As 2015 comes to an end, gold feels solid. There are many factors coming into play in 2016 that should incentivize investors to add to their positions, and do so with comfort.

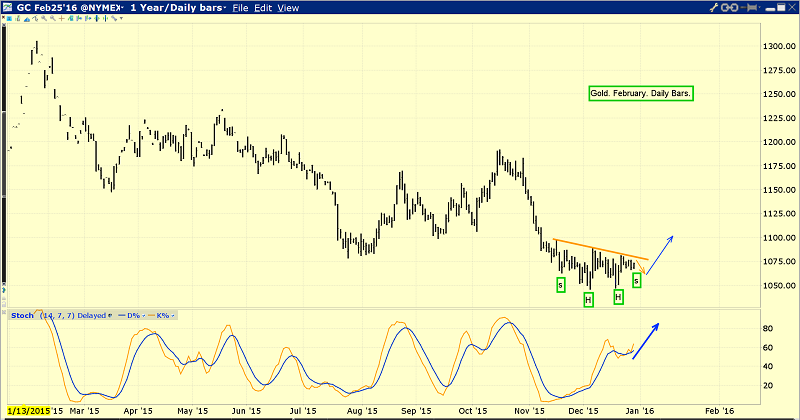

A week ago, I suggested gold was forming a key inverse head and shoulders bottom pattern.

The pattern has two heads, and a bit more work may be required to complete a right shoulder in the $1062 area. Overall, I like the technical action, and Chinese New Year buying is likely the fundamental catalyst that can launch a nice January rally.

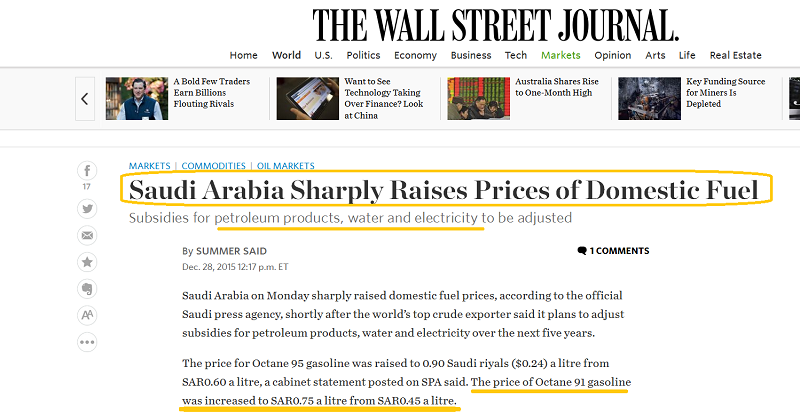

Inflation is suddenly on the move in Saudi Arabia, and in a country that already embraces gold, that’s going to add to demand.

The Saudi government has announced that the price of gasoline with an octane content of 91 will be hiked by about 66%! The government’s budget deficit is approaching $100 billion, and forex reserves are sinking.

Ominously, as the financial situation of the Saudi government deteriorates, the risk of civil unrest grows. Will a terrible crisis in Saudi Arabia be the trigger of the next global financial meltdown? I don’t know, but I do know that it’s critical to own gold bullion before geopolitical risk gets out of control.

Important US dollar versus Japanese yen weekly chart.

If Saudi Arabia does tumble into a crisis, US dollars and US bonds may not be the safe haven they were during the 2008 financial crisis. Incredibly, the dollar began losing upside momentum against the yen a year ago, in spite of unprecedented QE in Japan.

There’s a big head and shoulders top pattern in play for the dollar on that chart, and it’s testing a major uptrend line that extends back to 2012.

Also, Janet Yellen is trying to raise rates with experimental tools, and if her experiment fails, money could pour out of the dollar, and into gold and the yen.

It’s important for gold investors to be proactive rather than reactive. A lot of US stock market investors were badly burned in the 2000 and 2008 meltdowns, and they reacted by buying gold. They bought general equity stocks before those meltdowns, also as a reaction to low rates.

Investors should only react to price changes, and do so with modest buying on declines. Price rallies should be used to “prune” holdings. Pruning a tree (very light selling) or adding fertilizer to it (very light buying) is not the action known as “trading”.

Trading needs to be separated from investing. In the big picture, Western gold market investors should think like gardeners.

When an investor reacts to fundamental events and perceived scenarios with sudden movements of sizable capital, the odds of achieving long term success in any asset class become negligible.

The world has experienced many crises, and it will experience many more, until the end of time. If Saudi Arabia disintegrates into a “Mad Max” state like Iraq or Syria, it will be far too late for investors to “react” to the situation by buying gold.

Fear trade enthusiasts should also embrace the idea that the next major crisis in the West may not be as predictable as a lot of analysts want to believe it is.

