The head of HSBC's (NYSE:HSBC) Technical Analysis group just issued a major warning.

Unless the markets can take out its September highs, we could very well see a repeat of the 1987 Crash.

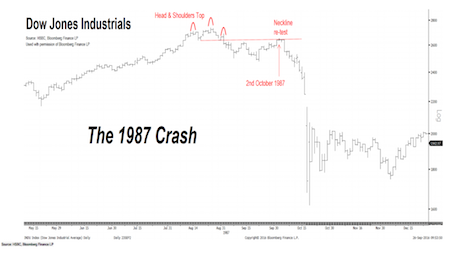

Murray Gunn is head of technical analysis for HSBC. In a recent client note, he pointed out the Head-and-Shoulders top pattern that presaged the 1987 Crash.

In its simplest form, the Dow Jones Industrial Average formed a Head-and-Shoulders top when it violated its neckline. We then had a failed attempt to reclaim the neckline, which resulted in the Crash.

The Single Best Options Trading Service on the Planet

Yesterday, while 99% of traders were getting killed we locked in THREE new double-digit winners.

We have a success rate of 70% meaning we make money on SEVEN seven out of TEN trades. And thanks to careful risk management we’ve already produced a return on invested capital of over 124% thus far in 2016.

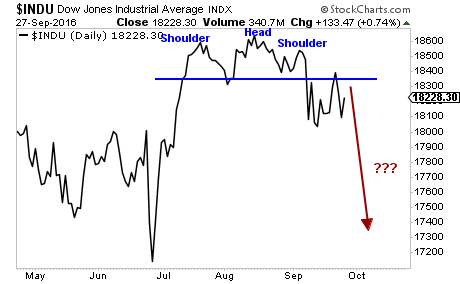

Gunn notes that the Dow is forming a similar pattern today. He also notes that momentum is waning and Elliot Wave analysis indicates a 1987-like crash could indeed occur.