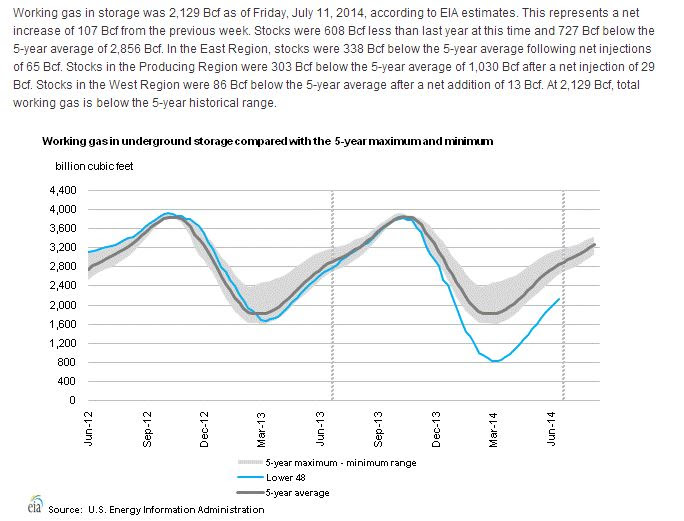

After failing just shy of the $4.90 level for the third time in 2014 most recently in mid-June, Natural Gas prices have depreciated nearly 20%. Front month natural gas prices are currently trading below the $4 psychological level for the first time since mid-January. On a daily chart you can notice that a gap was filled in the chart this week and in my opinion we are very close to an inflection point. While past performance is not indicative of future results the last time we traded around current levels buyers emerged and within 6 weeks prices had screamed 25% higher. The fundamentals are far different this time as we continue to see below normal temperatures contributing to above average injections in our weekly storage numbers (see below).

Looking at a weekly chart we are approaching the trend line that has acted as support for the last two years. A decision will be made in the next couple sessions to see if this level holds or we trade down to the 61.8% Fibonacci level that on a front month continuation chart comes in 30 cents lower. I have lightly started to tip-toe into bullish trade for aggressive traders. My suggestion is to gain long exposure in November futures and at the same time sell out of the money calls 1:1. Those traders that may want to protect against further immediate downside could also purchase out of the money puts until an interim low is established is August or September contracts. In previous sessions I had a few clients in August puts but we have let go of those trades at a profit on this week’s descent. On the entire trade we have a realize profit in the August puts and unrealized loss in our November futures, and an unrealized profit in the November calls.

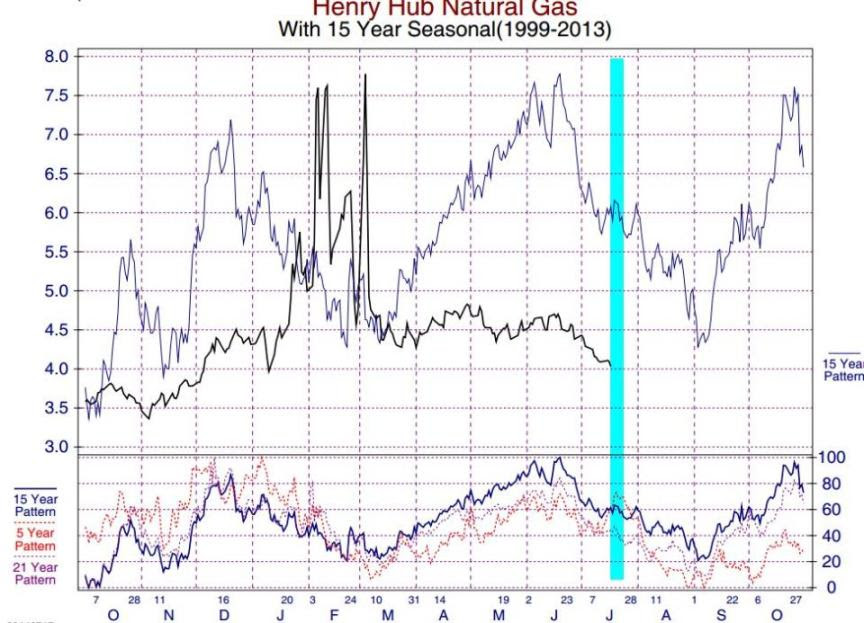

Looking at the seasonality in natural gas it would appear that we are following a similar pattern in 2014. Whether we bottom in the coming weeks and start trending higher as we have in the last 15 years remains to be seen. Past performance is not indicative of future results. Assuming we follow a similar pattern we should find a low around $4 and then trade higher into the Fall where I would expect prices to be 40-60 cents higher.