Clean Harbors (NYSE:CLH), Inc. CLH has an impressive Growth Score of B. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of quality and sustainability of growth. For 2021 and 2022, earnings are expected to grow at a rate of 9.5% and 13.2%, respectively, on a year-over-year basis.

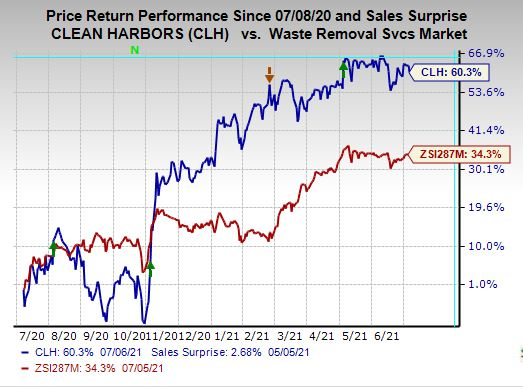

The stock has rallied 60.3% in the past year compared with 34.3% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Key Growth Drivers

We are impressed with Clean Harbors’ consistent record of boosting shareholders’ value in the form of share repurchases. In 2020, 2019 and 2018, the company had repurchased shares worth $74.8 million, $21.4 million, $45.1 million, respectively. Such moves indicate the company’s commitment to create value for shareholders and underline its confidence in its business. These initiatives instil investors’ confidence and positively impact earnings per share.

The company raised its guidance for the full year 2021. Adjusted EBITDA is now anticipated between $560 million and $600 million compared with the prior guidance of $545-$585 million. Net income is now anticipated between $116 million and $157 million compared with the prior guidance of $105-$146 million. Adjusted free cash flow is now expected between $230 million and $270 million compared with the previous range of $215-$255 million. Net cash from operating activities is now projected between $415 million and $475 million compared with the prior guidance of $400-$460 million.

Primary Concern

Clean Harbors has a debt-laden balance sheet. The company’s cash and cash equivalent of $571 million at the end of first-quarter 2021 was well below the total debt level of $1.56 billion, underscoring that it doesn’t have enough cash to meet this debt burden.

Zacks Rank and Stocks to Consider

Clean Harbors currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector can also consider stocks like The Interpublic Group of Companies (NYSE:IPG), Inc. IPG, Cross Country Healthcare (NASDAQ:CCRN) CCRN and Paychex (NASDAQ:PAYX), Inc. PAYX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The long-term expected earnings per share (three to five years) growth rate for The Interpublic Group of Companies, Cross Country Healthcare and Paychex is pegged at 10.2%, 10.5% and 8%, respectively.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX): Free Stock Analysis Report

Interpublic Group of Companies, Inc. The (IPG): Free Stock Analysis Report

Clean Harbors, Inc. (CLH): Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research