Surge In Sentiment Surveys

There is an interesting divergence going on between sentiment-based surveys -- specifically the ISM Manufacturing and Non-Manufacturing surveys -- and actual underlying economic data. This week saw both surveys rise sharply to cyclically high levels despite weakness in actual new orders and consumer consumption.

It is also somewhat intriguing that two groups measuring the same data are getting vastly different results. While the Institute of Supply Management survey saw sharp increases in optimism, Markit's surveys of the same manufacturing and services related data saw declines. This is one of those cases where only one can be right.

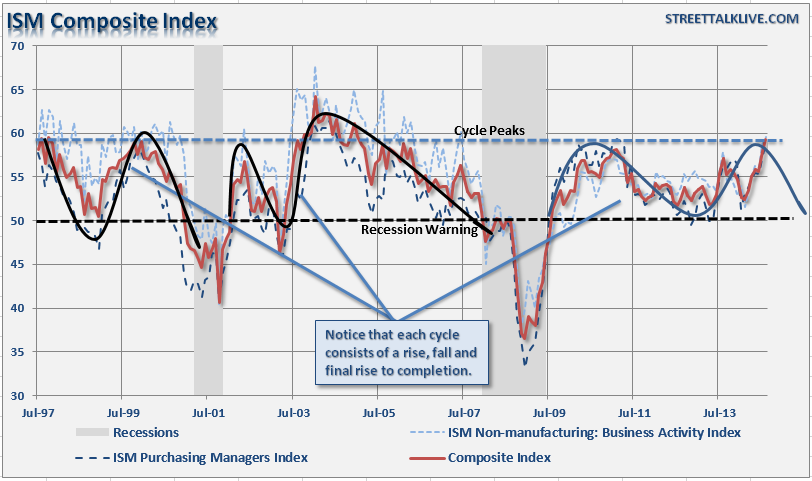

The chart below shows the composite index of the ISM surveys (simple average of manufacturing and services data).

There is a running pattern in the surveys, which the initial decline mid-economic cycle reverses back up to cycle peaks. The next decline in sentiment is during the latter stage of the economic cycle prior to the onset of the ultimate recession. The recent surge in survey activity, ex-underlying strength in the actual data, suggests that sentiment is anticipating a recovery that may or may not occur.

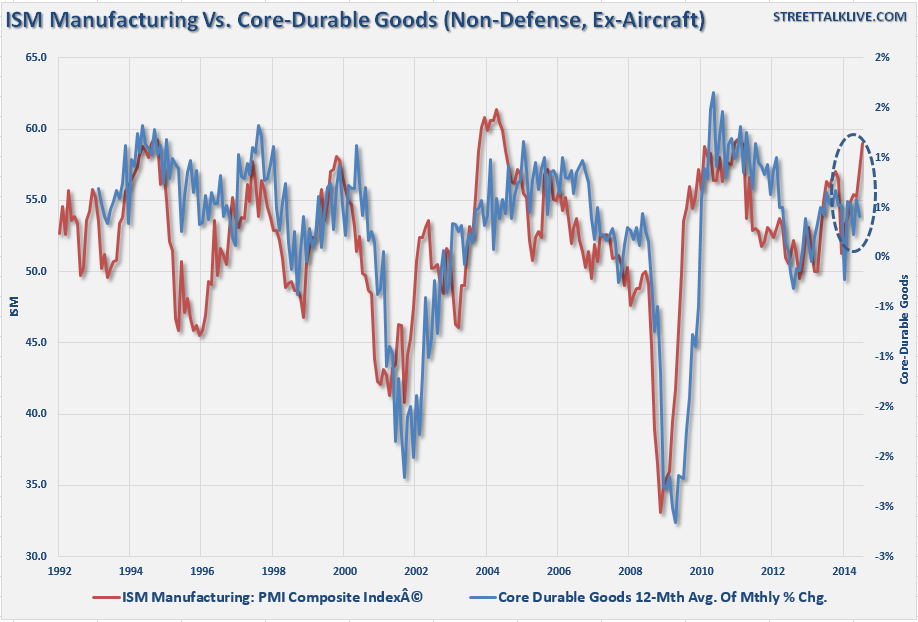

The chart below shows just the ISM Manufacturing survey compared to core-durable goods orders. Core-durable goods are ex-defense and aircraft orders, which is a better metric of what the average consumer is doing. The data, however, is very volatile, so I have smoothed with the monthly changes with a simple 12-month average.

