There have been a number of cautionary signs from sentiment models lately. Over the weekend, Barron's featured an interview with Neil Leeson of Ned Davis Research:

Leeson on Friday pointed to his firm’s crowd sentiment poll, which recently clocked in at “extremely optimistic” levels. Chart watchers often consider sentiment to function as a contrary indicator, one that can presage overly enthusiastic markets that are ripe to turn lower.

“This typically is not a great sign for the market going forward, at least in the near term,” Leeson said...

More specifically, Leeson singles out massive money flows into large-cap stock ETFs like the SPDR S+P 500 ETF (ARCA:SPY) and the SPDR Dow Jones Industrial Average ETF (ARCA:DIA) as a red flag. In November, all large-cap stock ETFs took in $25 billion, the most ever.

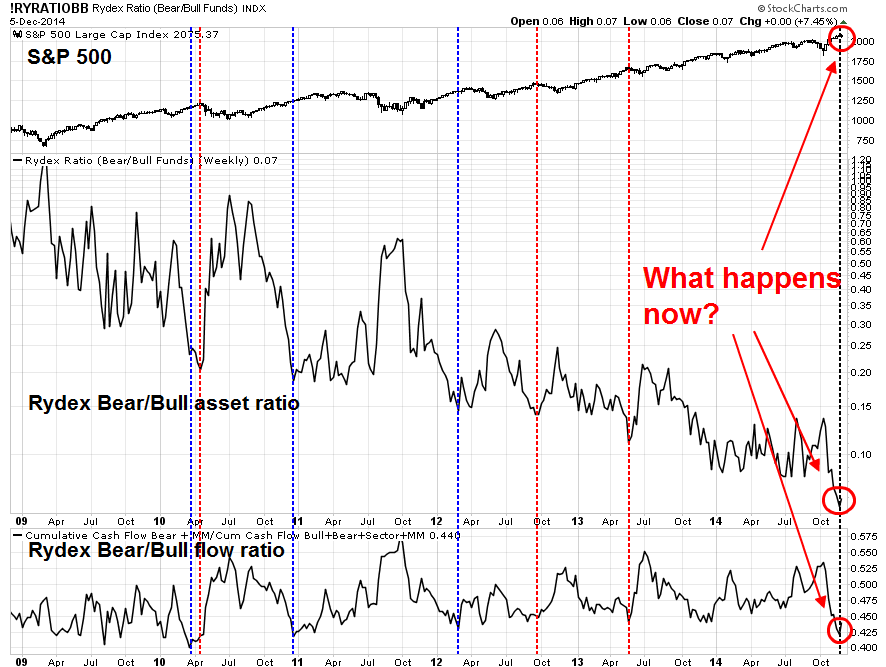

Yesterday, I also highlighted a possible crowded long position from Rydex sentiment data (see My trading plan for December):

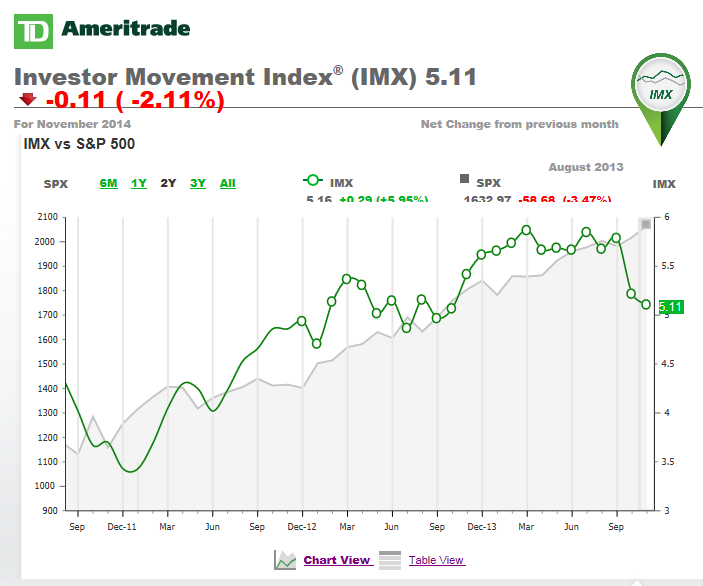

On the other hand, the latest release of the TD-Ameritrade Investor Movement Index (IMX), which tracks the equity commitment of TD-Ameritrade accounts, showed that retail investors retreated from their bullishness:

I differentiate the contradictory readings this way, on the basis of different investor constituents and time horizons:

- Fast HF money: Money flows into ETFs like SPY and DIA reflect the commitment of hedge fund fast-money first and retail funds flow second;

- Fast retail money: Rydex sentiment measures how the individual swing trading community is behaving; and

- Patient retail money: TD Ameritrade IMX is more reflective of the behavior of the slower, patient individual investor.

I interpret these readings as the stock market looking a bit overbought in the short-term and may be in need of a pause, but, as the mom-and-pop retail investor isn`t all-in yet, stock prices have more room to rally on an intermediate term basis.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.