Equities slid on Wednesday and during the Asian session Thursday, with daily coronavirus infections hitting a new record high yesterday, and with no consensus over a fresh stimulus package in the US yet.

Today, the main event is likely to be the 2nd debate between US President Trump and his rival Joe Biden. In the FX world, the pound was the main gainer among the G10s, rallying following upbeat Brexit headlines.

Investors Lock Gaze On The 2nd Trump-Biden Debate

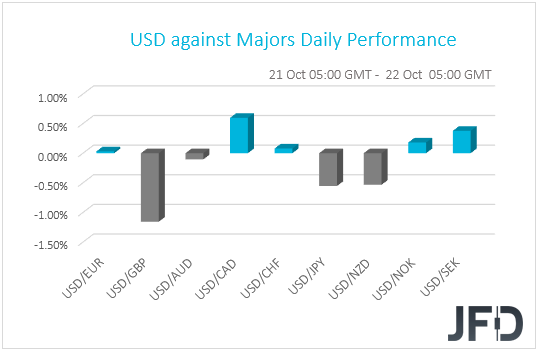

The US dollar traded mixed against the other G10 currencies on Wednesday and during the Asian morning Thursday. It gained against CAD, SEK, and NOK, in that order, while it underperformed versus GBP, JPY, and NZD. The greenback was found virtually unchanged against EUR, AUD, and CHF.

The strengthening of the yen and the weakening of the Canadian dollar suggest that markets traded in a risk-off fashion yesterday and today during the Asian session. However, the strengthening of the risk-linked Kiwi points otherwise.

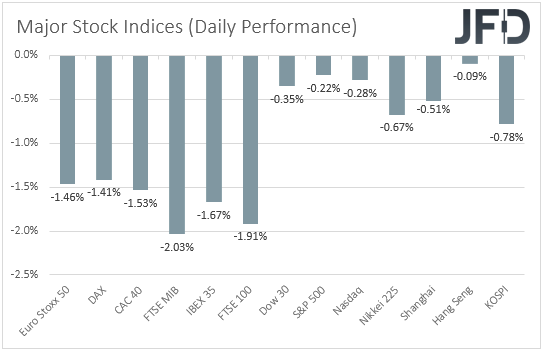

Thus, in order to get a cleared picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world. There, major EU and US indices were a sea of red, with the negative morale rolling into the Asian session today. Both Japan’s Nikkei 225 and China’s Shanghai Composite are down 0.67% and 0.51% respectively.

Remember that, yesterday, following the equity rebound on Tuesday, we noted that we are still reluctant to trust a long-lasting recovery, and yesterday’s slide confirms that view. We prefer to stick to our day-by-day approach.

With daily coronavirus infections hitting a new record high yesterday, and with no consensus over a fresh stimulus package in the US yet, we believe that investors will remain cautious. The fact that we are getting closer to the US presidential election may be another reason for investors’ conservative approach.

Speaking about the election, tonight, we have the second debate between incumbent President Donald Trump and the Democratic candidate Joe Biden. Last time, there was no clear winner and thus, we did not get a clear picture of how the markets may respond on the final outcome. That said, we may get an idea today.

In our view, bearing in mind that President Trump has pledged to keep the 2017 corporate tax cuts in place, his reelection may prove positive for US equities, while the opposite may be true if Biden wins, as he called for a tax increase. However, stocks in the rest of the world may not perform in a similar fashion.

A Trump reelection may result in more trade frictions between the US and other nations, especially China, and thus, equities outside the US may retreat in case Trump keeps his throne. Biden is expected to adopt a softer stance on trade, which means that global equities may rebound if he is victorious, even if US indices retreat.

In the FX world, a Biden victory may result in a slide in the US dollar. Both candidates are expected to push for more infrastructure spending, but Biden’s agenda is looser, which combined with an extra-accommodative Fed may result in some dollar selling. The yen and other safe havens could also slide on expectations of a better handling of international trade relations, while the commodity-linked Aussie and Kiwi could strengthen. The opposite may be true if Trump gets reelected.