Because I have smoothed the data with a 12-month average there is a slight lag to the data. However, what is clear is that there is a very high correlation between core-durable goods and manufacturing sentiment. Currently, sentiment is well ahead of actual activity which suggests that either the economy is about to come roaring back to life, which is what has been priced into the financial markets currently, or there will be disappointment.

There are a couple of important considerations with respect to your outlook with how this will ultimately be resolved. As I will discuss in just a moment, despite the ECB's attempt to stimulate the Euro-economy the deflationary pressures are picking up steam and the majority of economies are slowing. With 40% of domestic corporate profits coming from the global community, the Eurozone is the largest consumer, it is very likely the economic drag will be felt in the U.S. soon. Secondly, the U.S. is about to enter back into a period of the year where unseasonably cold weather will resurface once again. It is currently estimated that this winter will be as cold, or colder, than last which resulted in a 2% decline in economic activity in the first quarter of this year.

ECB Buys Bonds - Expects A Different Result

The European Central Bank announced, to the delight of stock-market investors, that it is lowering interest rates from 0.15% to just 0.05%, which results in a negative real interest rate for depositors and will begin buying asset backed bonds from its members. Via CNBC:

"Draghi announced the ECB would purchase asset-backed securities (ABS) and covered bonds to boost the economy and boost inflation."

If the goal of boosting inflation and the economy through buying bonds sounds oddly familiar, it is because it is exactly what the Federal Reserve and Bank of Japan set out to do. In both cases, it was a significant miss. The U.S. economy has muddled along with economic growth and inflation running below 2% with Japan just printing a near 7% drop in GDP despite a program three-times the size of the U.S. on a relative basis.

The issue of the inability to translate monetary policy into actual economic prosperity is something I discussed at length Wednesday, wherein I quoted Brad Delong:

"Instead, despite the absence of a significant increase in employment or a substantial increase in inflation, the Fed already is cutting its asset purchases and considering when, not whether, to raise interest rates."

In other words, what the Federal Reserve has figured out is that they are creating another asset bubble that must be unwound to some degree before it bursts. With interest rates at the zero-bound, an important tool of the Federal Reserve to support economic growth in the future has been exhausted. This leaves them few options for the future.

The interesting aspect to this is that despite expressed concerns by the Federal Reserve of inflated areas of the asset markets, the momentum chase has continued pushing asset prices to all-time highs. Likewise, the influx of liquidity by the ECB will likely push assets even further creating the anticipated "melt-up" in asset prices in the months ahead.

However, what is becoming abundantly clear, is that these monetary programs and interventions have little effect on the middle class which is where the most help is really needed.

What is that old saying about repeating an action and expecting a different result?

Interest Rates And Sentiment

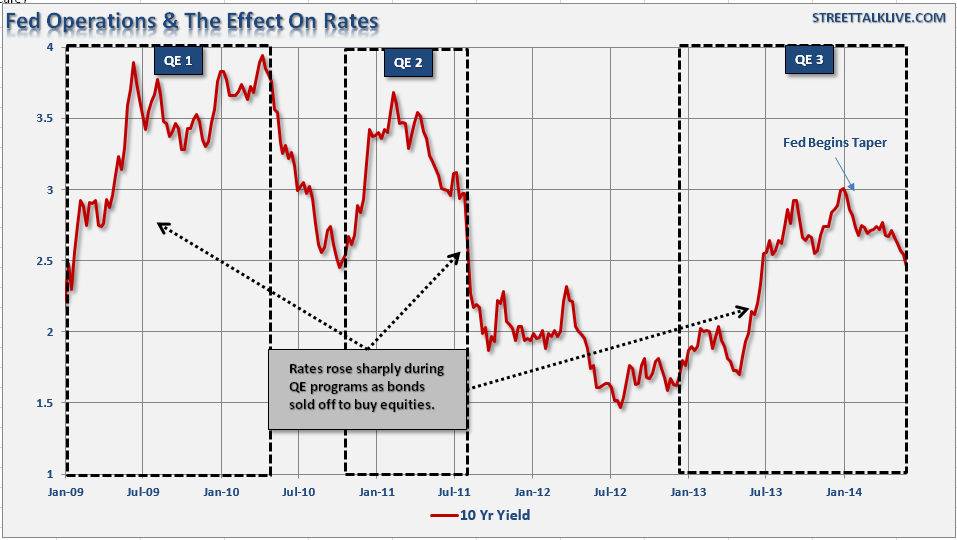

While the ECB's actions certainly aren't likely to cure the real problems that plague the Eurozone, primarily financially insolvency, what is clear is that investors love the idea of "more" liquidity. David Tepper of Appaloosa Management tweeted out this morning following the ECB's decision to buy bonds that this is "the beginning of the end" for bonds.

