Street Calls of the Week

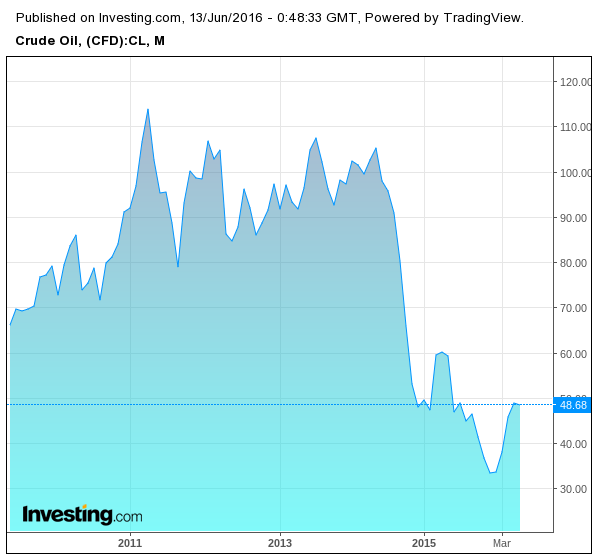

Flush with an influx of crude oil, independent global refiners are refining at breaking speed. Oil traders who bought at the lows in February ($26.01) are unloading to downstream channels.

These sales should continue and will help E&P balance sheets, but only so much, as losses have greatly damaged the industry. Continued sales and revenue will repair the losses and allow for more seemingly comfortable M&A and integration.

Reuters reported June 10th: Chinese independent oil companies are luring traders, marketers and risk managers away from dominant state behemoths, offering better pay and perks in a hiring spree triggered by the freeing up of China's crude import trade. Global oil firms and commodity houses have also been raiding state giants such as Sinochem and CNPC for staff to help handle up to $50 million a day in new crude flowing into China this year, and the cherry-picking of talent is likely just getting started (RTRS).

The volatility is still strong and our research pegs oil suffering additional losses, or perhaps slight price stagnation for the remainder of 2016.