Brazil's state-run energy giant Petroleo Brasileiro S.A. or Petrobras (NYSE:PBR) recently announced that a Brazilian federal court has issued an order to block the sale of the interest of its subsidiary, BR Distribuidora. Also, the court has suspended the company’s transfer of rights of oil and natural gas exploration, development and production of a set of onshore fields.

Petrobras, with net debt of around $103.56 billion, is the most indebted energy company in the world. The company is undergoing a deep financial crisis due to low oil prices and the loss of goodwill owing to the discovery of massive corruption within its ranks.

As a result, the company intended to sell its stake in BR Distribuidora – Brazil's largest fuel distribution company. Had the asset sale materialized, it would have substantially helped the company to reduce its large debt load.

However, the sale process was blocked on the request of the members of an oil workers union in the northern state of Sergipe. The workers argued that Petrobras should hold a public tender to sell the stake in the subsidiary instead of the current private negotiation. Petrobras intends to appeal the order.

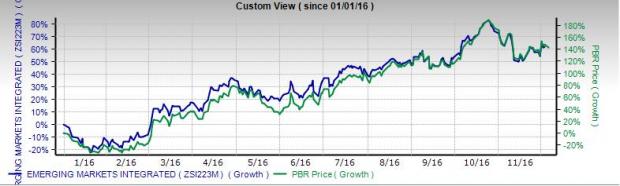

Price Movement

Year-to-date, the Zacks categorized U.S. Oil and Gas Emerging Markets Integrated Industry has registered an impressive growth of 61.91%. However, the stock price of Petrobras has outperformed the industry mark by registering a growth of 143.02%.

Petrobras engages in the exploration, development and production of crude oil, natural gas, and natural gas liquids. Additionally, the company sells crude oil and oil products produced at natural gas processing plants in domestic and foreign markets. It is also involved in the refining, logistics, transport, and trading of crude oil and oil products. Moreover, the firm exports ethanol and invests in petrochemical companies.

Petrobras currently carries a Zacks Rank #3 (Hold), which implies that the stock will perform in line with the broader U.S. equity market over the next one to three months.

PETROBRAS-ADR C Price

Some better-ranked players from the broader energy sector include Braskem S.A. (NYSE:BAK) , Ocean Rig UDW LLC (NASDAQ:ORIG) and McDermott International Inc. (NYSE:MDR) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the last four quarters, Braskem posted an average positive earnings surprise of 105.5%.

Ultra Petroleum, on the other hand, delivered an average positive earnings surprise of 65.91% in the last four quarters.

In the last four quarters, McDermott posted an average positive earnings surprise of 250.00%.

Zacks' Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

PETROBRAS-ADR C (PBR): Free Stock Analysis Report

MCDERMOTT INTL (MDR): Free Stock Analysis Report

BRASKEM SA (BAK): Free Stock Analysis Report

OCEAN RIG UDW (ORIG): Free Stock Analysis Report

Original post

Zacks Investment Research