The Orphan Drug Act was passed in January 1983 to encourage companies to develop drugs that treat rare medical conditions. Companies that receive Orphan Drug Status gain certain financial incentives such as a longer period of exclusivity, enhanced patent protection, clinical research financial subsidization, and even tax breaks. Additionally, companies have greater success in getting their Orphan Drugs approved because there is a significant need for its treatments.

Insmed (INSM) is a biopharmaceutical company that discovers and develops targeted inhaled therapies for those suffering from debilitating orphan lung diseases. Insmed focuses on cystic fibrosis patients with pseudomonas lung infections and also those with non-tuberculosis mycobacterial lung infections. Patients with cystic fibrosis develop a sticky mucous that can clog the lungs and encourage pathogens, such as Pseudomonas, to settle and infect the lung. These infections are very difficult to eradicate and there is no cure; however, current treatments focus on reducing inflammation and preserving lung function for as long as possible. Insmed is working on developing a better treatment for these patients with its lead product Arikace.

Arikace uses liposomal amikacin as an inhaled antibiotic, which so far in trials has shown to have better efficacy, safety, and patient compliance than other treatments. Insmed has been granted Orphan Drug Status in both the United States and European Union for Pseudomonas lung infections in cystic fibrosis patients. Recently, Insmed was also granted Orphan Drug Status for Arikace in treating those with non-tuberculous mycobacterial lung infections. In mid 2013, Insmed is reporting top-line clinical results from its Phase III trial for Arikace to treat cystic fibrosis patients with Pseudomonas lung infections. In the fourth quarter 2013 Insmed will also report Phase II results for patients with nontuberculous mycobacteria.

Proprietary Liposomal Technology

Insmed uses its proprietary liposomal technology to create an antibiotic that is both safer and more effective. They use a layered lipid as a drug delivery system by alternating molecules with hydrophilic heads (water-loving) and hydrophobic tails (water-hating). This creates a lipid bilayer with water in the core and between each layer. Drugs that are water-soluble are placed in the liposome's core and those that are not are placed in the membrane layers. Insmed then manipulates the charges of the antibiotic to ensure effective delivery into the infection. Typically, antibiotics like amikacin are positively charged and immediately bind to the negatively charged compounds produced by the bacteria in the lungs. This is troubling because it limits the penetration of the drug into the deep lung tissue, where treatment would be more effective. By making its Arikace liposomes neutrally charged, the drug is able to penetrate and treat these infections deeper than current approved treatments.

The ability of the drug to be delivered more effectively and closer to the source of the infection should lead to a better efficacy and safety profile. The liposomes contain high concentrations of the drug and are able to deliver localized treatment in the lungs. This should also lead to less toxicity and fewer adverse reactions. Insmed also pairs Arikace with its proprietary eFlow Nebulizer System to deliver concentrated treatment directly to the site of the infection. So far this has led to better patient compliancebecause patients have to administer less treatments for a shorter amount of time to achieve beneficial results.

- Cystic Fibrosis Patients with Pseudomonas Lung Infections

Currently, Novartis (NVS) markets an inhaled tobramycin, termed TOBI, for psuedomonas lung infections in cystic fibrosis.However, Novartis' TOBI has shown significant disadvantages when compared to Arikace. Novartis's therapy takes up to 3 hours per day and requires two or three sessions of dosing. Arikace is the first ever once daily treatment for this indication and leads to an increased patient compliance. Furthermore, the dosing schedule is 28 days on and 56 days off, which is a significant advantage over current therapies.

In Phase III trials, TOBI also showed that lung function declined to baseline or lower at the end of 24 weeks of treatment. In Insmed's Phase II trials, Arikace showed statistically significant improvement in function throughout the 28-day treatment period; and that improvement was sustained through the off-treatment period. Furthermore, resistance to TOBI by the bacteria has increased by 85% since 1999, so a new treatment is in dire need.