As Zerohedge aptly noted:

"Empirically, Tepper may be right: in the past every time a central bank has launched a massive easing program (think QE1, QE2, Twist, QE3, etc.) it resulted in aggressive stock buying offset by bond selling. The issue is when said programs came to an end, and led to major selloffs in equities, pushing bonds to newer and lower record low yields. So perhaps for the time being, we may have seen the lows in the 10Year and in the periphery.

More importantly, it also explains why central banks now have to work in a constant, staggered basis when easing, as the global capital markets simply can not exist in a world in which every single central bank stops cold turkeywith...liquidity injections."

I seriously doubt this is the end of the "bond bull" due to many reasons I will discuss next week. However, with respect to the ECB's decision the size and scope of the purchases fall well short of the broad, large-scale asset purchases advocated by many economists (similar to the measures used by the Federal Reserve). While the announcement was "bullish" for investors wanting liquidity, it will likely have little effect on the broad deflationary pressures that are keeping rates under pressure.

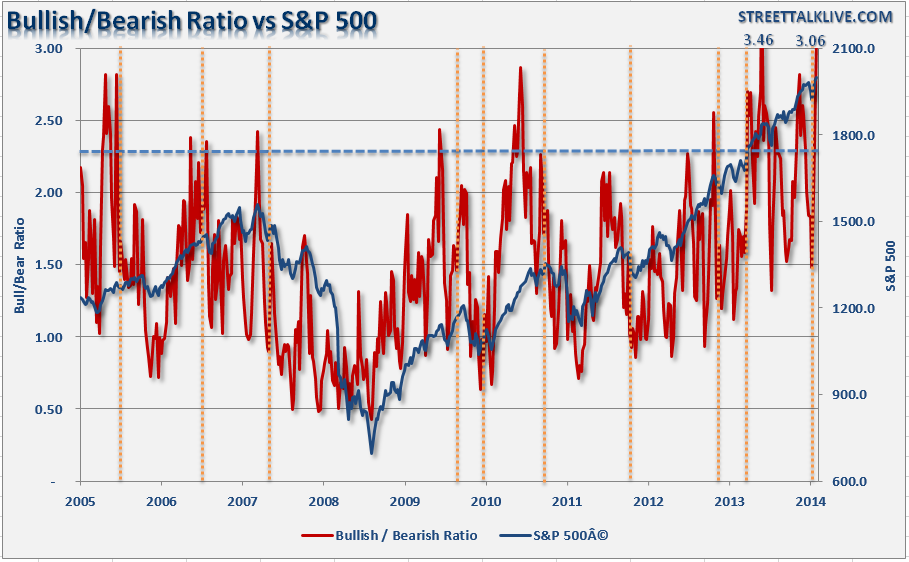

However, as I stated, bullish sentiment was bolstered by the news. The chart below shows the composite index of both individual and professional investor "bullish vs. bearish" sentiment. Currently, the index is at levels reached only once before in the history of the data. At 3.02, the index signals extreme bullish sentiment in the short term and is at levels that exceed all previous minor and major market peaks.

While there is currently no "technical" reason to become overly cautious on the markets (bullish trends are still firmly in place), there are many reasons to be "aware" of the rising risks.

Market reversions, when the occur, are extremely rapid and tend to leave a rather brutal "scar" on investment portfolios. There is clear evidence that economic growth is being impacted by deflationary pressures on a global scale. This suggests that the sustainability of current and projected growth rates of profits is questionable given the magnitude to which leverage has been used to boost margins through share repurchases. Manufacturing profits through artificial means, ie. cost cutting and share repurchases, are finite in nature, and most of the benefit of such activities have already been fully harvested. If the current rise in sentiment surveys is not met with actual activity in the near future this could pose a problem for over zealous investors.