Key Points:

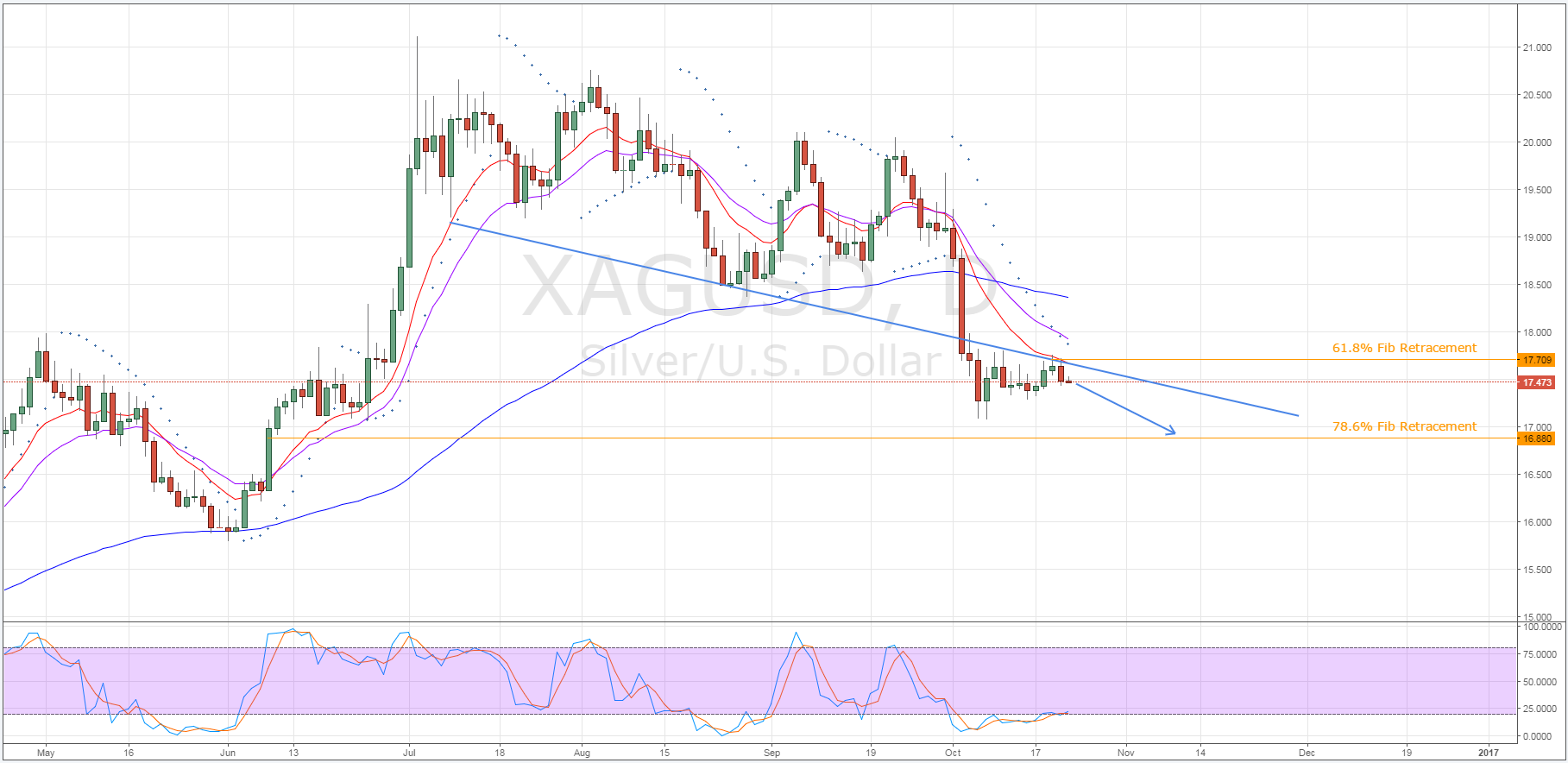

- EMA bias remains highly bearish.

- Parabolic SAR readings still indicative of an ongoing downtrend.

- Should travel as low as the 16.880 mark.

Unlike gold, silver looks as though both its near and long-term bias could be rather bearish going forward. Specifically, basically all of its key technical readings appear to be in agreement that the metal should move into decline imminently.

Moreover, silver’s recent uptrend is now seeing selling pressure build as it defies the technical bias which could mean that the bears are about to wrest control of the metal back from the complacent bulls.

Firstly, it’s worth mentioning, silver prices have already begun to retrace slightly which could either be indicative of a technical reversal or simply be the consequence of the strong US data seen last session. However, regardless of what sparked the tumble, it looks as though the technicals are now playing their part in keeping the metal depressed.

Furthermore, as the week winds down, we could see the descent accelerate as traders begin to close out any long-positions which were entered into whilst silver strayed into oversold territory.

From a technical perspective, a number of factors are causing selling pressure to be felt as we move forward. Obviously, the incredibly bearish EMA bias that resulted in the wake of the recent slide is now generating a significant portion of the negative sentiment. However, the general swing away from silver is also being exacerbated by the consistent bearish bias evident on the daily Parabolic SAR reading.

In combination with the EMA and Parabolic SAR reading, the lower constraint of the old bearish channel is also doing its part to cap upside potential for the metal. As is shown on the above daily chart, silver has tested and, ultimately, failed to breakout above the old boundary multiple times over the past number of sessions.

In fact, the most recent attempt at breaching this trend line is ostensibly proving to be a turning point as the 61.8% Fibonacci reinforced resistance around this level and slapped the metal lower. As a result, it’s now expected that resistance remains in place as the commodity continues moving forward which should keep it depressed in the foreseeable future.

Ultimately, silver is expected to retrace as low as the 78.6% Fibonacci level at around the 16.880 mark over the proceeding sessions. Of course, fundamentals will play their usual role in influencing the metal’s movements. However, the general consensus that US rate hikes are due shortly should largely offset any short-term surges in pro-silver sentiment resulting from weaker fundamental figures.