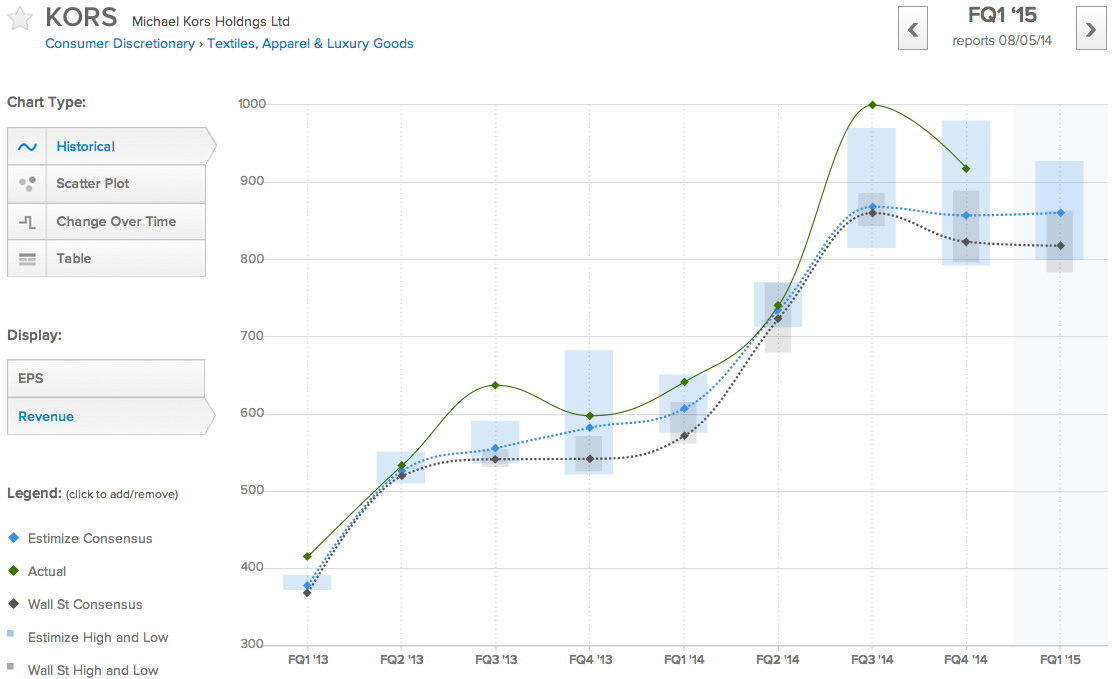

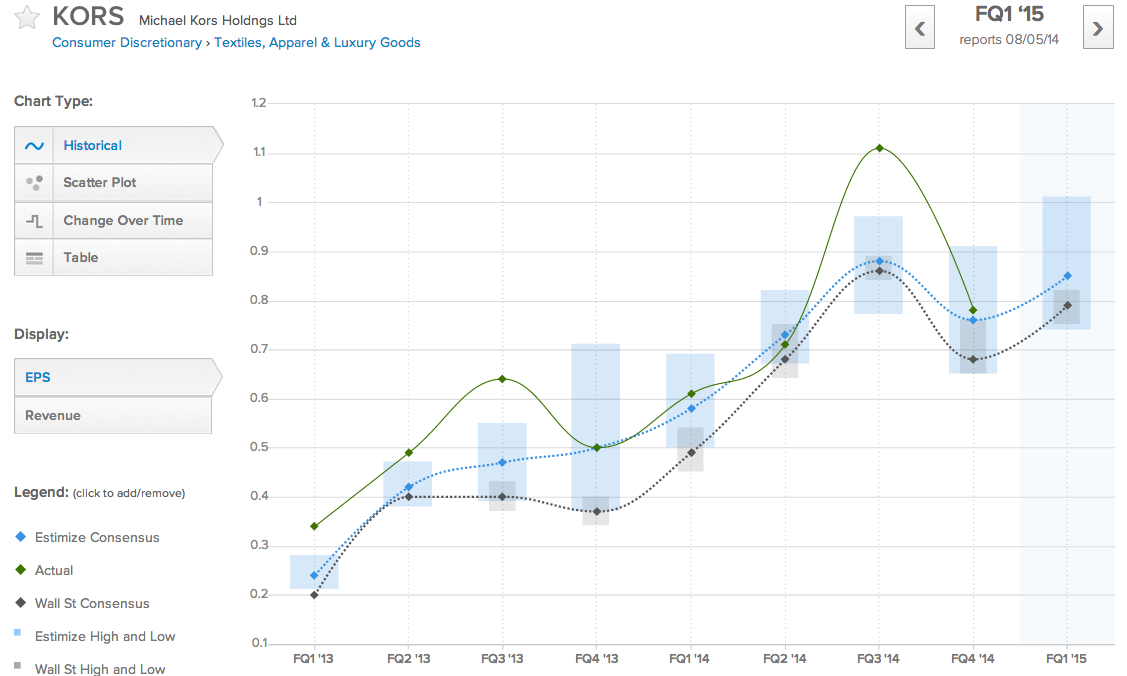

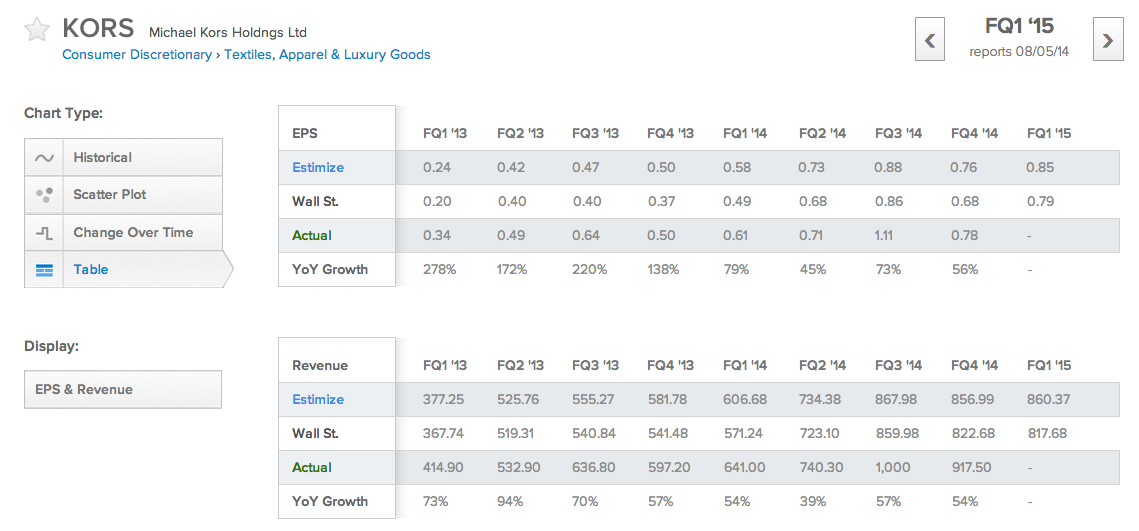

Michael Kors Holdings Ltd. (NYSE:KORS) has done it again. Wednesday morning the luxury fashion company topped the Estimize consensus on sales for the 9th consecutive quarter and beat the earnings forecast for the 8th time out of the past 9 opportunities. Sales dropped off slightly as expected from the incredible $1 billion holiday quarter, which is almost always the strongest period of the year for retailers. Michael Kors has continued to impress, although this quarter the company may have shown a crack in its armor.

There were many positive takeaways from KORS’s quarterly financial performance, but that didn’t stop a few shaky hands from cashing out their shares in early morning trading action. KORS stock was trading lower in pre-market action and Initial selling after the opening bell saw KORS shares drop as low as $91.80 before rebounding and drifting higher as one would expect on average after a company beats the Estimize earnings consensus. KORS roared back for an intraday gain all the way up to $97.01, or a 5.7% increase from the morning’s bottom.

The graph above from ChartIQ above shows the positive post earnings drift KORS experienced on Wednesday after the open. The far left side of the chart shows that Michael Kors opened the day’s trading marginally lower than it closed on Tuesday. And while the majority of the news from KORS was positive on Wednesday, there may be a legitimate concern or two in the earnings release as well.

CNBC contributor, journalist, and blogger at TheStreet.com Herb Greenberg laid out the bear case yesterday morning. Mr. Greenberg was quick to caveat that this quarter has been weak across the board in retail. His argument about KORS zeroed in on the company’s quarterly gross margin. Michael Kors’s gross margin (gross profit/net sales) came in at 59.9%, compared to 59.7% in last quarter. Gross margin did increase slightly compared to the previous quarter, but it also narrowly missed compared to 60.1% a