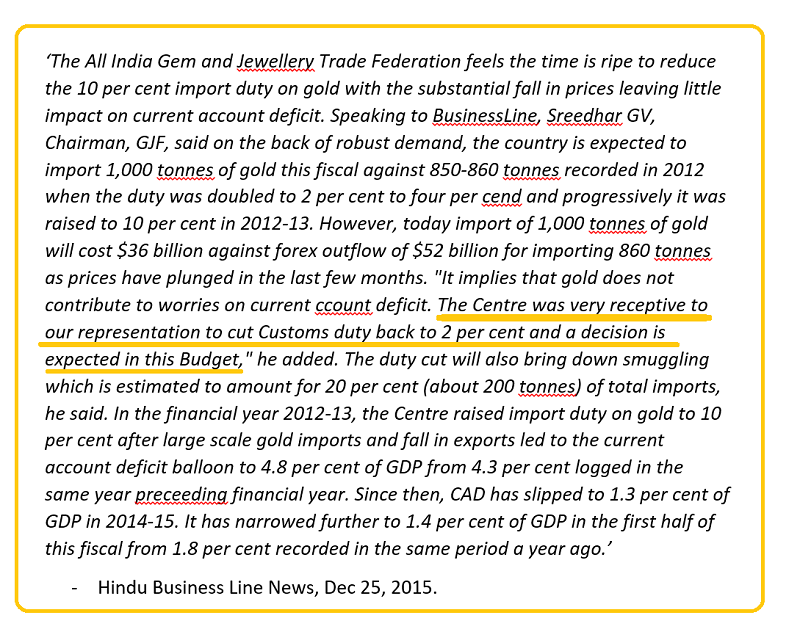

India continues to move closer to a massive 80% chop in the gold import duty.

In India, gold is traditionally the scapegoat for high crude oil imports and massive government corruption. In early 2013, the Indian current account deficit had reached almost 5% of GDP. It’s down to under 2% now, and India’s most powerful jewellers are getting very good vibes from the nation’s finance ministry. A duty chop in the next national budget appears to have a green light.

Also, the PBOC-controlled Shanghai Gold Exchange (SGE) is set to launch a gold fix around April. That’s around the same time that India’s next budget is released. April is shaping up to be a very interesting time for gold price enthusiasts.

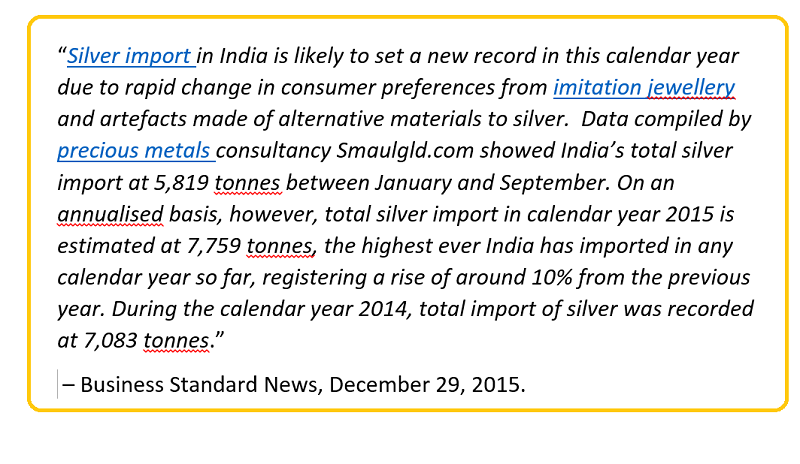

The news for silver is, arguably, even better than for gold. Indian imports of silver have been surging, and are approaching 8000 tons on an annualized basis. The import duty applies to silver as well as to gold. A chop in that duty could lead to even bigger demand for silver.

In the Western gold community, the World Gold Council (WGC) has a bit of a bad name. A new World Silver Council is being launched, in India, and that should also help to significantly boost silver demand.

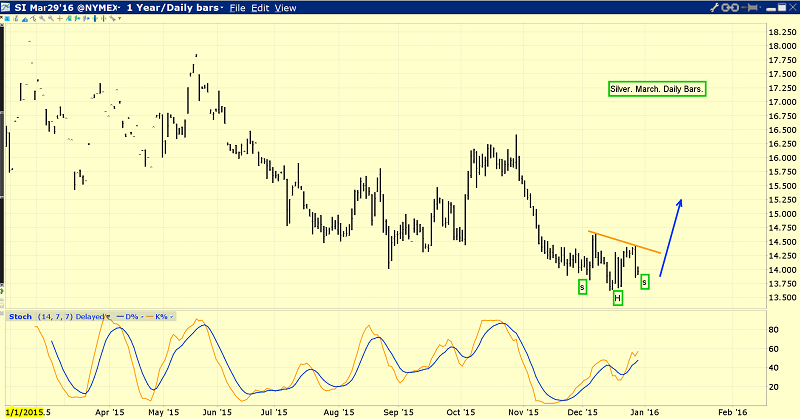

That’s the daily silver chart.

There’s a nice inverse head and shoulders bottom pattern in play, and a January rally would take the price of this mighty metal closer to the “AISC Threshold” for many miners. A number of Western silver mining companies have AISC (all-in sustaining costs) in the $16 area.

Some investors may be wondering whether they should own silver bullion or the silver mining stocks. I suggest owning both assets. If Indians are buying over 7000 tons a year, Western investors should buy some too. With the launch of the WSC (World Silver Council), silver mining companies may have a new friend. 2016 will be a great year for gold, and an even better one for silver.

Risks, Disclaimers, Legal: Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?