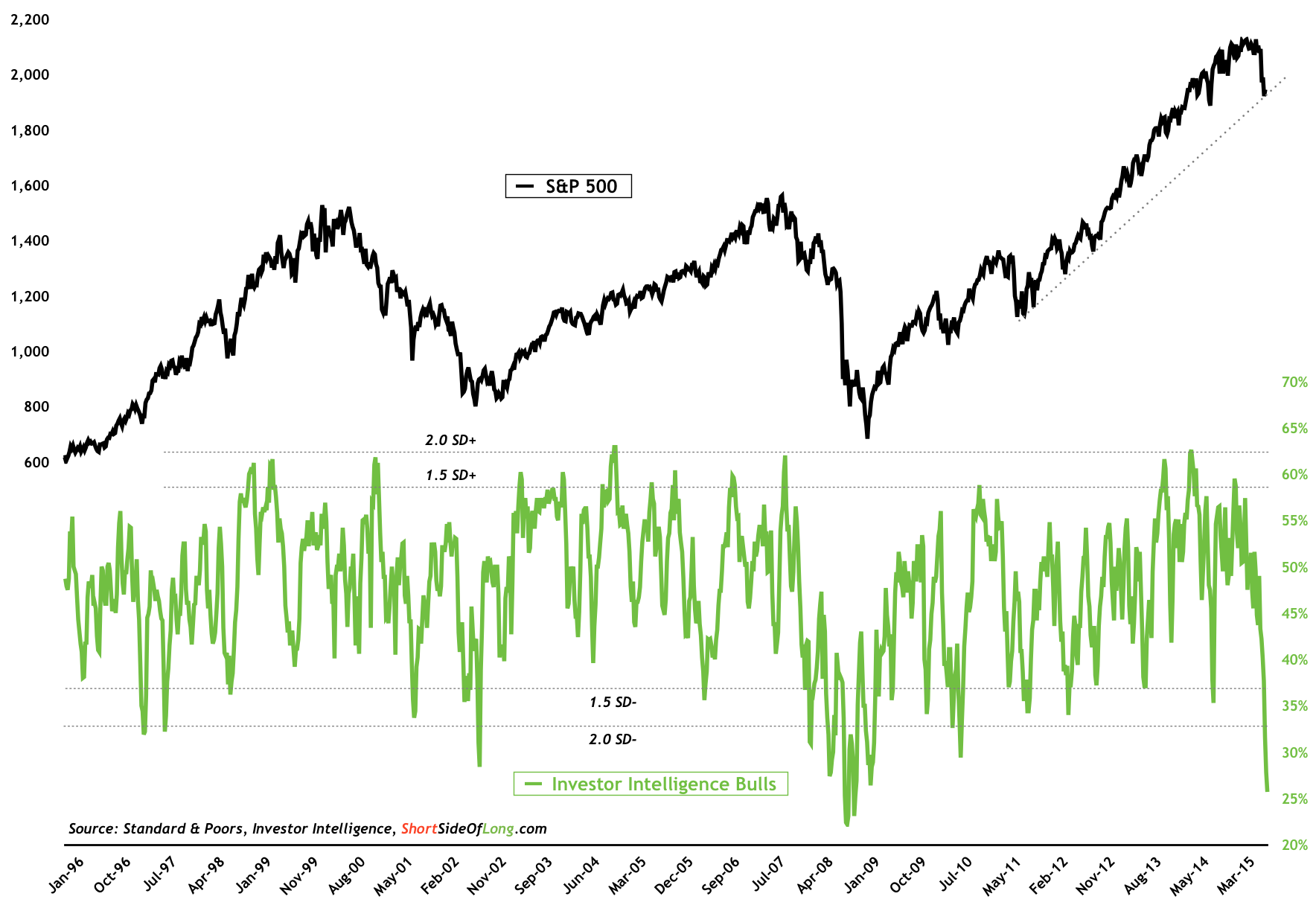

Lowest percentage of bullish newsletter editors since Lehman bankruptcy

Source: Short Side of Long

We discussed market sentiment with regard to the S&P 500 at the beginning of this month, focusing on the Investor Intelligence newsletter and advisor survey. At the time, we concluded that bullish sentiment has dropped to levels we have not seen since March 2009 lows. A quick update this week shows that the number of bullish advisors has fallen even further. Apart from the Lehman bankruptcy and the aftermath of the market crash of October 2008, over the last two decades, there has been no other time when bullish sentiment was this low.

