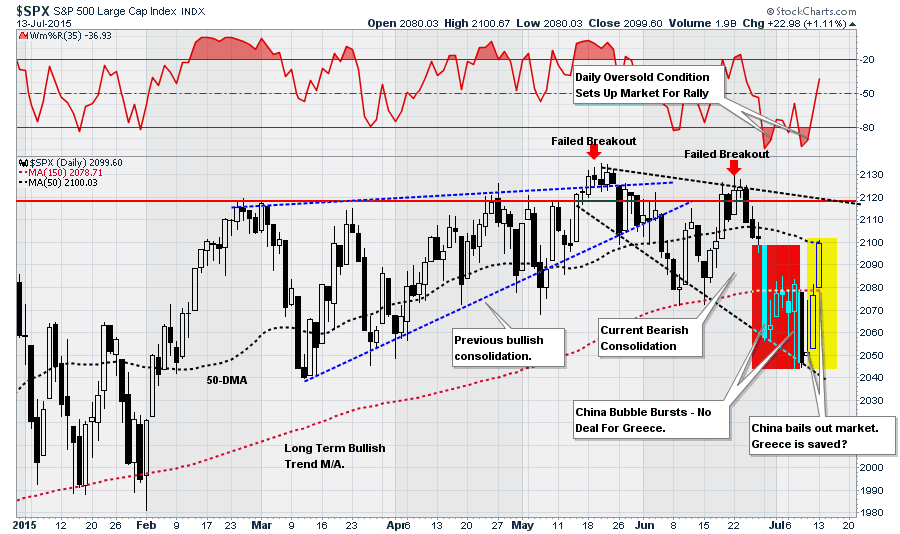

Last week I discussed the reflex bounce from critical market support levels as the headlines blared that "Greece was saved" and "China rescued their markets." To wit:

"However, as has been the hallmark of the financial markets, Central Banks, and Government officials "raced to the rescue" to ensure a continuation of "market stability." In the case of China, a swift intervention of liquidity, a trading halt on almost half of all securities and a ban of selling of securities stalled the 30% dive in the index. (Of course, it did.)

For Greece, it was the brute force of Government pressure that brought the Greek Prime Minister to his knees. In a deal that will leave Greece in ruins for decades, the crisis was brought to a temporary end as the proverbial "can" was kicked down the road for a third time. Unfortunately, for Greece, when the debt comes due next time, the situation will be far worse and a similar outcome much less viable.

But that was just the latest headlines. The question that investors must answer is whether the rally that started last week, and continued Monday, put an end to the correction that begin several weeks ago?"

That was "so a week ago..."

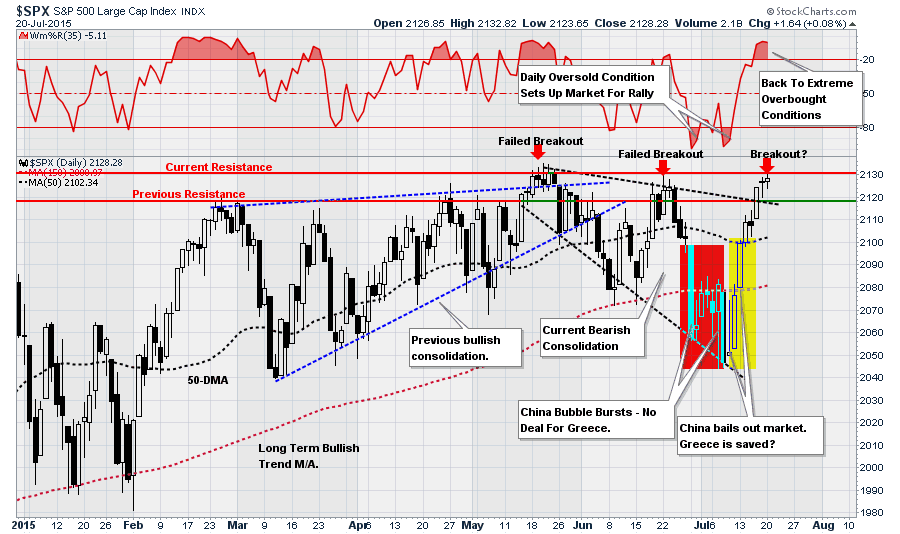

Here is that same chart updated through yesterday's close.

As I stated last week:

"To re-establish the longer-term bullish trend, the market will need to move to new highs. Any failure to do so will simply keep the markets trapped in the ongoing topping process that began earlier this year."