year earlier. Greenberg drives home his bear case with this. “Reality: If this were a genuine beat on revenue and earnings the company, arguably, would have also beat on margins.” Any discounting KORS may have used use to drive its great 54% year over year revenue growth and management’s warnings of “normalization” in margins in the future are a concern worth talking about.

There is a fine line to ride in the ‘affordable luxury’ market. Companies like Michael Kors must balance marketing products that are within reach for much of the middle class at high prices with protecting against brand dilution. It’s not an easy task.

Not too many years ago Coach (NYSE:COH) was the dominant player in the handbag industry. Then you saw fake Coach bags on every corner of Canal Street selling for $20. Suddenly everyone and their mother had a “Coach” bag. Many of the bags you’d see people with were knock offs, but suddenly it wasn’t nearly as desirable to be seen rocking Coach. Discounting your products isn’t quite the same as getting ripped off by imitators, but there is a similarity. Once your brand becomes diluted, its hard to go back to asking consumers for the prices that fetch high margins. Once the market is saturated with Michael Kors bags, it wouldn’t be as cool to have one.

There is a certain irreversibility to discounting, once a brand becomes cheaper and more common, luxury consumers won’t be willing to shell out for the steeper price tags. Brands are always rising and falling in America. That couldn’t be more true in the world of fashion were consumer behavior is dictated in large part by the public perception of brands. Thus far Michael Kors has had a captivating run. Can the company keep the magic up? Or as the bears imply, will the decline in KORS’s gross margins cut into future earnings potential and limit forward profitability? Head over to the Estimize.com platform and submit your own estimates on KORS and other fashion retailers to see how your own predictions stack up to Wall Street and the pros.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.