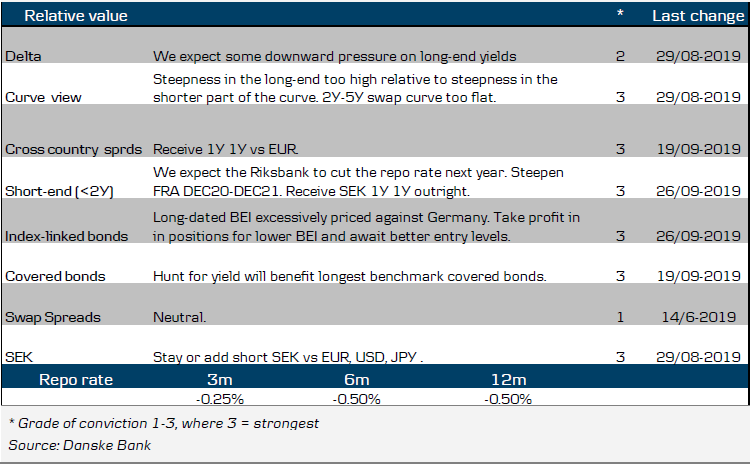

Trades

Profit taken: in SGBi 3109 BEI at 150bp, profit 29bp.

Loss taken: NDH5532 (May 2021) at -10bp, loss -12bp.

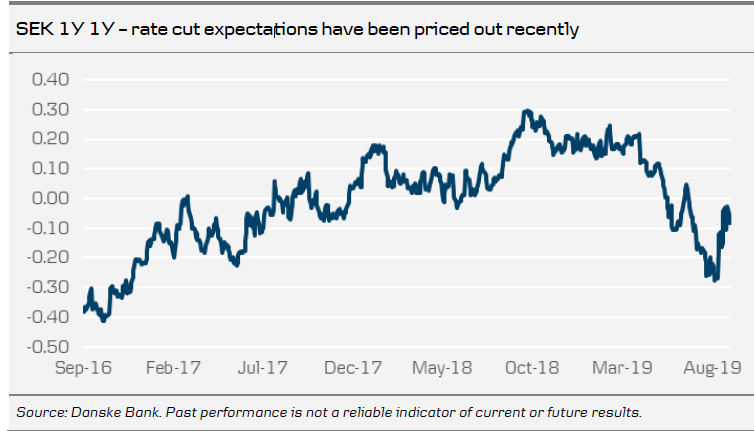

New trade: Receive SEK 1Y 1Y outright at -8.5bp. P/L: -30bp/+7bp

Further signs of slowdown

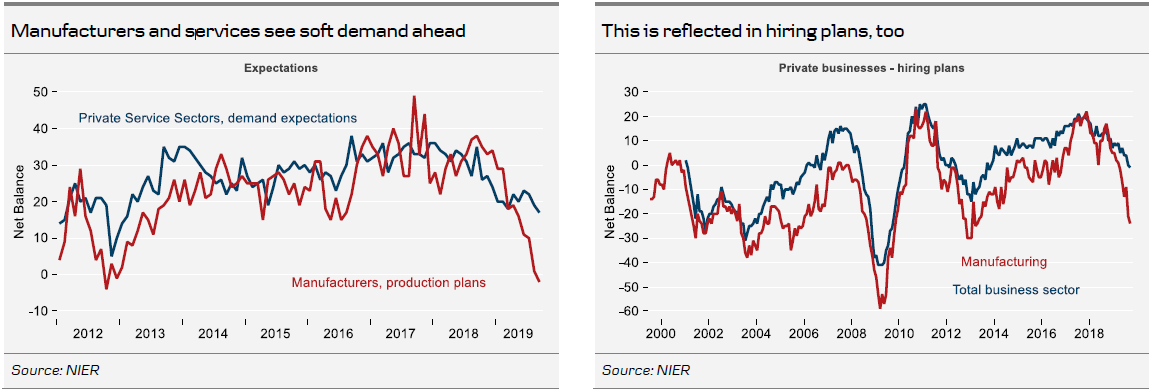

The recent NIER business and consumer confidence survey basically reiterates earlier surveys. In part, the interpretation depends on whether you focus on levels (which the RB currently does) or the direction of data. As an example, looking at the private business sector in total, the NIER on one hand states that businesses’ views on current demand are still slightly better than the historical average. On the other hand, demand conditions have been on a downward trend over the last year.

