Silver Price Forecast 2016 - 2017

Historically, the silver price has a tendency to decline and rise way more and faster than most people expect. The recent 5-year decline is a good example of a decline that went lower than expected. There are good reasons for this, but we often miss them due to our focus on the now instead of the bigger picture.

Based on the bigger picture for silver, the current silver price rally will also likely far exceed most people’s expectations. There are many fundamental and technical reasons that give this silver price rally an edge above all other previous rallies. I have written about this on various occasions (here is one example).

These fundamental and technical reasons can often be best explained by way of fractal analysis. Here, I would like to point out a few of these reasons.

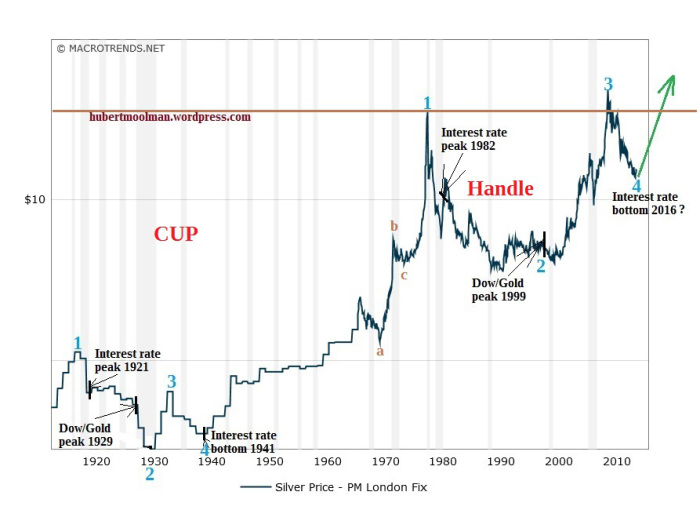

Below is a long-term chart for silver:

On the chart, I have marked two fractals (1 to 4) to show how the period from 1921 to 1941 is similar to 1980 to 2016 for the silver market. The two fractals exist in similar conditions relative to interest rate (yearly) peaks and bottoms, as well the Dow/Gold ratio peaks.

We appear to be around point 4, the point where silver and eventually interest rates are likely to rise significantly, like silver did from around 1941. However, the speed of the increase is likely to exceed the historical one by a large margin.

This is due to the difference of where these two patterns exist within the larger pattern (the big picture almost everyone ignores). The larger pattern (as a whole) takes the form of a cup-and-handle-type pattern (or even a flag/pennant-type formation). The older pattern exists before the handle (at the bottom of the large cup), whereas the current pattern exist at the end of the handle.

The older pattern existed during a period of consolidation or building, whereas the latest pattern will conclude at the explosive stage of the pattern (just after the handle, where the impulse move happens). This means that the conclusion of the current pattern (from point 4 to an eventual top) will occur within a fraction of the time of the conclusion of the older pattern.

If you accept the larger pattern as a cup-and-handle-type pattern, then the expected target, based on the standard movement of such a pattern, is almost unbelievable in this case. The movement from the bottom of the cup in 1932 was from $0.28 to $50 in 1980 (the chart is a little distorted since it shows a lower top in 1980). This is a 178.57 (50/0.28) fold increase. Therefore, the target for this larger pattern would be a similar move from the $50 level. So, that would be $50 x 178.57 = $8928.

Although this target might seem ridiculous now, it is still very much possible. Especially, considering that someone in 1932 would also have thought it impossible that silver would reach $50. However, I do not think that this “fight” will go the distance, because we are likely to have a knockout (total collapse) or technical knockout (reset) before this pattern concludes.