- Patients with Non-Tuberculous Mycobacteria Lung Infections

- Non-CF Bronchiectasis Patients with Pseudomonas Lung Infections

We have reported favorable results from our Phase 2 study (TR02-107) ARIKACE randomized, placebo-controlled phase 2 clinical study results in which the drug was administered once daily for 28 days demonstrated an improvement in time to pulmonary exacerbations/reduced need for anti-Pseudomonas rescue treatment, a decrease in Pseudomonas Log CFUs and a decrease in frequency of cough with expectoration. The study also revealed that ARIKACE was well tolerated with adverse events consistent with underlying chronic lung disease in bronchiectasis patients. Patients in the 560 mg cohort had a slightly higher frequency of dry cough than those in the 280 mg cohort, but the cough was of short duration, was self-limiting, and did not result in any physician choosing to discontinue a patient from the study.

With more than 250,000 patients in the United States with this condition and no approved treatment, Insmed is set to capture a large market if the company is able to get Arikace approved for this indication.

Near-Term Catalyst

Insmed is expecting to report Phase III trial results for Arikace to treat cystic fibrosis patients with Pseudomonas lung infections in the middle of 2013. It is stated in the company's recent First Quarter Financial Results.

Completed the patient treatment period of the Company's registrational Phase 3 clinical trial of ARIKACE®, the Company's Iiposomal amikacin for inhalation, to treat cystic fibrosis (CF) patients with Pseudomonas lung infections in Europe and Canada and remain on track to report top-line clinical results from the trial in mid-2013.

In 2012, treatments for pseudomonas lung infections in CF generated about $424 million in sales, with Novartis capturing about $317 million from TOBI and Gilead Sciences' Cayston capturing $107 million. If Phase III trials are successful and the drug is ultimately approved, Insmed should be able to capture a large portion of the market share.

Future Catalysts

Insmed is also expecting to report Phase II results later in 2013. Also stated in the company's recent First Quarter Financial Results Report:

Insmed's U.S. Phase 2 clinical trial in patients with NTM [nontuberculous mycobacteria lung infections] is well underway with clinical results expected in late 2013.

Since this is an indication with no approved treatment and 50,000 patients in the United States, positive results from this trial would be a large milestone for the future of the company.

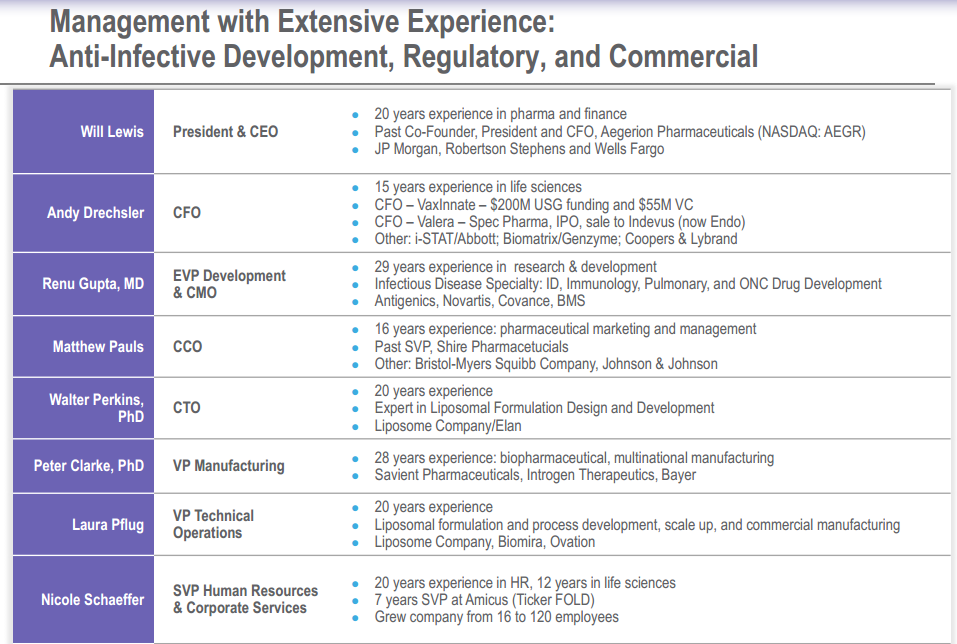

In small cap biotech companies it is important to develop a drug that can capture market share; however, it is equally important to have a management team who can execute. Developmental biotech companies most often are not profitable and continually burn through cash until its drug is approved by the FDA and becomes marketable. Thus, having an experienced management team is key when it comes to smartly utilizing funds and achieving milestones in a timely manner.

