Sell Rosh Hashanah

Overnight and early in the Asian session the S&P 500 futures (ESU15:CME) rallied up to the 1964.00 handle up about 15 handles from Friday’s close before falling back and opening nearly unchanged on the U.S. regular-trading-hours (RTH) open at 1952.00. At that time the index proceeded to drop to 1937.75 and found support there early in the RTH session and traded as high as 1945 from there but for the most part remained in a tight range throughout the day as total volume just barely made it over 1.5 million as the futures closed down 7 handes at 1943.25

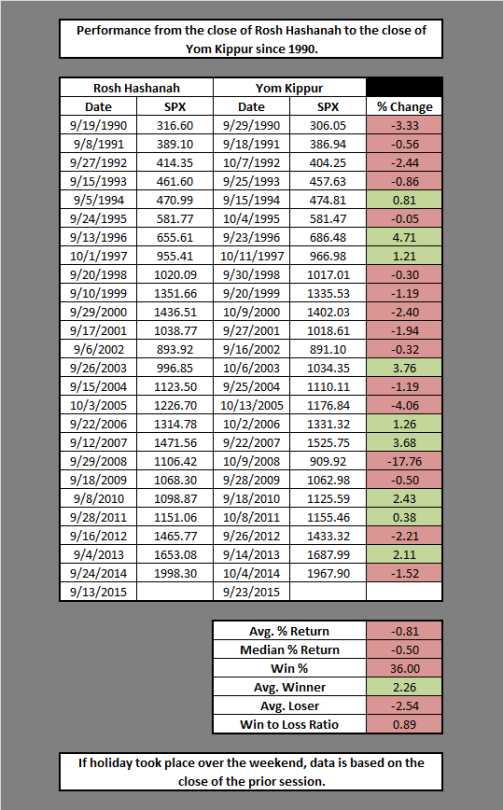

Yesterday marked the Jewish holiday of Rosh Hashanah and there is well known market observation stating to sell Rosh Hashanah and buy Yom Kippur which comes on September 23rd. As noted by Chad Gassaway and featured in the above image this trade has been moderately successful dating back to 1990 having produced negative returns in the S&P 500 16 of the last 25 years.

Heading into Tuesday are stats suggesting a potential turnaround as Tuesday has closed in reverse of Monday in 12 of the last 17 weeks. Also, as noted by Ryan Detrick, today began week 37 of this year, interesting that week has been the best performing week over last last 37 years and has closed higher in 9 of the last 10 years. Also worth noting is that September’s Quad Witch week has been the strong option expiration week over the last 10 year of any month, as opex week has been considerably strong all year as monthly highs have traded in 6 of 8 months this year during that week.

However for this week, all eyes will be on the meeting of the FED, which concludes on Thursday and is the most highly anticipated meeting in many years as several key analyst and banks have suggested that a rate hike will come this month.

by FairValue Trader