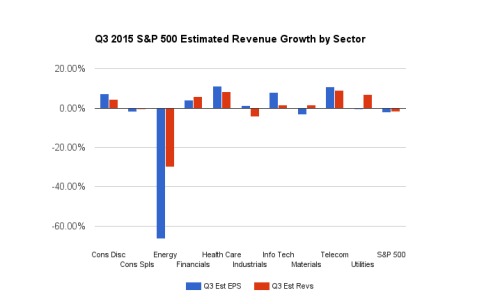

Earnings season for the third quarter of 2015 unofficially kicks off on Thursday when Alcoa (NYSE:AA) reports. Similar to the last two quarters, we head into the season with negative top and bottom-line growth expectations for the S&P 500… but as anyone that follows corporate earnings knows, that likely won’t stick. Currently the Estimize community is expecting earnings per share (EPS) to decrease 2.2% for the quarter, and revenues to decline 1.7%. Revisions activity has been a prominent feature of this cycle as heightened uncertainty has caused analysts to rethink their initial assumptions and constantly update for the latest news.

So what’s driving expectations lower again this quarter?

Lower Year-over-Year Energy Prices

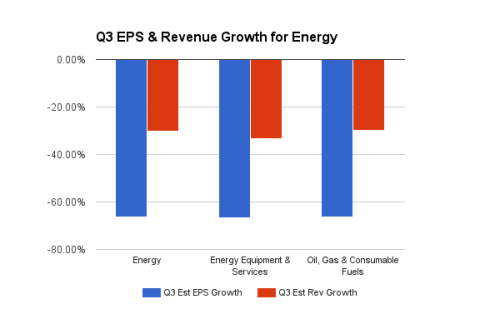

Many of the same concerns from the first half of the year still persist. Weakness in the energy sector remains, with profits anticipated to decline 66% and revenues down 30% year-over-year (YoY). It was initially thought that Q3 would be the first quarter of even year-over-year comparisons. Oil prices initially dropped during the third quarter of 2014 in response to the stronger dollar, therefore making Q3 2015 the first quarter with level comparisons. However, oil prices dropped even further in the third quarter, prolonging the difficult YoY comparisons. brent crude oil is down 22% since the end of Q2, and has fallen 50% YoY. Similarly, West Texas Intermediate ended Q2 at $59.83 a barrel and closed last week at $45.56, down 24%.

There are of course benefactors of lower gas prices, such as the consumer discretionary and industrials sectors, but even so, those benefits are not enough to offset weakness in energy. Ex-energy, S&P 500 growth would be closer to 5%.

China

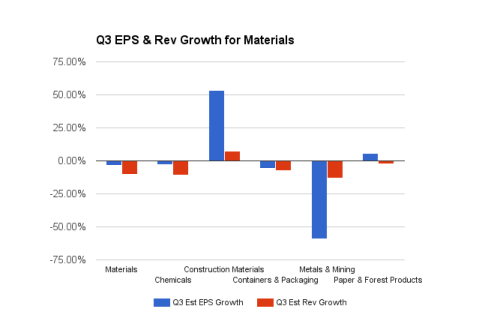

Worries surrounding China’s softening are nothing new, and began in 2012, the first time in 10 years their economy reported yearly GDP below the 9% mark. For the next three years GDP settled in the 7% range and now even those lower levels have come into question following the bursting of the Chinese equity bubble this summer. While a topic during the Q2 season, not many companies mentioned what sort of impact a collapsed Chinese economy would have on their future reports, but that will likely change this season. Sectors that will be affected range from consumer discretionary to materials. China is the largest importer of commodities -- and waning demand has driven down prices. At the same time, global weakness for certain metals such as aluminum and steel have also made matters worse in China as they are the biggest exporter of those metals. Even gold, typically seen as a safe haven, is suffering due China’s spot as the number one importer of the precious metal, behind India.

Alcoa (NYSE:AA) not only unofficially kicks off the earnings season, but is the first S&P 500 Metals & Mining name to report, an industry which is expecting a dismal EPS decline of 47%. Alcoa, which competes with many Chinese based aluminum producers, has revised estimates downward due to lack of demand coming out of that economy. For example, the company is expecting a 4 - 6% decline in the heavy-duty truck and trailer market in 2015 due to weakness in China, worse than prior guidance of negative 2 - 4%. The aerospace and automotive segments are expected to offset some of this weakness however, anticipated to grow 8 - 9% and 2 - 4%, respectively. However, last quarter the company cut EPS estimates by $0.09 and reduced full year 2015 and 2016 projections by approximately 20%. The stock has followed suit, falling 40% YTD.

The Strong Dollar

The stronger dollar will no doubt be heavily mentioned once again as a detractor to Q3 earnings. Ironically, the downside to a strong American economy is a rising dollar that puts pressure on two commodities deemed most important, gold and oil. The S&P 500 derives about 40% of sales from overseas, therefore relying heavily on global strength. The companies impacted hail from a variety of sectors (materials, industrials, information technology, consumer staples and consumer discretionary), with the exception of telecommunications and utilities, which are mostly domestically focused. That said, the stronger dollar is nothing new and many companies have figured out how to hedge against it by entering into currency swaps, localizing production etc. While the dollar is down from it’s peak in March, the AMEX Dollar Index is still up 10% YoY.