Comparing manufacturing and services producers we see a similar pattern as in the EZ. Manufacturers’ production plans are now about as downbeat as during the Euro-crisis. Services producers are not there yet, but expectations of future demand for the firms’ services in September were below the historical average for the ninth consecutive month.

Looking at hiring plans, the picture is the same. Private businesses say that staff numbers have been about unchanged in the latest few months and hiring plans for the next few months are roughly unchanged as well. Manufacturing is an exception, with hiring plans close to the lows in 2012. How does this match with employment data which say that the number of employed and working hours have started to decline? We think the answer lies in the municipal sector. Data suggest that employment in this particular sector (which of course isn’t covered in the NIER survey) has dropped quite significantly of late and we suspect that this is explained by the fact that many local governments (unlike the central government) are under financial pressure. Notice that local governments are not allowed to run deficits. If deficits occur, corrective measures must be taken, by either raising taxes, or cutting costs.

Back to the survey, we also observed that consumers’ expectations of unemployment over the next 12 months jumped to a six-year high. Honestly speaking this might very well reflect the intense media coverage of worsening labour market conditions. Nonetheless, it is worth keeping an eye on in case of potential second-round effects on big-ticket spending.

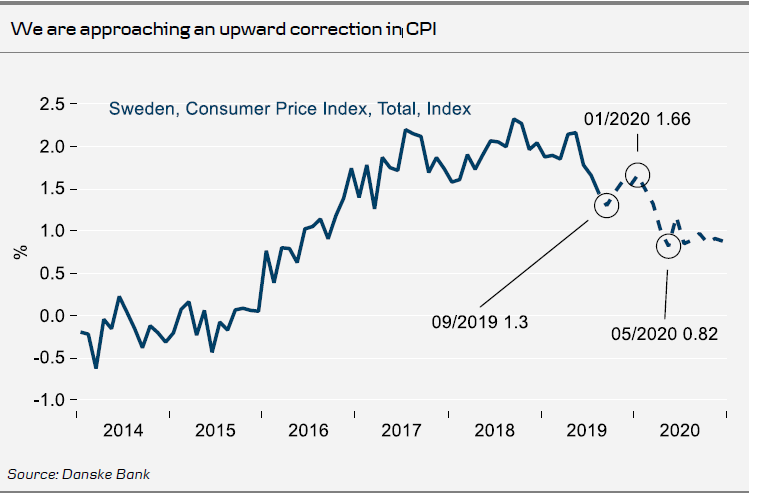

Profit taken in SGBi 3109 BEI

On the back of our CPI projection, on 7 June we initiated a position in BEI tightener (buy SGB1058 vs SGBi3109), then trading at an elevated 179bp. Only last week we reached the initial profit level at 160bp and decided to lower the level to 150bp.

Looking at our near-term CPI forecast, we are approaching a period where we foresee some upward correction. We expect CPI y/y in September to decline only slightly from the current 1.44% y/y to 1.3% y/y. Thereafter we expect a correction, reaching 1.66% in January before turning down again (see chart below).

As a result we have decided to close the position (@ 150bp with a profit of 29bp) for now, awaiting another opportunity to re-enter at a later stage.

Loss taken in NDH5532 (May 2021), receive SEK 1Y 1Y outright

During the week we have also reached our loss level in our position in NDH5532 (May 2021) @ -10bp. This feels somewhat ironic, as recent economic data if anything have supported our case for a repo rate cut. Also, the ECB and Federal Reserve have cut rates since the case was initiated on 29 August. Nevertheless, the market has interpreted the Riksbank as less dovish, and given the recent MPR, minutes and speeches the Riksbank have indeed sounded hawkish.

However, we regard this as a result of the Riksbank’s communication policy. The policy states that Riksbank’s board members should stick to the official message until the minutes have been released. But more importantly, the communication policy states that after the minutes have been released, a board member “shall not, however, anticipate their own or the Board’s future decisions.” So let’s say a board member, following a bad set of data, are contemplating a rate cut at the next meeting. Given the constraints of the communication policy, our interpretation is that the board member in such cases cannot publicly state that they are about to change their mind. Thus, our conclusion is that the Riksbank might not actually be as hawkish as they currently sound.