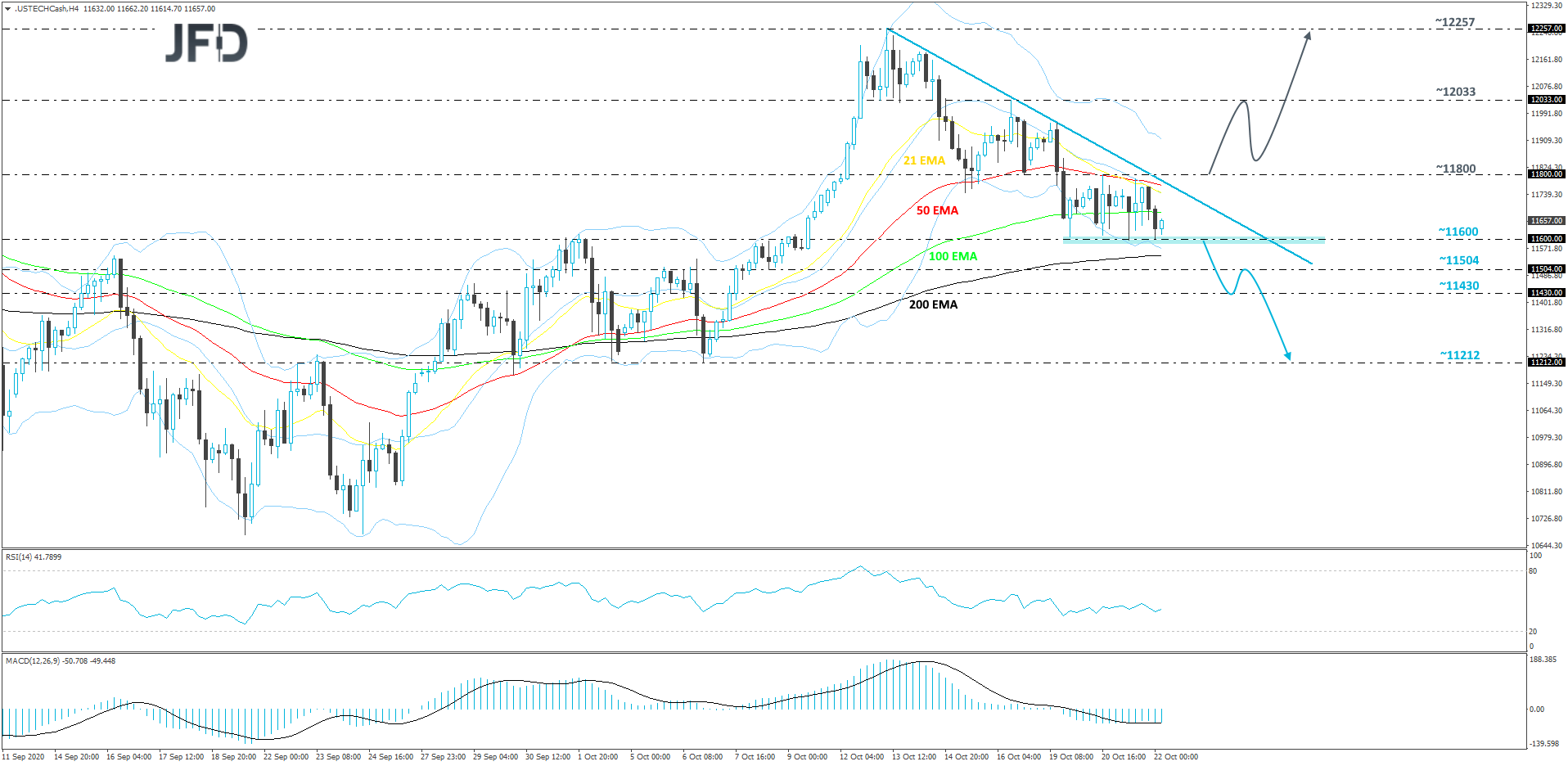

NASDAQ 100 Technical Outlook

From around Oct.13, NASDAQ 100 is seen to be forming lower highs, while trading below a short-term downside line taken from the high of that day. However, recently, the index seems to be struggling to go for a lower low, as the 11600 hurdle continues to hold.

Although there is a good chance for the index to move further south, in order to get a bit more comfortable with that idea, we would prefer to wait for a break below that 11600 zone first, hence our cautiously-bearish approach for now.

If, eventually, the price does fall below the 11600 area, that would confirm a forthcoming lower low and could open the door for further declines. NASDAQ 100 might then travel to the 11504 obstacle, or even the 11430 zone, marked by intraday swing low of Oct. 6. A temporary hold-up may occur there, but if the bears are still feeling stronger, a further push south could send the price towards the current lowest point of October, at 11212.

Alternatively, if the aforementioned downside line breaks and the index rises above the 11800 barrier, which is the high of Oct. 20, that may attract more buyers into the game, what may result in a further uprise. That’s when we will aim for the 12033 obstacle, a break of which might set the stage for a test of the 12257 level, marked by the current highest point of October.

