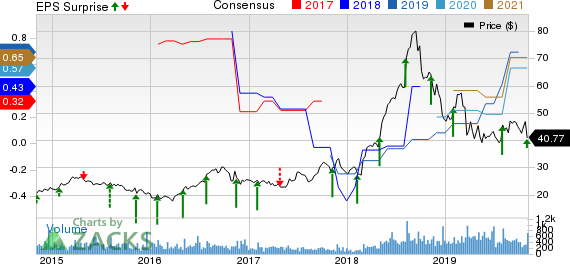

Surmodics, Inc. (NASDAQ:SRDX) delivered adjusted earnings per share (EPS) of 37 cents in fourth-quarter fiscal 2019 which surpassed the Zacks Consensus Estimate of 35 cents by 5.7%. Moreover, the bottom line significantly improved from the year-ago quarter’s 5 cents.

Reported EPS came in at 26 cents against reported loss per share of 13 cents a year ago.

Revenues in the quarter increased 33.8% year over year to $30.8 million. This figure beat the Zacks Consensus Estimate by 8%.

Fiscal Q4 Highlights

In the quarter under review, Product sales were $10.7 million, up 0.1% from the prior-year quarter. Royalty and license fee revenues totaled $16.8 million, up 62.8% from the prior-year quarter. Research, development and other were $3.3 million, up 64% year over year.

In the reported quarter, enrolments under Surmodics’ TRANSCEND pivotal clinical trial for SurVeil drug-coated balloon (DCB) was completed.

Segmental Analysis

Medical Device

In the reported quarter, sales at the segment rose 46% to $24.8 million, including $7.6 million from the SurVeil agreement with Abbott, in comparison to $2.2 million in the year-ago quarter. The Medical Device business unit recorded $3.7 million of operating income in the fourth quarter against operating loss of $2.1 million a year ago.

In Vitro Diagnostics

In the quarter under review, sales declined 1% to $6 million. Operating income at the segment was $2.8 million in the reported quarter, up 18% from the same period last year.

Operational Details

Gross profit rose 43.3% to $27.2 million during the quarter on account a 10.5% decline in Product costs to $3.7 million. Gross margin expanded 580 bps to 88.1%.

The company’s research and development costs totaled $14.5 million, up 15.3% year over year.

Selling, general and administrative expenditures were almost $7.2 million, up 10.5% from the prior-year quarter.

Total operating costs and expenses in the quarter were $26.9 million, up 5.7% year over year. The company reported adjusted operating income of $5.7 million against the year-ago quarter’s loss of $0.1 million.

Fiscal 2020 Guidance

Surmodics initiated its fiscal 2020 revenue expectation at the range of $87-$91 million. The Zacks Consensus Estimate for the metric is pegged at $107.7 million, above the guided range.

Adjusted loss per share is projected between 14 cents and 44 cents.

Our Take

Surmodics exited the fiscal fourth quarter on a strong note. The company continues to gain from the core Medical Devices unit, which saw significant contribution from the SurVeil deal with Abbott in the quarter. Management is also upbeat about the completion of TRANSCEND enrolment. A strong revenue guidance for fiscal 2020 buoys optimism. Expansion of gross margin is encouraging.

On the flip side, surging operating expenses raise concern. Softness in IVD sales was disheartening as well.

Earnings of Other MedTech Majors at a Glance

Surmodics carries a Zacks Rank #3 (Hold).

Some better-ranked companies, which posted solid results this earnings season, are Edwards Lifesciences (NYSE:EW) , Thermo Fisher Scientific (NYSE:TMO) and ResMed (NYSE:RMD) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences delivered third-quarter 2019 adjusted EPS of $1.41, outpacing the Zacks Consensus Estimate by 15.6%. Net sales of $1.09 billion surpassed the Zacks Consensus Estimate by 5.5%.

Thermo Fisher delivered third-quarter 2019 adjusted EPS of $2.94, which surpassed the Zacks Consensus Estimate by 2.1%. Revenues of $6.27 billion outpaced the consensus estimate by 1.3%.

ResMed reported first-quarter fiscal 2020 adjusted EPS of 93 cents, which beat the Zacks Consensus Estimate of 87 cents by 6.9%. Revenues were $681.1 million, surpassing the Zacks Consensus Estimate by 3.6%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Thermo Fisher Scientific Inc. (TMO): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Surmodics, Inc. (SRDX): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

Original post

Zacks Investment Research