So to balance up our more rate bearish trades (FRA DEC20-21 steepener, 2Y-5Y swap steepener) we decide to add an outright receiving position in SEK 1Y 1Y, in addition to our spread position vs EUR in the same segment. As we reason above, not much is priced in on the RIksbank at the moment (-2bp in cuts over the next 12 months) – as the market remains torn between the weakening data and the still somewhat hawkish signals from the Riksbank. Thus, we feel that current levels (-8.5bp) are attractive for establishing new outright receiving positions. We set the P/L levels to -30bp/+7bp.

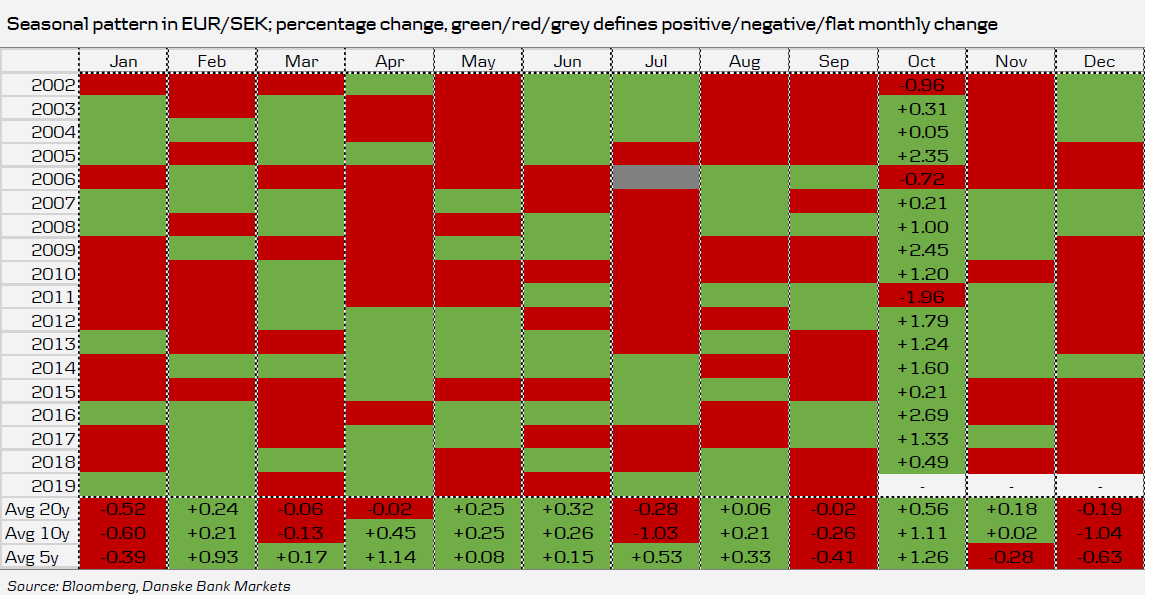

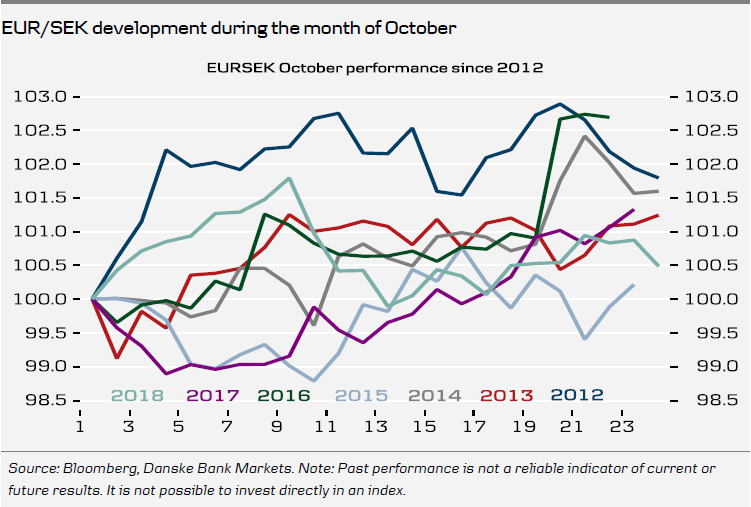

October a challenging month for the krona

October has historically been a challenging period for the SEK. EUR/SEK and USD/SEK have had a strong tendency to trade higher during the month. For EUR/SEK it has been a positive month (green in the chart below) every year since 2011 (which was when the euro crisis weighed on the cross). Since 2002, EUR/SEK has traded lower only in 2006 and 2011 (red in the chart). That makes October the single most negative SEK period with an average change of +0.56% over the last 20 years and +1.26% over the last five years. The October pattern is similar for USD/SEK, which also has risen every year since 2011. The average USD/SEK performance over the last five years is +3.09%. In terms of EUR/USD May is the most USD-bullish period, followed by October. JPY/SEK has also had a strong tendency to rise in October, as has AUD/SEK which is up every year since 2008, that is, 10 years in a row. Most other SEK crosses show a more mixed pattern.

For those who want to base their investment decisions on this seasonal trading pattern, it seems like a good time to enter a short position in SEK vs EUR, USD, JPY or AUD.

Importers and other natural SEK sellers should act early in the month whereas exporters and natural SEK sellers are advised to wait until the end of the month.

But what is behind this strong seasonality? Our view is that it often can be explained by soft messages from the Riksbank, similar to what we have argued has been a key reason for the strong April seasonality. It was the case in 2014 (+15 figures on the Riksbank day), 2015, 2016 (+26 figures) and 2018. 2015 was on the verge of ending on a positive note for the krona, but the Riksbank changed that “at the last minute” with its decision on 28 October.