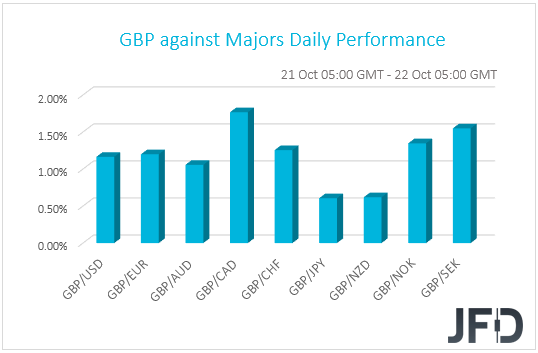

GBP Rallies On Positive Brexit Headlines

Flying from the US to the UK, the British pound was yesterday’s main gainer among the G10 currencies, coming under strong buying interest after a Bloomberg report noted that Brexit negotiations are set to restart and that the two sides will try to reach consensus by mid-November.

EU Brexit negotiator Barnier’s remarks that a deal is still possible, and the rejection in UK’s parliament upper house of the draft legislation that would give the British government the right to override parts of the Withdrawal Agreement, may have also helped the pound to march higher.

Last week, the EU and the UK failed to make any significant progress in trade talks, with UK PM Johnson saying that the UK should get ready for a no-deal exit. That said, he stopped short of announcing that his nation will walk away from trade talks, keeping on the table hopes that a deal could still be reached before December 31st, when the transition period ends. Thus, anything suggesting that the two sides are willing to resolve their differences may keep the pound supported, while the opposite may be true if headlines point to no narrowing of the differences-gap.

