- EUR: How Turkey’s 425bp Rate Hike Affects the World

- How Dollar Reacts to FOMC Hinges on 3 Key Elements

- NZD: What to Expect from RBNZ

- AUD: Surprise Improvement in Business Confidence

- CAD: Hits Fresh 4-Year Lows vs. EUR and USD

- GBP: Q4 GDP Eases Pressure for BoE to Tighten

- Yen Crosses Rally, Japanese Data Reinforces Positive Outlook

EUR: How Turkey’s 425bp Rate Hike Affects the World

Shock and Awe – The Central Bank of the Republic of Turkey raised interest rates by 425bp to 12% sending the Turkish Lira soaring vs USD and EUR. The market only anticipated a 200bp making Tuesday’s 400bp rate hike a major surprise. Turkey’s decision to raise rates by 425bp reflects level panic inside the central bank and is a sign of their commitment to end the crisis of confidence in their currency. They are sending a strong message to the market they will do whatever it takes attract investment back into their country. For the rest of the world, Tuesday’s bold move by Turkey mitigates the risk of spillover and reduces uncertainty. It also makes the Federal Reserve’s decision Wednesday to taper much easier. Investors have responded very positively to the announcement with USD/JPY rising above 103. Looking ahead, we expect a further improvement in risk appetite in the Asian and European trading sessions. While this does not resolve Turkey’s underlying problems that include a massive current account deficit and political troubles, it should be enough to temporarily restore confidence for investors. We expect the euro to underperform as investors buy back the Lira by selling EUR/TRY.

How Dollar Reacts to FOMC Hinges on 3 Key Elements

Don’t expect Ben Bernanke to go out with a bang. Wednesday the outgoing Federal Reserve Chairman will sign off on the last monetary policy statement of his career and with no press conference scheduled, Bernanke will see a quiet end to a long and colorful career as the head of the world’s most powerful central bank. He was the key architect of Quantitative Easing and at the end of last year he laid out a plan for reducing the massive amount of stimulus that he injected into the economy over the past 8 years. It should be a smooth transition for Janet Yellen who has been intimately involved in all of the decisions including the central bank’s most recent decision to begin reducing asset purchases. More than 90% of the 70+ economists surveyed by Bloomberg expect the Fed to reduce asset purchases by another $10 billion this month and judging from Tuesday’s rally in the U.S. dollar and rise in U.S. 10 year yields, many investors share their views. However there has been a lot of unevenness in U.S. data since the last FOMC meeting and the turmoil in emerging markets have made life more difficult for many central banks including the Fed. Just because the market expects a $10 billion taper doesn’t mean that Wednesday’s announcement will be nonevent for the dollar. Quite the contrary because investors will be looking for answers to 3 key questions:

1. Will the Fed Taper? – Of course the first question is whether or not the Fed will taper at all. If they reduce asset purchases by $10 billion, it would be mildly positive for the dollar. If they keep asset purchases unchanged, expect a nasty sell-off in the greenback.

2. Was the Decision Unanimous? – The next question is whether the decision is unanimous. If everyone member of the FOMC agreed that another round of tapering was necessarily, we can expect a more significant rally in the greenback. However the greater the number of dissenters, the weaker the rally for the dollar and the higher the chance of a reversal.

3. Changes to Economic Outlook or Forward Guidance? – While we expect Bernanke to leave the decision about changing forward guidance to Janet Yellen, we will be combing through the monetary policy statement to look for any changes to the central bank’s outlook for the economy and monetary policy given the recent deterioration in data. Will they feel that slower payroll growth justifies a longer period of low rates or will they look beyond the number and reassure investors that the economy is still recovering. The answer to this question will play a big role in how the dollar trades post FMOC.