The Asian Financial Crisis in 1997, the Russian default in 1998, the Tech crash during the early 2000s, the September ’11 attacks, world dot com bankruptcy and every other recent panic have not scared bulls as much as the first potential Federal Reserve interest rate hike since 2006. It is very clear that market participants have gotten used to extremely loose monetary policies via all the major central banks.

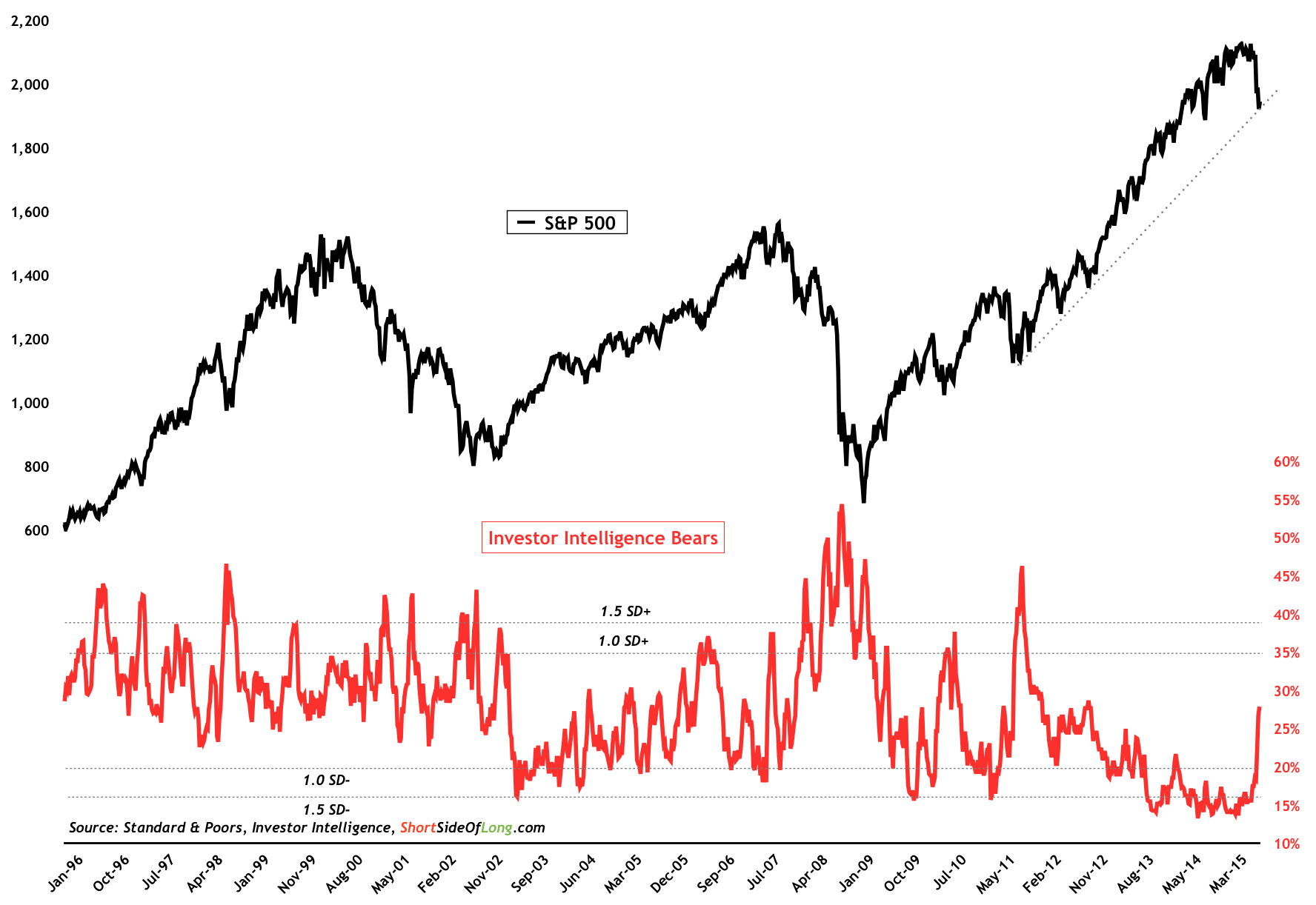

Furthermore, for the first time since the Eurozone entered a recession in 2011, bearish newsletter advisors have now outnumbered the bullish ones. According to SentimenTrader research, with data going back to the 1980s, whenever bearish newsletter advisors outnumbered bullish ones for the first time in a year, three month stock returns were positive 100% of the time. The average return showed about an 8% gain in the coming 12 week timeframe.

First time since 2011 EU recession, there are more bearish than bullish advisors

Source: Short Side of Long