Investors continued to shun risk assets on Thursday amid a mix of global themes. The stalemate in the US and China talks alongside rumors that the US could blacklist more Chinese firms set the tone for the day. On the economic front, US flash manufacturing and services PMI from Markit came out weaker while new home sales grew just 673,000 from a revised print of 723,000 previously.

Sterling Holds Declines as PM May Stands on Shaky Ground

Developments in the UK related to Brexit saw Prime minister May inching closer to a potential resignation. This follows the latest Brexit plans tabled in the Parliament. The new set of Brexit plans raised more criticism. Lawmakers demanded that May clarifies by today on when she will resign as the Prime Minister.

GBP/USD Bounces Off Lower Support

The currency pair posted a modest rebound as price tested the lows of 1.2606. However, GBP/USD will need to clear the upper resistance as 1.2716 in order to confirm the upside shift in the bias. For the moment, we expect the cable to maintain a sideways range within these levels. Consolidation at the current range could mean that the bias could shift in any direction leading to the next leg of the trend.

Crude Oil Slips as Inventories Rise

WTI crude oil prices fell over 5% on the day on Thursday. The declines came after the US Energy Information Administration’s weekly inventory report. US stockpiles of crude oil rose to the highest levels since July 2017. The US crude oil production grew by 100,000 barrels, rising close to the record levels of 12.3 million.

Oil Needs a Firm Test of 57.50 Support

Oil prices briefly tested the 57.50 level of support on Thursday. But price quickly retraced to pullback modestly on the day. We could expect to see the bounce offering some near term gains. However, the price will need to establish firm support near the 57.50 level. As long as this support holds, WTI crude oil prices could drift sideways with the recently breached support at 60.33 likely to turn to resistance.

Gold Briefly Gains on Risk off Sentiment

The precious metal rose 0.77% on the day as the risk-off sentiment in the markets saw investors rushing to safe haven assets. Equity markets fell with the Dow Jones easing 1.6% during trading. Tech stocks fell, dragging the NASDAQ lower as more and more companies backed away from Huawei.

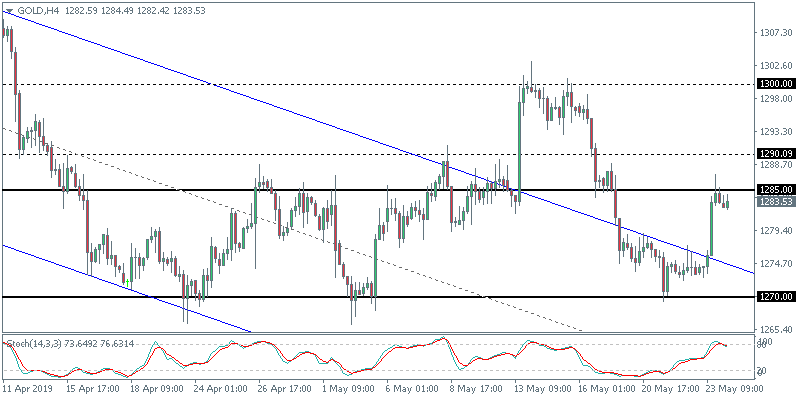

Is XAU/USD Turning Bearish?

The rally in the gold prices stalled at the 1285 handle as the resistance level is being tested currently. The Stochastics oscillator is pointing to a bearish divergence. This also coincides with a potential right shoulder being formed off the head and shoulders pattern. A successful retracement off the 1285 handle will see XAUUSD testing the support at 1270 which marks the neckline support. A subsequent breakdown below this level will trigger declines to the 124 – 1250 handle.