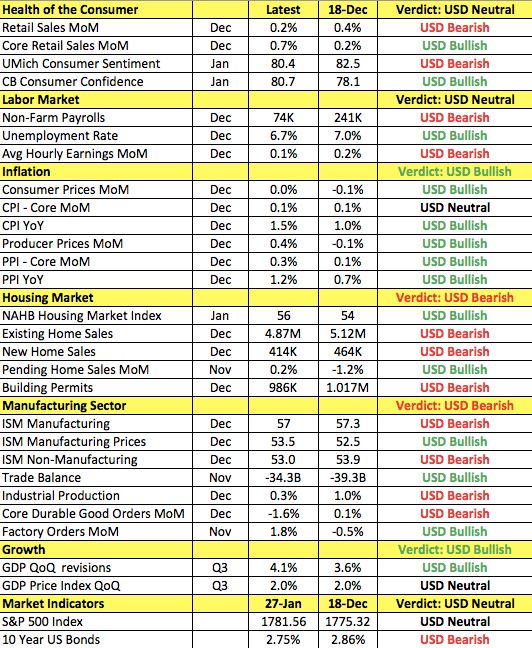

As shown in the following table, although non-farm payrolls growth slowed to 74k from 241k in December, there has been improvement as well as deterioration since the last FOMC meeting. In the labor market alone, the unemployment rate dropped closer to the central bank’s 6.5% threshold and even though advance retail sales growth slowed, core retail sales growth accelerated to 0.7% from 0.2%. Consumer confidence has been mixed, manufacturing and service sector activity slowed but inflation is stabilizing and ticking higher on an annualized basis. Overall the US economy continues to improve and the decision to begin tapering last month was carefully calculated. This is why everyone expects the Fed to overlook last month’s softer economic reports and forge forward with tapering.

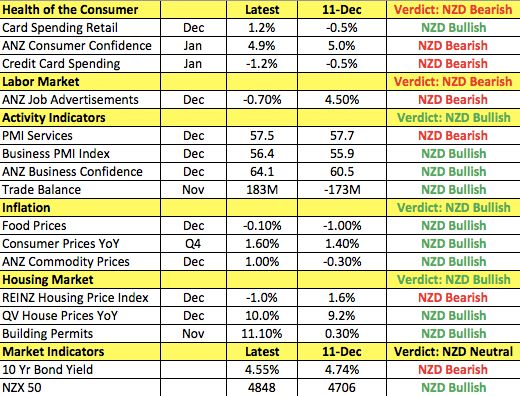

NZD: What to Expect from RBNZ

While the New Zealand and Australian dollars traded higher ahead of the Reserve Bank of New Zealand’s monetary policy meeting, the Canadian dollar dropped to a fresh 4 year low versus. The RBNZ is not expected to change interest rates but they will be preparing the markets for a rate hike in very near future. As shown in the table below, there have been more improvements than deterioration in New Zealand’s economy since the last RBNZ meeting. Inflation is on the rise, along with manufacturing activity, business confidence and housing. The drop in consumer confidence, job advertisements and service sector activity has been nominal and even though the Chinese and Australian economies have weakened, New Zealand stayed buoyant. For this reason, we expect the New Zealand dollar to extend higher on the back of the RBNZ announcement. Rating agency Moody’s also warned that New Zealand’s credit rating could decline if the country’s government debt ratios do not improve but FX traders have taken the announcement in stride. The Australian dollar on the other hand benefitted from stronger business confidence. The NAB index rose from 5 to 6, which was surprising given the recent deterioration in economic data. According to the NAB, “the increasing slack in the labour market and limited signs of a turnaround in real activity indicators – in light of the looming declines in mining investment – suggests these improvements may be fleeting, although higher building approvals and recent signs of life in the retail sector are encouraging.” If the RBNZ is hawkish, AUD/NZD could drop to fresh lows.

GBP: Q4 GDP Eases Pressure for BoE to Tighten

Despite relatively healthy fourth quarter GDP numbers, sterling ended the day unchanged against the euro and U.S. dollar. The U.K, economy expanded by 0.7% in the last 3 months of the year, bringing the annualized pace of growth to 2.8% from 1.9%. The muted reaction in sterling can be attributed to the market’s expectations for an even stronger growth given the improvements in retail sales and trade activity towards the end of the year. Nonetheless, the details of the report were consistent with a broader recovery as the index of services and manufacturing output expanded at a faster pace. This steady pace of growth works very well for the Bank of England. If GDP growth exceeded by 0.7% in a significant way, the central bank would be pressured to raise rates, especially with the unemployment rate falling rapidly. The U.K. economy is still expanding at a healthy pace and Tuesday’s marginally slower GDP growth (GDP expanded 0.8% in Q3), gives the central bank more breathing room to keep monetary policy steady.

Yen Crosses Rally, Japanese Data Reinforces Positive Outlook

As risk appetite continued to improve, the Japanese Yen extended lower against all of the major currencies. Better than expected economic data from Japan helped the Nikkei avoid further losses and reinforced our positive outlook for the economy. Corporate service prices rose 1.3% in the month of December, up from 1.1%. The efforts of Prime Minister Abe’s administration are paying off with inflationary pressures rising slowly. Small business confidence also increased slightly with the Shoko Chukin index rising to 51.3 from 51.1 in January. There were no major Japanese economic reports scheduled for release Tuesday evening and Wednesday’s FOMC rate decision will decide whether or not the rally in Yen crosses can be sustained. If the Federal Reserve does a good enough job of managing expectations and the market does not become overly concerned about the negative impact of tapering and higher U.S. yields, the risk rally could continue, driving the Yen crosses higher. USD/JPY traders in particular should keep an eye on the 10-year yield.

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.