Some years inflation disappointments have set the tone for October. Hence, we argue that macro triggers have often been the cause of SEK weakness in October.

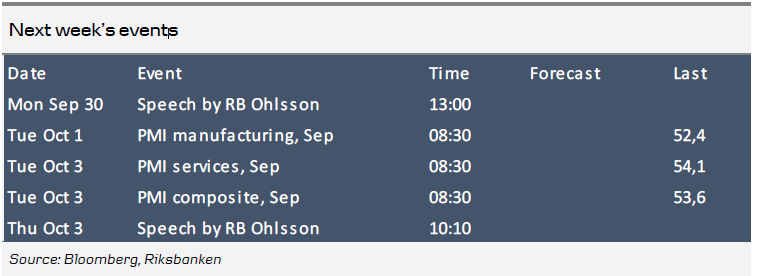

Macro triggers in the coming month and what potential they may have for the SEK:

1 Oct. PMI industry has kept up better than expected in light of the collapse in Germany where PMI September printed 41.4. The latest Swedish print was 52.4. Here we would look out for a sharp drop, to below 50. Very important for EUR/SEK.

3 Oct. PMI services. Watch out for contagion from the industry and the labour market alike. Somewhat important for the SEK.

3 Oct. Speech by Riksbank’s Cecilia Skingsley. Very important for EUR/SEK.

4 Oct. Speech by Riksbank’s Per Jansson. Very important for EUR/SEK.

8 Oct. Industrial data. Weak global cycle in for Sweden important markets. Trade war has had a negative impact on global trade, which in turn correlates well with industrial production in a small open economy as the Swedish one. Somewhat important for the SEK.

9 Oct. Prospera’s monthly survey has already dropped below 2% - 2-year expectations was last 1.7% - and risks falling further. This data is super important for the Riksbank and a worry for some Board members. Very important for the SEK.

10 Oct. Inflation data. Our forecast is preliminary 1-2 tenths below the Riksbank forecast. Very important for the SEK.

17 Oct. Labour market statistics. Surprisingly weak summer readings. Chance for correction in a positive direction, which may dampen the worst fears. However, our view is that the slowdown is and will be sharper than the Riksbank anticipates. Very important for the SEK.

24 Oct. Riksbank rate decision. As far as the Riksbank is data dependent it is hard to see how it will not waver in its call for Dec/Feb hike. Very important for the SEK.

25 Oct. Retail sales. Somewhat important for the SEK.

30 Oct. NIER data. Somewhat important for the SEK.

Overall, our view on macro data in the coming weeks is that they will add further pressure on the Riksbank and at the same time be a headwind for the SEK. Hence, our base scenario is that October 2019 will reinforce the seasonal pattern and put another green box in the chart above. Our 1M target is 10.70 and 3M (NYSE:MMM) 10.80.