While the prices did manage to breakout of the downtrend that has contained the market since mid-May, so far that rally has failed to attain new highs. Furthermore, the previous oversold condition that acted as the "fuel" for the recent rally has been exhausted with the markets are now back to an extreme overbought condition. This suggests that there is likely very little upside currently and that investors should consider using this opportunity to engage in prudent portfolio management practices such as taking profits, reducing laggards, and rebalancing allocations.

With earnings season now in full swing and the Greek and China debacles now moved back to "page-6," this leaves only the well telegraphed and anticipated rate hike by the Federal Reserve slated for the September FOMC meeting. With earnings estimates still suppressed, this gives the "bulls" some breathing room for the quarterly "beat the number" game. When combined with the ongoing "share repurchase" spree, there is likely to be enough "hype" to push markets to fresh highs.

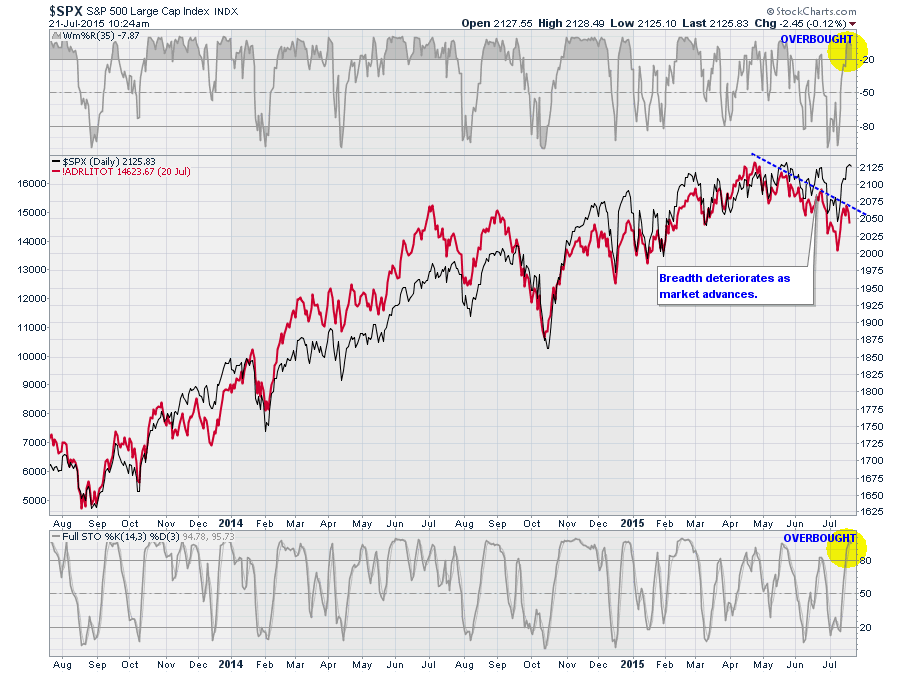

However, that push to new highs, if it occurs, will likely prove temporary UNLESS the ongoing deterioration in the market is soon reversed.

The chart below is the TOTAL cumulative advance-decline ratio as compared to the S&P 500. You will notice that there is a very historical correlation between these two indices (as there should be.) However, over the last couple of months, there has been a clear deterioration in the A/D line even as the markets work to move higher. If the market is going to resume its longer-term bullish advance the "breadth" of the market will need to improve.