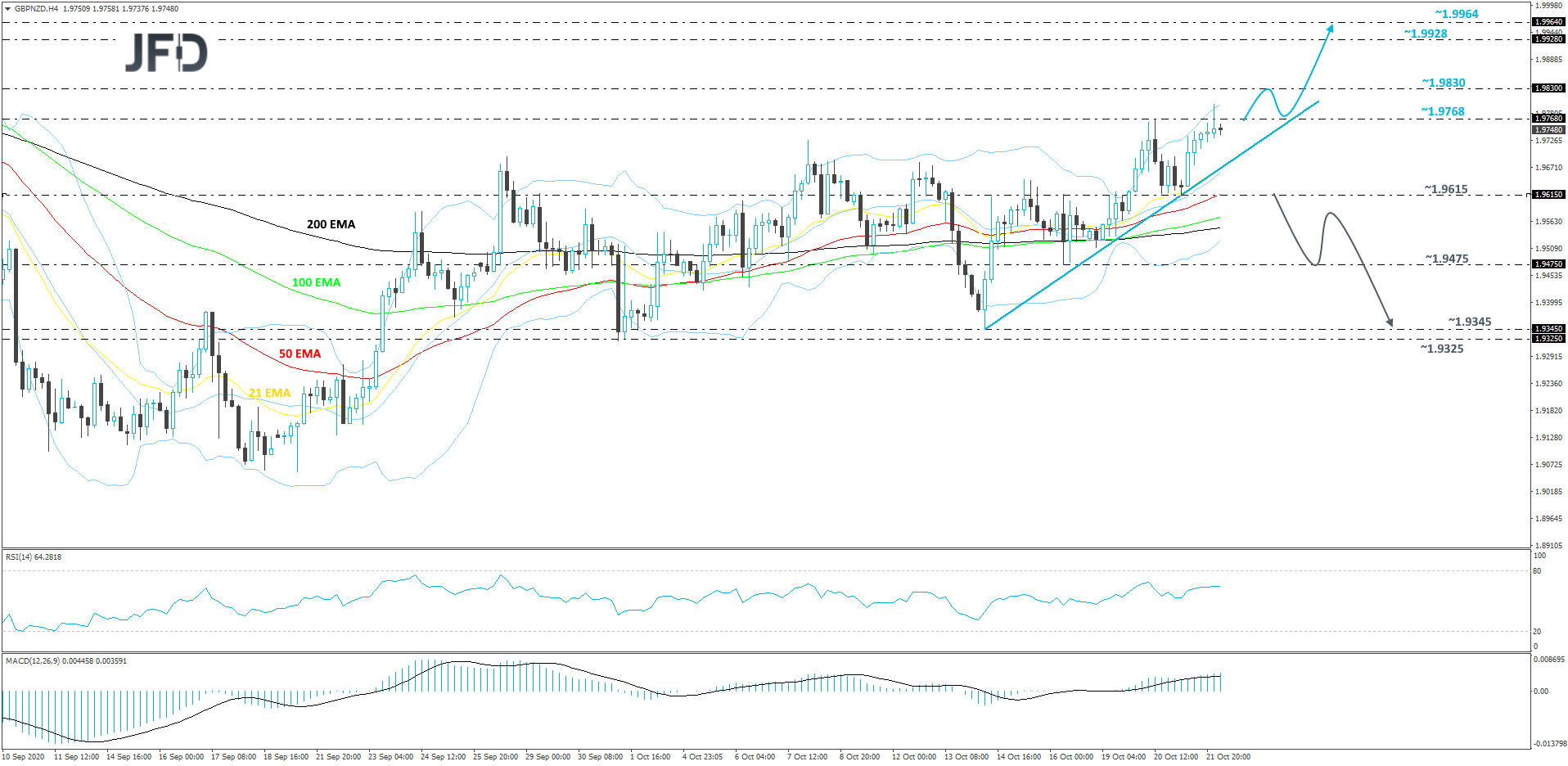

GBP/NZD Technical Outlook

GBP/NZD continues to slowly grind higher, while balancing above a short-term tentative upside support line taken from the low of Oct. 14. At the time of writing, the rate is trading below yesterday’s high, at 1.9768. As long as the pair stays above that upside line, we will continue aiming slightly higher.

A push above the aforementioned resistance barrier, at 1.9768, may help the buyers to feel a bit more comfortable. If so, GBP/NZD could move to the 1.9830 zone, marked by the high of Sept. 3, which could halt the uprise for a bit. That said, if the rate continues to balance above the previously-mentioned upside line, the outlook might remain positive. Another uprise and this time a break of the 1.9830 territory may increase the pair’s chances of moving further north. This is when GBP/NZD may travel to the 1.9928 hurdle, or the 1.9964 level, marked by the highest point of September and the high of Aug. 27 respectively.

In order to shift our attention to some lower areas, a break of the aforementioned upside line is needed. In addition to that, a rate-drop below yesterday’s low, at 1.9615, may strengthen the downside case. GBP/NZD might then drift to the 1.9475 zone, a break of which may set the stage for a push to the area between the 1.9345 and 1.9325 levels, marked by the lows of Oct. 14 and 1 respectively.

As For The Rest Of Today's Events

Besides the Trump-Biden debate, the only worth mentioning events on the economic agenda are the US existing home sales for September, and the initial jobless claims for last week. Existing home sales are expected to have increased somewhat, while initial jobless claims are forecast to have declined to 860k from 898k the week before.

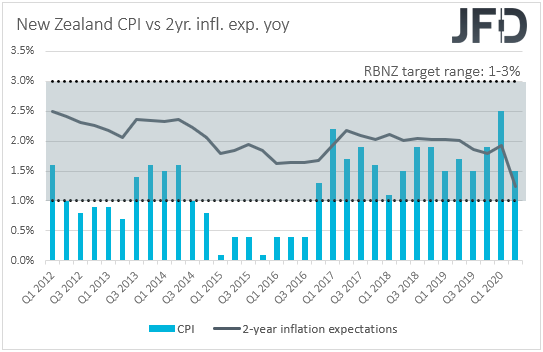

As for tonight, during the Asian session Friday, we have New Zealand’s CPI for Q3, but no forecast is available for neither the qoq rate nor the yoy one. At its last meeting, the RBNZ kept its Official Cash Rate (OCR) and its Large-Scale Asset Purchases (LSAP) unchanged, repeating that further monetary stimulus may be needed in the foreseeable future, including a Funding for Lending Program, a negative OCR, and purchases of foreign assets.

That said, recently, RBNZ Assistant Governor Christian Hawkesby said that some economic data have surprised to the upside, reducing the chances for the adoption of negative interest rates by this Bank. However, he added that the discussion of negative rates is “not a game of bluff”, keeping the prospect well on the table.

With that in mind, a better-than-expected CPI may reduce the chances of policymakers acting at the next gathering, scheduled for Nov. 11, while a disappointment may revive some speculation for an imminent cut, which could result in a slide in the local currency.

We get CPI data from Japan as well, but for the month of September. No forecast is available for the headline rate, while the core one is anticipated to have remained unchanged at -0.4% yoy. The headline Tokyo rate slid to +0.2% yoy from +0.3%, but the core one ticked up to -0.2% yoy from -0.3%. This suggests that the National rates may move in a similar fashion as well.

We also have four speakers on today’s agenda: BoE Governor Andrew Bailey, BoE Chief Economist Andy Haldane, ECB Executive Board member Fabio Panetta and Richmond Fed President Thomas Barkin.