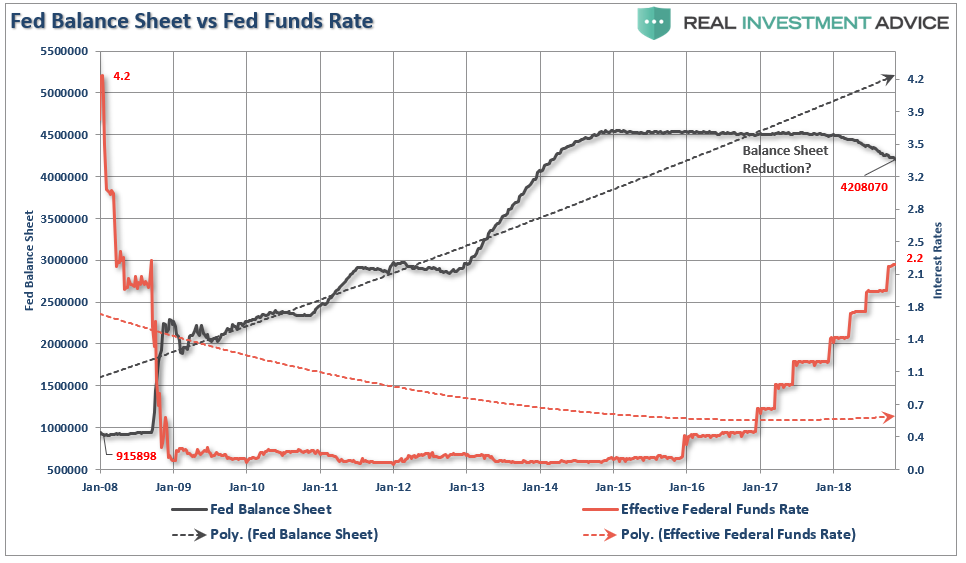

The problem the Fed faces currently, as we discussed previously, is that when the last recession started the Fed Funds rate was at 4.2% not 2.2% and the Fed balance sheet was $915 billion not $4+ trillion.

“If the market fell into a recession tomorrow, the Fed would be starting with roughly a $4 Trillion dollar balance sheet with interest rates 2% lower than they were in 2009. In other words, the ability of the Fed to ‘bail out’ the markets today, is much more limited than it was in 2008.”

But…what do you do?

The Trap

There are clearly rising inflationary pressures on the market, which are also beginning to impede economic growth. Those pressures, combined with a sharp decline in asset prices, spurred the Fed to react to political and market pressures.

The Fed is most likely aware that if a recession were to occur, their main lever for stimulating economic activity, interest rate reductions, will have little value. Given the amount of debt outstanding and the onerous burden of servicing it, the marginal benefit of lower rates will likely not provide enough benefits to lift the country out of a recession. In such a tough situation the next lever at their disposal is increasing their balance sheet and flooding the markets with liquidity via QE.

Sure, Powell might be taking a dovish tone to placate the markets, the President and his member banks and concurrently buying time to further normalize the balance sheet? But this approach is like pouring liquid out of your cup so you can add more when the time is right. You would do this because it is not clear just how much “the cup” will ultimately hold.

Bernanke and Yellen have both acknowledged that they were aware that each successive round of QE was somewhat less effective than prior rounds. That certainly must be a concern for Powell if he is called upon to re-engage QE in a recession or another economic crisis.

If this is the case, Powell will continue to publicly discuss minimizing reductions to the balance sheet and refrain from further rate hikes. Despite such dovish Fed-speak, he would continue to shrink the balance sheet at the current pace. This tactic may trick investors for a few months but at some point, the market will question his intentions and damage Fed credibility.

So, therein lies the trap. Do you hike rates and reduce the balance sheet anyway to be better prepared for the onset of the next recession, OR reverse policy to try to “kick the recession can” down the road a bit which leaves you under-prepared for the next crisis?

For the Fed, it is a choice between the lesser of two evils. The only question is did they make the right one?

While the Fed has a long history of using economic jargon and, quite frankly, non-truths to help promote their agenda, they also have a long history of making the wrong policy moves which spark either some sort of crisis, recession or both.

As Michael Lebowitz concluded last week:

“The market has largely recovered from the fourth quarter swoon, as such the Fed should be resting more comfortably. Economic data remains strong, and if anything it is slightly better than December when the Fed was ready to raise rates three times and put balance sheet reduction on “autopilot.”

Today the Fed has all but put the kibosh on further rate hikes and, per Mester’s comments, will end balance sheet reduction (QT) in the months ahead.

It is becoming more suspect that the Fed knows something the market does not.”

But, exactly what is it?