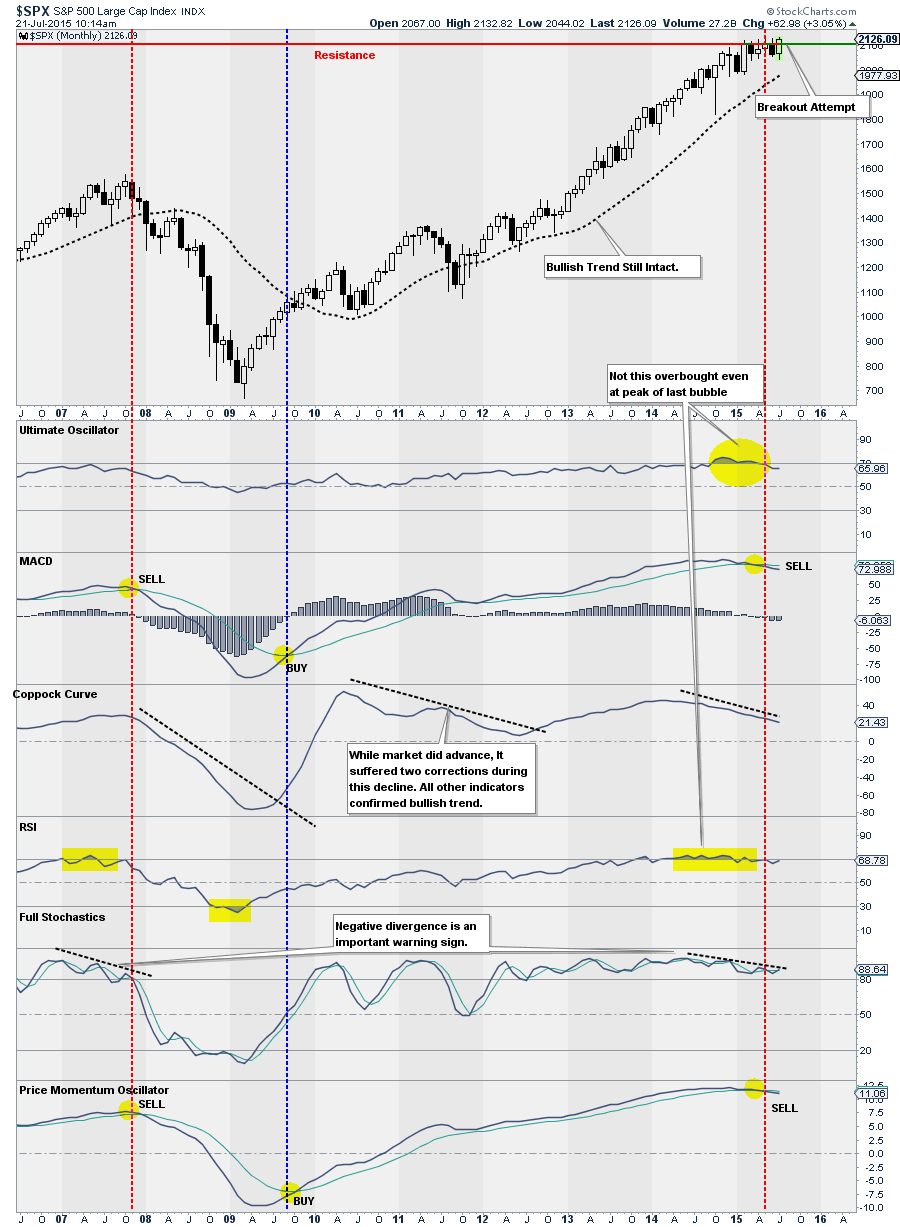

However, the internal deterioration is more prevalent when viewed on a longer-term basis. The chart below is a monthly chart of the market. As I addressed previously:

"Importantly, for investors, the TREND of the market remains positively biased for now. Regardless of your personal bias (bullish or bearish) as it relates to the economy or markets, the positively sloping market trend requires portfolios to remain tilted toward equity (risk) based exposure.

However, and importantly, where investors inherently go wrong is the extrapolation of the current condition indefinitely into the future. As shown in the chart below, there are internal dynamics that suggest that current "environment" for carrying excess "risk" is deteriorating."

The market, on multiple levels, has reached points that have existed only at previous major market peaks. Furthermore, the internal dynamics are issuing very similar warnings, in terms of momentum, deviation, and relative strength, as to what was seen just prior to major turning points previously. While this does NOT mean that the market is on the verge of immediate mean-reverting correction, it does suggest that future market returns are likely to be far less robust than what has been seen previously.

For investors, it is not time to become complacent or dismissive of market action. While recent price declines have not violated or changed the current bullish trajectory of the market, it does not mean that such will not eventually become the case. The markets, much like a ball thrown in the air, have been lofted higher due to an enormous amount of "force" that was created through liquidity interventions, suppressed corporate profitability, pent-up investor demand, and a variety of other factors following the financial crisis.

However, when that "force" is ultimately exhausted the ball will eventually return to earth. The markets, like anything, adheres to the laws of physics. The gravitational pull of the longer-term moving average will eventually drag prices into a mean reverting event. At that point, the issue of valuations, price extensions, and a variety of other factors will become vividly apparent. Unfortunately, for most it will be far to late to be proactive which will lead to a replication of the "buy high / sell low" process that has destroyed investor capital repeatedly in the past.

While I don't know WHEN the next major market reversion will occur, I do know that it eventually WILL. This is why managing portfolio risk and paying attention to the overall trend of the market will allow for a more logical decision-making process rather than reacting to headlines, which is generally far too late to be of any real use.

It is always better to be more conservative during periods of market uncertainty as it is much easier to increase portfolio "risk" when the overall environment gains clarity. However, spending long periods of time making up losses is much more problematic in achieving long-term investment goals.