From the picture above, we can see that Insmed has a proven management, with executives that worked on developing multibillion-dollar companies. Will Lewis, President and CEO of Insmed, was the co-founder and former president of Aegerion Pharmaceuticals (AEGR), which ran from about $14 to $46 in less than a year. Noting some other big names in management: CFO Andy Drechsler worked at Abbott Labs (ABT), EVP Development and CMO Renu Gupta worked at Novartis, VP of Manufacturing Peter Clarke worked at Bayer, and Nicole Schaeffer worked at Amicus Therapeutics (FOLD).

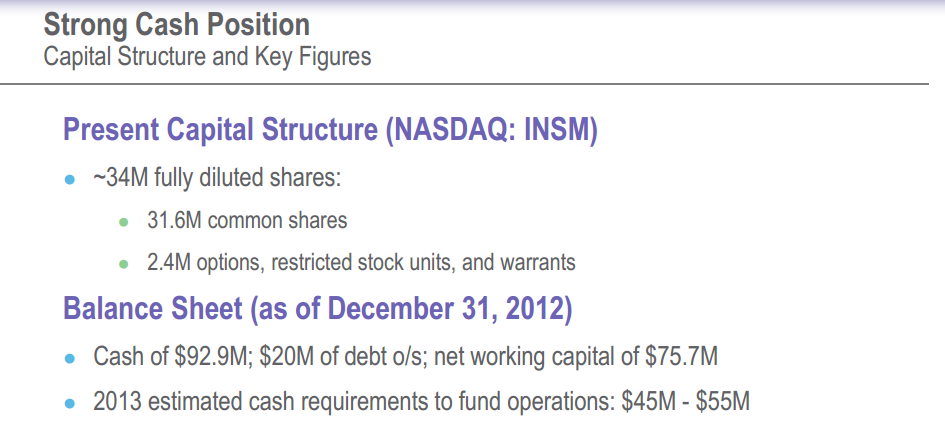

From Insmed's April Presentation the company has enough cash to fund operations through 2013. Insmed has $92.9 million in cash and are expecting to burn between $45 and $55 million this year. On September 27 2012 the company raised approximately $26 million in a direct public offering, so shareholders should not expect the company to do another raise any time soon.

To understand where Insmed stock price might go in the coming months, we need to take a look at the above daily two-year chart. From the two drawn horizontal lines, we can see that there is still a huge gap to be filled. From its last run, stock price has flagged down to about the top of the previous peak. This should act as support and a base for the next run higher. On Monday, it bounced off its previous $8.20 peak and created a nice bullish engulfing candle. As we get closer to the catalyst date, I expect that the stock runs to a minimum of $11.00 to fill the gap.

A company with a similar chart is Cornerstone Therapeutics (CRTX). Cornerstone had a gap down on gap down from about $6.20 to $5.10 on a negative Adcomm on September 13, 2012. Months later, this gap was filled and the price is currently at $8.79.

Conclusion

Insmed has positioned itself to capture market share for several indications with unmet needs. With a near term catalyst and another later on in the year, I expect that Insmed stock price will climb in anticipation of the clinical trial results. Insmed has experienced management and should be able to execute on its plan to make Arikace the leading treatment in its field.

My short-term price target is $11.00 per share. If Phase III results are positive my price target is $15+ per share. Negative results would likely see a stock price back under $5 a share.

Disclosure: I am long INSM.

Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky -- always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.