After Bitcoin Hits a Yearly Low, Can It Fall Even Further?

Bitcoin hit the lowest price in September so far yesterday, reaching a low of $456.30, and then an immediate recovery to $470.77 took place. However, the move lower has been sustained and the current price is nearer to monthly low posted yesterday. At present, there is a weak downward trend at the hourly timeframe and seems to be testing the $464 support level. A downward move past this support could see the next support at $454.37 tested as well. In the event of an upward swing, the $470.80 and $480.96 levels will provide resistance.

It was announced earlier today that the creator of Bitcoin, Satoshi Nakamoto, had his email account hacked. However, it is unlikely that any of Satoshi’s Bitcoins have been compromised. The motives behind this hacking are currently unknown but could be a tactic to pressure the notoriously elusive Bitcoin creator into revealing his identity. The hackers were unable to hack into GitHub, the coding repository for Bitcoin, since Satoshi removed his access due to foresight of an event like this.

Braintree, a subsidiary of eBay (NASDAQ:EBAY), has announced a partnership with CoinBase and will start to accept Bitcoins. Braintree offers $1 million in transactions for free for new merchants in Bitcoin, but only $50,000 for any new merchants for non-Bitcoin payments. Today will also see Apple (NASDAQ:AAPL) present several new products, including the iWallet, in an apparent attempt to rival Bitcoin. Although it is very unlikely Bitcoin will not be featured, a surprise announcement that it will be featured will bode positively for the virtual currency. Also, PayPal released an advert yesterday mentioning Bitcoin, suggesting their use of Bitcoin is imminent.

Today marks the start of Futures contracts trading on BTC-USD on the OKCoin exchange and indicates a rise in the Bitcoin price for all timeframes (1 week, 2 week, 1 month and 3 months). The chart below shows the 2 week forward contract price at the 15 minute time frame. This implies that given current information, the BTC/USD rate will be $469.26 on the 23rd September. There has been large buying volumes executed on this exchange and the trading of futures should help to stabilize the BTC/USD rate over the coming weeks. The lack of past data means that most technical indicators are unavailable. However, the parabolic stop and reversal currently indicates an upward trend. The futures price action will be a useful tool going forward in analysing the Bitcoin price.

The chart below shows the hourly price action with the Ichimoku cloud indicator, which shows that the conversion line crossed the base line in the downward direction very early this morning, indicating bearish momentum. A move above $467 would reverse the momentum in bullish traders favour. The cloud signals resistance at $465-$469 over the next 24 hours. If the price manages to establish itself above the $470 level, we could see an upward trend forming.

However, an establishment of an upward trend seems unlikely. Looking at the 4-hour chart below, the technical are strongly bearish with the parabolic stop and reversal still indicating a downward trend is taking place and the relative strength index is below 30, but not in the oversold region just yet.

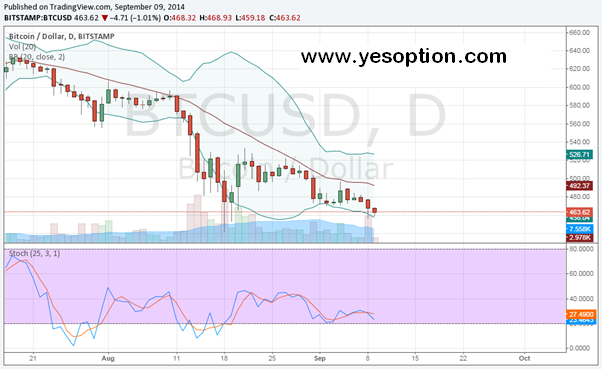

The daily price action also reiterates the downward trend. The stochastic is moving closer to the oversold region suggesting further price declines before an upward correction. The price is likely to hit or break through the lower Bollinger Band at $458 today. Therefore, a move to $450 could materialize, at which point it would be expected to bounce upwards towards to middle band at around $490 over the coming weeks.