Sector Winners

While Energy is expected to be the biggest loser in the first quarter, which sectors are showing strength?

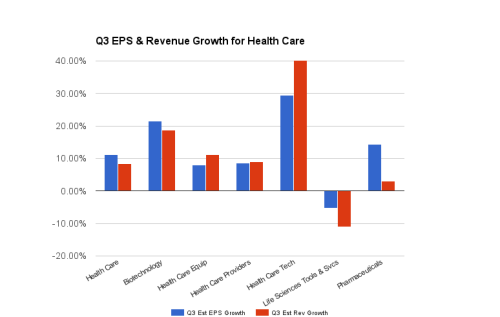

The health-care sector is on a tear again this quarter, expecting profit growth of 11.2% and revenues of 8.4%. Again this quarter it is health care technology that is expecting the highest profit growth of 29.5%, with even higher revenues of 40.5%, although the industry only contains Cerner (NASDAQ:CERN). As usual, biotech garners most of the attention in this sector and is anticipated to have the second best top- and bottom-line growth numbers of 18.9% and 21.4%, respectively. Biotech darling, Gilead Sciences (NASDAQ:GILD) is estimated to continue its run of robust results due to continued strength of their popular Hepatitis C drugs Slovaldi and Harvoni. Despite this, according to early reports, sales of those drugs began to slow last month. The steep prices of the medications have been an issue in the past, with Gilead having to make several price concessions in order to get insurers to carry Slovaldi and Harvoni as their primary Hep C drugs. Another issue is the curative nature of the drugs, Gilead is already researching other franchises to develop.

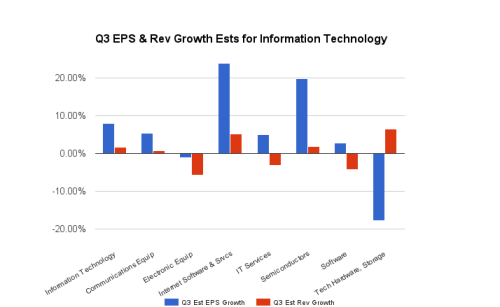

Other expected winners include information technology and consumer discretionary. IT is estimated to yield YoY EPS growth of 8.0%, with much lower revenue expectations of 1.6%. You’ll notice Estimize estimates for the IT sector are much higher than Wall Street’s, more than any other sector, there is also a greater volume of estimates. The sector is being lead higher by the internet software and services sector, with EPS of 24% and revenues of 5%. Standouts in that industry include behemoth’s Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL). Surprisingly, semiconductors are also looking as though they are making a comeback, with EPS growth of 20%, but again low revenues of 1.8%. While technology hardware, storage and peripherals is the weakest link in the sector, with profits expected to plummet 17.7% due to the likes of Hewlett-Packard (NYSE:HPQ) and SanDisk (NASDAQ:SNDK). Tech giant Apple (NASDAQ:AAPL) is also in that industry and will certainly be one to watch this season. Record iPhone 6s opening-weekend sales will partially be included in Apple’s Q4 report, which will reflect all sales made through September 26.

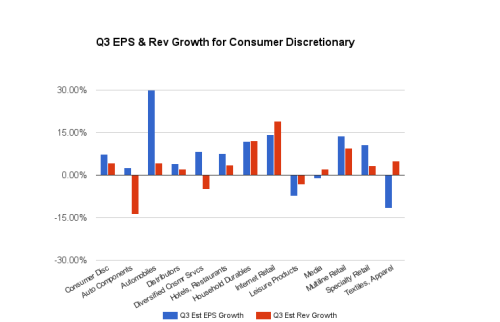

Consumer Discretionary is also a leader again this season. EPS expectations currently stand at 7.2% and revenues at 4.4%. Automobiles are leading the sector higher with the September reading for Motor Vehicle sales clocking in at a whopping 18.2M, the strongest reading since July 2005. A lot of that strength came from truck sales, as falling gasoline prices have made consumers less cautious about purchasing gas guzzlers and more confident in general to allocate discretionary income to large-ticket items. Other industry winners include internet retail and multi-line retail.

Beat/Match/Miss

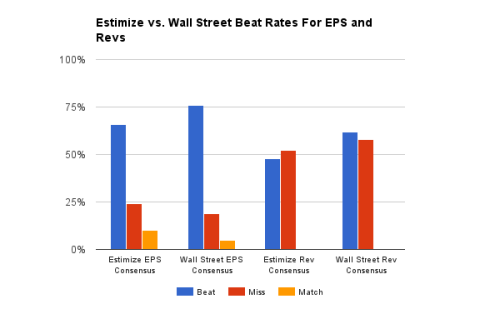

At this point only 21 S&P 500 companies have reported for the quarter, 66% have beat the Estimize EPS consensus, 24% have missed and 10% have matched. On the revenue front, 48% of companies have beat the Estimize consensus and 52% have missed. By comparison, a much larger 76% of companies have beat the Wall Street EPS consensus, 19% have missed and 5% have met, while 62% have beat the revenue consensus and 58% missed.

This week starts out light, with only three S&P 500 companies scheduled to report, including Alcoa, PepsiCo (NYSE:PEP), Monsanto (NYSE:MON), Yum! Brands (NYSE:YUM) and Constellation Brands (NYSE:STZ).